"JRI In Review", Pt. 2.1: Company Discussions, "The Winners"

Part 2 of my deep dive into the collective returns of all the companies I've ever interviewed. Market-beating overall (see pt. 1), pt. 2.1 here focuses on the winners and other core tickers.

tl;dr:

Now that I am back from pounding pavement through Vancouver conference season (watch for that video soon). here’s part 2 of my “JRI In Review” project, calculating how my “JRI Interview Portfolio” has performed since inception.

Brief recap of the results? Pretty darn good. Like, beat the market good. Universal portfolio returns of 44.7% and Core portfolio returns of 58.1% (I’ve stuck my methodology infographic below for a refresher on that). These compared to sector ETFs which returned 28% - 45% and SPY itself, at 48.9%.

Part 1 got the general information out of the way, and focused on crunching overall numbers. The core infographic from it is also here.

Part 2, this one here, I’ve also split into two parts. These are designed to provide company-by-company performance reviews, and attempts to pick out lessons to learn from how the various companies and their projects did - or didn’t - execute. Today’s article focuses on my winners and other core companies. Next article will deal with the losses.

So, in review? In my first (nearly) three years of this as my organised, full-time gig, I beat the market. And I break down returns by company here. What went right? What went wrong? More importantly, what lessons can I learn as as an investor from this to improve?

Read on.

No need for me to waste too much time on preamble. Part 1 is over here. It gives a longer rundown on what I’m doing, why I’m doing it, and how. My goal with this update isn’t just to review the companies I have covered, though that’s part of it. This isn’t meant purely as a navel-gazing exercise. The true goal is to learn from them. What lessons - positive or negative - do these company histories have to teach me that might allow me to continue to improve and grow as an investor and analyst?

So I have tried to structure this process around uncovering common themes/lessons across various stories. Most companies will come with at least one or two lessons, and interestingly the same themes and lessons often emerged across multiple companies.

I’ve put up some bare bones context in sections 2 and 3 (what were my overall returns and explaining my methodology). If you want to skip straight to the company discussions, check out the index below and then head to section 4.

And look. I know. This thing is long. Over 10,000 words. Read the whole damn thing if you want. And heck, let me know if you do, maybe I will send you a t-shirt. But I have tried to build it in a way that makes it useful as a reference guide - easily navigable and each company section its own independent writeup. I also have infographics for each company and other visual cues to help you along. So jump in and take a look.

My Methodology - A Brief Review

Below is a quick recap of how I crunched my numbers:

I treated the date of publication for my first interview with a company as a “buy” using the SP from that day.

The weighting system is tied to the amount of coverage I’ve provided. See infographic below for a longer overview.

Companies with a weighting of 3 and up are considered the “JRI Core Portfolio”.

I believe “companies I worked with the most” is a reasonable distinction to draw and reflects my own confidence levels.

This also neatly cuts my portfolio in half. Exactly 50% of companies have been interview 3 or more times.

I am going to make you scroll through my overall results one more time. This infographic… I don’t want to admit how long it took. If anyone has Visual Capitalist’s phone number, please send it my way. Anyway, here’s the overview of my work:

I’m proud of those numbers. A true, universal, return from my companies matches GDX almost to the tenth of a percent while coming in ahead of every other sector ETF.

And, if you’ll let me be optimistic here: My Core Portfolio (defined as top 50% of companies in terms of total coverage) had 58.1% returns, which is nearly a fifth (19%) better than SPY’s 48.9% and 30% - 107% better than sector ETFS. That’s pretty damn good.

And to be clear here - that “Core” designation is based on an objective metric of amount of coverage by me. So companies I worked with more closely did significantly better than the one-offs. That seems like a good thing.

There’s also lesson there about tightening up my own selection criteria.

Indeed, working to improve your knowledge and due diligence process should always be your primary goal if you’re in this game - no matter if you’re an analyst, fund manager, or retail investor. And that’s doubly true if you operate in the deep waters of the junior resource sector. Out where the sharks are lurking.

So this look back at the wins and the losses, as well as the hows and the whys has indeed turned out to be a genuinely valuable reflective exercise, which uncovered trends and themes and ideas which contained within them have lessons to be learned.

The lessons you will find discussed below are:

Hold Onto Your Winners

Trust the Process/Working Model

Timing

Focus on Quality

Value Companies that Value the Treasury

Royalty Cos Need Revenue

Insider Buys and Sells

Cheap is Good

Critical Metal Kickers

Trust the Team

Portfolio Composition

Knowledge Is Patience

Bulk Tonnage Nickel Struggles

Rocks are Hard

Jurisdictional Risk

Beware Niche Metals

Part 4 below provides for conversation on these in the context of the companies and projects they spring from.

Organisation

To help with organisation, I’ve got a couple coding systems: “Categories” and “Title Bar Tags” to help you track through the lengthy list. Explanations below:

1. Categories

Most simply, I’ve broken down the companies into 4 categories:

“Wins”, “Losses”, “Draws”, and “TBD”:

Today’s update (cut in half again for the sake of readability) will feature “The Wins” and “TBD”. The rest will be published in a couple of days.

To be clear, the first three categories were sorted simply and objectively: I used +/-20% from first interview share price as the boundaries. 20%+ a win, -20% or worse a loss, and everything in between a draw.

The only subjective judgement calls I allow myself is the “TBD” category, where I have put those high conviction companies I have followed and worked with very closely but are currently losses but I still believe in their potential.

2. Title Bar Tags

Watch for this in the top right corner for the most prominent companies in the portfolio. These are the plays that stand out, for good or ill:

Gold, silver, and bronze tiers for obvious grades of my top winners. These are the companies that have done well and I believe will continue to do well moving forward. Ultimately these are a judgement call on my part.

The magic eight ball’s beautifully-evasive “ask again later” for companies that have been core conviction picks and are down currently, but I still believe in them.

The red stock chart are for the companies I have worked closely with who I currently chalk up as a loss.

Alright. Onto the companies.

Group 1: The Wins

Read on to see my biggest winners in this section, ranked in rough order based on a combination of past returns, future potential, and my own personal convictions.

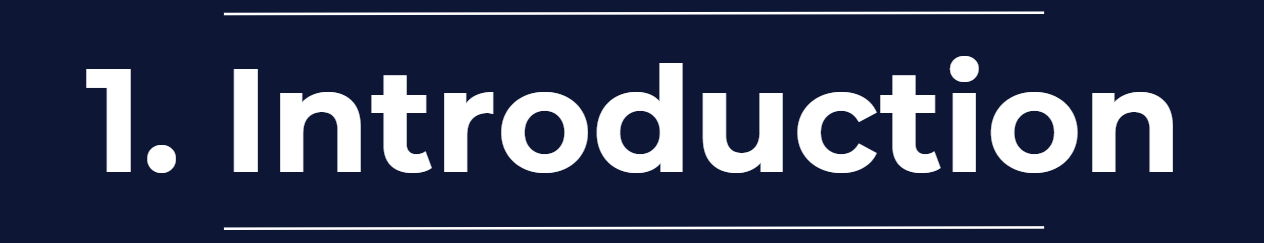

1.1. Founders Metals (FDR.V), Gold-Tier

Lesson: Trust the Process/Working Model

Lesson: Hold Onto Your Winners

I have to lead with Founders. They aren’t technically my biggest win by %, but in terms of buying into, and being involved with, and continued conviction in? They feel the biggest win to me so far. I was still comparatively late to Founders, finally working with/jumping in around $1.40 (and $75m market cap). I’d been tipped about them at PDAC 2023 around 30 cents, but didn’t move on it and spent the next year or so in a state of fearful FOMO, constantly thinking I had missed the bus and scared to enter.

This is a fairly core rule for me. Don’t chase. Especially in a choppy market. Just be patient, and wait for the next one, because there’s always a next one.

But everything is relative. And Founders just felt special. And still does. Right away in my conversations with CEO Colin Padget (dude’s smart, sharp, and driven) and watching the discoveries continue (2 separate zones, then 3, then 4, oops those ones just got tied together, etc.) it became clear that 1. They knew what they were doing and were hungry, and 2. There’s a shitload of gold waiting to be discovered down there.

The opportunity a few months in to go down there and see Antino - that was a massive conviction-building opportunity for me. The size, the scale, the obvious evidence everywhere of the opportunity was laid out for all to see. Doing a tour of the workings, and seeing exposes mineralisation. Getting to speak to the local miners, the technical team, the visiting analysts and geos about what they see and believe? It just felt blindingly obvious this was going to be one of “those” projects. The ones that are name dropped in a hundred different slide decks for 20 years as the best case comparable - “this could be the next _______!”

So yeah, it’s been gratifying to see the market continue to agree with me since, marching Founders all the way from $1.40 to almost $6.00. It always feels good calling your shot.

And not to be too bold, but I really don’t think Founders is done yet. They keep uncovering new targets, drilling them, and discovering more gold. Their win rate is ridiculous (I’m not being silly here - have they missed in a meaningful way?) and the list of targets just keeps growing. I take care when I say this to not just be promotional, but based on past results, it feels like the process is still just getting started. We’ll see I guess.

So what’s the lessons to draw from this, even just for me? Well, if you think you’ve identified one of those true, rare, prized, tier 1 projects, you essentially have to ignore all your other investing rules. Dangerous, but powerful. Things like:

Lesson: Hold Onto Your Winners

So not to be too cute, but the lesson from special projects is that, well, they’re special. The numbers bear out that you have good odds of successfully riding them longer for bigger gains.

Lesson: Trust the Process/Working Model

Founders was in a sweet spot that I have found works well for me: Proven geological models and a bunch of matching, untested, (nearly) drill-ready anomalies with a good treasury. These companies have projects that Find those stories.

These guys remain a favourite. My called shot today I’ll make once more is that Founders where it is now just south of $6.00 is going to look like one hell of a deal this time next year after they’ve drilled 60,000 or more meters into Antino. It’s easy to see a $500m market cap and think the story has been told, but I just don’t think this thing is done. They certainly aren’t done drilling and discovering.

1.2. Power Nickel (PNPN.V), Gold-Tier

Lesson: Hold Onto Your Winners

Lesson: Trust the Working Model

This is in the middle of absolutely busting out. When I started working on this project in December, PNPN was an 8 bagger around 95 cents. As of writing (Jan. 30), it closed at $1.49, making it almost a 12.5x from the first interview share price of just 12 cents back in fall of ‘22.

Not bad.

The only reason these guys aren’t #1 is because I’ve stopped engaging as actively and publicly in their story. But I was all over them early on and had Terry on multiple times in the early days when he was still working from his Chilean Metals email. Well before Lion even had a name - back when all this insane grade they’ve been hitting (32m @ 6.97% CuEq, 14.4m @ 12.14% CuEq) was just some untested anomalies that looked awfully similar to Nisk (which - return to these lessons I’m building - was a big reason why I was so excited for PNPN in the first place).

If you keep reading down through to my losers, I took a big L on bulk tonnage nickel on multiple occasions (for obvious reasons, ie, Indonesian HPAL). Even those bulk tonnage projects with legitimate shots at high grade within it (looking at you Fathom) but haven’t quite managed to get it figured out have struggled mightily.

But boy does Power Nickel prove that high-grade magmatic Ni+ deposits remain among the most exciting and desirable projects on the market (though PNPN reports generally in CuEq now).

My reasons I liked PNPN then:

They had a working geological model in the sweet spot for me, as described in Founders. (“Trust the Working Model”)

Their Nisk project in northern Quebec has huge jurisdictional advantages. It’s Quebec - there is mining support culturally, technically, legally, politically.

It was remote, but well-connected. Electrical substation and paved highway both run near to site.

Fresh start - Terry became CEO in March of 2018. He followed quickly with a 2.5:1 rollback in May of 2018, 4:1 rollback in July of 2019, and a name change and pivot to Power Nickel and Nisk in 2021. These hard pivots of course can put the hurt on existing shareholders, but fresh starts are also a potentially excellent entry point for new shareholders. Loss and gain are two sides to the same coin.

So I felt a lot of vindication watching Power Nickel start its run about a year ago. But if I am being honest, I have to admit I underestimated it. I had thoughts that maybe PNPN had run its course this past spring around 60-80 cents, which put it around a $100-$150 million market cap, as I wasn’t sure they had the tonnage booked to command a higher valuation.

But my goodness didn’t the new anomalies they drilled into new discoveries force the market to keep adding value to PNPN. Those are industry-leading grades, over healthy widths.

PNPN has made me start to reconsider. The amount of strength it shows, and the way it keeps building, makes me now think this could keep going for a while yet. They’re on my shortlist for buying a position in, having already rode it from ~20 cents to ~60. And there’s that other lesson. Hold onto your winners. If you truly believe you’ve got a unicorn, you owe it to yourself to ride it.

So, in the end, despite their being two very different projects, I actually see a lot of parallels between Founders and Power Nickel. And there’s a lesson there - that winners do have a tendency to stick out, in grade, size, and market reaction.

I know Power Nickel certainly has.

1.3. Arizona Gold & Silver (AZS.V), Gold-Tier

Lesson: Trust the Working Model

Lesson: Timing

This one is little different than the last two. Significant gains in FDR and PNPN have already happened. AZS, though already a healthy win, still feels in the “before” time of its potential.

Already a good win that has been *not quite* a double for much of the time since I started following them a few years ago. With an important drill campaign just nicely started, there promises to be lots of news flow this year that might boost those numbers.

Quick hits:

Good leadership team

Tight float

Smart with their money and cashed up

Not too promotional

Recent financing led by Sprott and Rick Rule

Have drilled out a healthy (unofficial) resource (1-1.5m oz most likely)

12,000+ meters planned for 2024/25

Imminent assays from important drill campaign with large bulk tonnage targets

Months more of drill results to follow

Lesson: Trust the Working Model

Again, lots of overlap in themes here with my first two winners: AZS have confirmed a working geological model with an initial discovery under their belt but their true prize lies in having other matching, untested-but-understood targets to add to it.

Maybe you miss the ride from ground floor up for a couple levels, but if you pick the right project there’s still lots of levels left above you. And not to mention you avoid the risk of crashing into the basement.

Now, I don’t think the known scale of Philadelphia is at the same level as FDR or PNPN, but that’s hardly meant to be an insult. There’s lots of immediate and long-term potential here. In terms of drill-ready targets, there’s surface veining to the south, gaps in drilling along the fault from their original drill campaigns and, the biggest, the Red Hill target. More distantly, there large unexplored anomalies further afield - i.e. a claim to the northeast and “Philadelphia East” as well.

Which is to say, a lot of potential targets.

Lesson: Timing

This one has been a bit of a slow burn. They run a tight ship and have had good drill-based success, so there’s been good long-term momentum. But unfortunately, BLM permitting delays over the past year or two had slowly increased the head winds here. But that also means opportunity for shrewd investors.

So AZS definitely was good timing in the short term this past year - as the permits got approved and a strong financing closed over the course of 2024 (and I said as much this past July and October), it was obvious to me that Arizona was a smart buy in the lead-up to drilling. And it was, swinging from the low $0.30s to $0.50+ in anticipation. Whether you wanted to play some pre-drill momentum or hold truly long through results, AZS was in an “easy buy” window for much of the past 6 months.

And you know what? In the long term, I still think the timing is right. People are still sleeping on AZS and that means increased opportunity. Zoom out: They’ve planned for 12,000+ meters of shallow (300m holes max, most within 100-200m) drilling in 2024/25 and a lot of varied targets available to them.

Yes, the single assay so far from Red Hill didn’t quite hit pre-drill hopes (100+m of 1+ gpt) but in the right context, the 64.2 metres at 0.563 gpt it returned is still mineable. (and Rising Fawn also did just fine.) Indeed, nearby Moss Mine’s cut-off grade is/was 0.15 gpt (though, to be fair, with 0.88 strip). But in terms of cheap projects, Philadelphia has a lot going for it. The first BLM assay wasn’t a grand slam, but it was a base hit. Points on the board.

So even if Red Hills only turns out a modest win (and again, this is all based off a single hole, so let’s not be too dramatic here), it will still substantially increase the tonnage coming from this property. This is your classic forward-looking statement, but there seems like a reasonable path to two million? Three million? More? Cheap, close-to-surface ounces here in fairly short order.

So, a two-part question:

1. “What do you rate the odds of a happy ending for?”, and

2. “What do you place the overall value at?”

Of potentially two or three million ounces (and a reasonable chance for more with positive results) of cheap, near-surface, heap-leachable, above cut-off grade gold just a half dozen miles as the crow flies from a nearby mine with exhausted reserves under brand new ownership? I’d say the odds are pretty good for AZS to ultimately sport a market a lot higher than its current $35-$40m, surely. And that’s ignoring those eastern claims.

So yeah. Timing and Working Model. 2025 could be the start of an inflection for AZS. 12,000m+ of shallow drilling can do a lot of damage, and that promise of constant drilling results from a pivotal campaign over many months is exactly how exploration companies rerate in real time in this sector.

This one is poised to have an excellent 2025 if things pan out.

1.4. AbraSilver Resources (ABRA.V), Gold-Tier

Lesson Learned: Focus on Quality

Lesson Learned: Trust the Working Model

Abra is another one of those “easy” picks that, again, fits that same model of focusing on potential for further discovery (rather than potential of initial discovery), albeit at a more advanced stage than my previous 3 picks.

As a backpatting aside - this is another one I beat Rick Rule to. If anyone cares. All three so far have had billionaires and mid-tiers/majors come piling in after me.

When I first picked Abra, they already had a healthy, high-grade resource, but it was the targets they had identified yet to be drilled which made Abra’s path for future growth pretty obvious. And in the 18+ months since my original interview with CEO John Miniotis, my interpretation on this front has been emphatically confirmed. Outstanding grade and healthy scale caught my eye then, still catches my eye, and is why Abra feels like another one of the those projects that’s just going to keep growing till someone takes it out.

The results have been impressive. Abra’s Diablillos project is capable of producing just silly high grade. Indeed, some of the top gold/silver intercepts every year come out of Diablillos. And all else equal, grade, as they say, remains king.

Another, related, piece of logic behind this one (and other wins of mine): In weak markets, only top-tier projects are going to get sustained love. Pre-discovery plays of course don’t have any backing to their valuation. They hope for speculative pre-drill growth. And sometimes that works and sometimes it doesn’t.

But this is a market that doesn’t provide benefit of the doubt for very long. Speculation-driven valuations can disappear shockingly fast and pre-discovery misses are punished swiftly and harshly. I get the sense that projects with demonstrated size, grade, and further potential (like Abra) serve almost as a “flight to safety” alternative for investors looking to remain in this sector.

Similarly, I think a key point many people fail to make is that investing isn’t about maximising exposure to reward, it is about maximising the ratio between reward and attending risk. Companies like Abra are a great example of this. You weren’t going to get a 10X off this play when I picked it, but the certainty of Abra’s story continuing to grow made this a smarter pick than 99% of those pre-discovery “penthouse or outhouse” plays, especially in this unforgiving market.

Sitting now as it is at roughly a double since I recommended them, this is one of my best and highest conviction picks, even if it hasn’t hit the heights of others. And looking forward, it remains a good, safe pick to keep getting better until its bought at a premium (why hello Kinross) as Argentina continues to to attract increasing foreign investment.

1.5. Globex Mining (GMX.T), Silver-Tier

Lesson Learned: Royalty Cos Need Revenue

Lesson Learned: Value Companies that Value the Treasury

This is one I still quite like and am unsurprised to see it get some love since I first met CEO Jack Stoch. Jack is notoriously flinty as a negotiator. The guy is polarising - if you like his business model, you think he’s genius. If you don’t like his business model, it’s because you think he’s such an unrelenting negotiator that he’ll never get to make moves on major projects as his asking price is so steep.

That’s because his ask is large and almost unique - a 3% GMR (yes - gross!? metals royalty) for optioning projects to would-be explorers from his very large portfolio of properties under Globex’s control. When those actually get turned into producing royalties, that is a huge cut.

So realistically, it’s probably true that some projects or teams will never cross Jack’s plate because the price to play is just too steep. And it’s probably true that the projects he does option out to others can end up fairly seriously encumbered by that 3% GMR.

But I don’t think that’s much concern to Jack - too much to handle? Feel free to let the option lapse so the property can to return to Globex, now with however many more millions of dollars you’ve spent on it in exploration data. Don’t want to give up on the project but still want that GMR gone? Then you’re also more than welcome to hand Globex millions in buybacks on those GMRs. No matter what, Jack wins, and Globex’s collection of assets grows.

So, maybe your chance at true home runs is pretty small with Globex, but you know Jack is going to keep hitting singles every single time. He risks sometimes selling low on high potential (Brunswick Exploration’s Mirage/Lac Escale project is often held up as an example of that). But he almost never loses. And that’s a significant thing.

It is precisely because of this shrewd strategy that Globex’s list of assets has just kept getting bigger and bigger. And whether it comes in the form of a thousand loonies or one single $1000 bill, a thousand bucks is a thousand bucks.

So at a certain point, who cares if Globex won’t ever land a 10m ounce gold project or work with a true industry major? After decades of wheeling and dealing, Globex has acquired a massive, massive arsenal. Jack has little red paper clipped his way into having the potential to make some very big moves if he wanted to.

Indeed, I’m sure the liquidation value alone of everything would be well in excess of the current market cap. I don’t know the end goal here, but the constantly-growing value proposition for investors is undeniable.

Lesson Learned: Royalty Cos Need Revenue

Jack Stoch can afford to be patient because he is constantly bringing in revenue, whether as recurring payments from some of his royalties, or the constant churn of options and sales. And that’s a critical point to make with royalty companies.

I have a negative example of a royalty co. with decent assets that gets zero credit because it has no revenue coming up. Pre-revenue royalty companies sort of are the worst of both possible worlds when things are going poorly in the sector - no revenue to protect against dilution and no easy-to-sell exploration thesis to attract capital and interest.

Globex consistently bringing in more than enough revenue for operations and even conducting stock buybacks proves this isn’t an issue for Globex.

Lesson Learned: Value Companies that Value the Treasury

That last comment above leads me to the other lesson from Globex as well. Even the best companies in this sector end up with massive levels of dilution to create their value. They’re pre-revenue. It’s the name of the game. Success means managing to create more value than they destroy. However, some companies do a good job of protecting shareholder capital, while others do not.

Jack does an excellent job of protecting shareholder/Globex capital. Cheap, low overhead, no lifestyle company shenanigans. Stoch is well-compensated, but I don’t think anyone could ever reasonably accuse him of acting against the interest of shareholders. He works has ass off and is very defensive of Globex capital. That’s his whole schtick. To wit, the share count has been essentially the same for years upon years. That’s obviously an excellent sign. In a sector of fundamentally unsustainable business models made worse by lifestyle CEOs, Globex is refreshingly aligned with shareholders.

I owe Globex some attention. I am still eager about them and their little run to almost a double in early 2025 from where I started with them has been gratifying to watch. There is a bit of a “hidden gem” allure of a company having so many projects - what secret treasures are lurking? I did a few dense updates on some of Globex’s major projects, but the strength of Globex as a company (the sheer amount of projects it has) makes it kind of maddening as an analyst - there are so many it’s almost a full-time gig just keeping up with and reporting on Globex news flow alone.

Still, I have plans to get them worked back into the rotation here, as I just don’t see how this story ends badly for investors. Because yeah, what’s the nightmare scenario - liquidation? That would be an incredibly healthy final dividend indeed.

1.6. Dolly Varden Silver (DV.V), Silver-Tier

Lesson Learned: Focus on Quality

Lesson Learned: Insider Buys and Sells

You can almost plug and play my comments about Abra to here regarding why this met my investment criteria. Great grade. Pre-existing resource but a geological model and thesis that suggested there was lots left to explore and discover (which they have successfully executed on since I first covered them). Similar gains - peak and current. And I even beat Rick Rule to this one, too (that’s three).

Dolly Varden was an early favourite of mine and CEO Shawn Khunkhun one of my first interviews. One plus - I like Gold-Silver combo projects (AZS, TAU, others). Similar to Abra, when you look at the “top assays” list for gold and silver, Dolly Varden is on that list. They hit some absolutely absurd grade pretty consistently and have done a good job of increasing their land package and then stitching it neatly together through strong discoveries.

However, I admittedly haven’t kept up with this one as closely the last year or so, aside from reading assay results as they come in. Still, it’s been a good call that has certainly provided market-beating returns since I picked them.

Be a little wary - the float is getting a little big. Abra successfully survived a 5:1 rollback without damage because they had a slew of impressive news to go along with it. Will have to see how Dolly Varden navigates that moving forward as I assume it will happen eventually.

And another note here - there’s been significant insider exercising and selling of options lately. A little here and there doesn’t bother me (kinda the whole point of buying a stock is to sell it eventually and I am okay with the concept of executives who have built success being reward, but multiple insiders sold millions of dollars of shares as the price was at all-time highs in early November, and the trend has been consistently downward since.

Right or wrong, fairly or unfairly, millions of dollars of insider selling - even at all-time highs - risks putting out a negative signal to the market. Hard not to interpret the significant selling at that ~$1.30 range as being at least an intermediate top on the chart and that further sp growth will have to be fueled by either improving market sentiment or substantive further drill bit success.

Still. Strong jurisdiction. Strong grade. Strong technical team. Lots of drilling. Strong project. Strong pick.

1.7. Tocvan Ventures (TOC.CN), Silver-Tier

Lessons Learned: Cheap is Good

Lesson Learned: Value Companies that Value the Treasury

This is another one I think could be in line to have a very good year for roughly the same reasons as AZS. Though off ATHs still, Tocvan’s chart has been more resilient than most in this sector over the past few years, and there is a positive trend line emerging. Though it’s perhaps taking longer than he would have originally hoped, CEO Brodie Sutherland has a good project, a smart idea, and is executing on his plans to advance Tocvan’s Gran Pilar project quickly to pilot production in 2025.

A few things drew me to Tocvan and is a big part of why I believe Tocvan has weathered this market downturn fairly well, though it is indeed still down from its own all-time highs:

First, this project is cheap. Cheap to explore, and almost certainly will be cheap to mine and produce. Shallow holes, surface/near-surface mineralisation, utilisation of RC drilling, cheap jurisdiction, heap leachable. Generally speaking, when costs go down, odds of success go up.

Secondly, Brodie does a good job protecting the purse. His raises are generally sufficient to continue operations without unnecessary bloat and well-supported. No massive promotional efforts outsized for smaller companies. No massive salaries. I trust his instincts in this regard.

Thirdly is my confidence in Brodie’s aggressive game plan (he wants to do a pilot production “proof of concept” 50,000 tonne bulk sample this year as a step toward building Tocvan into a small, low-cost producer). My confidence that it is feasible is largely due to the fact there are peer projects in the neighbourhood that host deposits similar to Gran Pilar and employ the same production methods with known opex and capex numbers. Brodie believes he can do it because it’s already been done and publicly recorded. Sounds reasonable to me.

Tocvan has importantly increased the size of the land package significantly, bringing in areas being worked by local artisanal miners (that sounds familiar doesn’t it?) and extension of known trends. The two newly-unified parts are just now starting to be understood and drilled as a unified hole.

And Tocvan has had success up to now in drilling out Pilar. Zones of mineralisation continue to be expanded, as the company tests many targets for the first time ever. Let me remind you hear of the advantages of Pilae - and I really am going to start echoing AZS here - shallow, heap leachable, cheap. I like this because in these scenarios, you can do a lot with a little when it comes to grade. It doesn’t take much to be economic. And Tocvan has been adding meaningful ounces through their drilling.

There have been some head winds - Mexican open pit concerns loom, even if they don’t technically impact pre-existing permitted concessions. I am of the opinion Sheinbaum will recognise they simply can’t afford a blanket ban, and will instead toughen up permitting or regulatory oversight in some way. So be it.

And timelines have stretched a bit. This bothers others more than it does me. I assume it to be inevitable, so, so long as the company has shown it knows how to execute I can handle occasional delays. Things take time and things go wrong. This is where having a company be responsible with shareholder investments comes into play especially. When time is money, that means blue sky potential is bled out slowly when timelines stretch. Circling back to a previous point, this is where fiscally responsible management helps big time. Credit to Brodie here.

So yeah, Tocvan is another company I think is poised to have an excellent year. Drilling is ongoing. They will no doubt continue to expand the known areas of mineralization and, with any luck, new discoveries are on their way.

And if and when this bulk sample is completed by Tocvan, that will provide critical metallurgical insights that will significantly confirm the technical understanding of Gran Pilar. Which in turn paves the way to significantly greater confidence in Gran Pilar - for Tocvan if they continue their path towards becoming a producer, or for any bigger fish looking to potentially take them out. And that success would no doubt be felt by the share price as well.

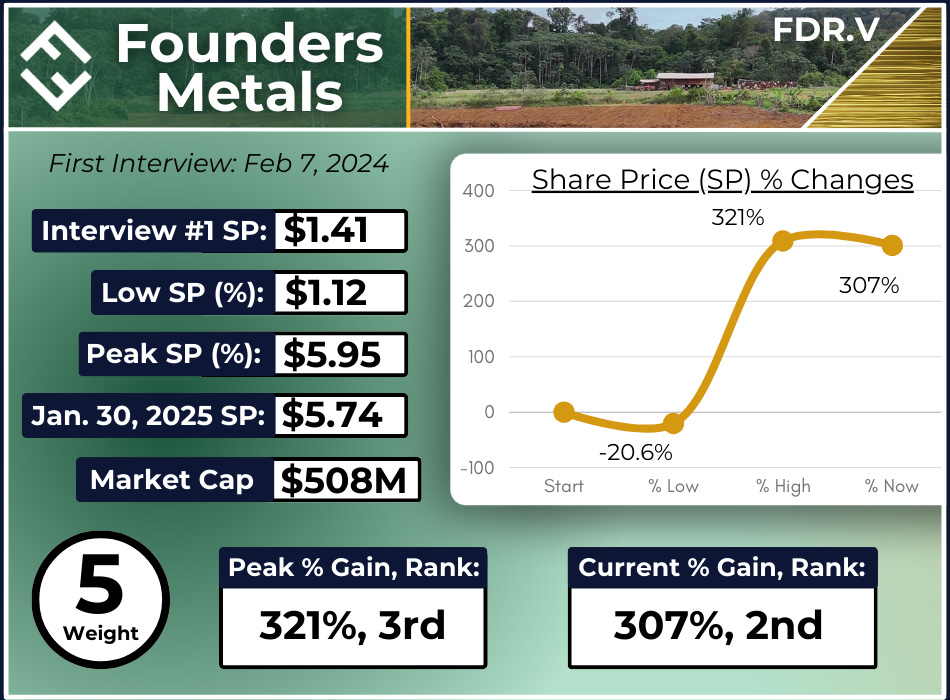

1.8. Perpetua Resources (PPTA.V), Bronze-Tier

Lesson Learned: Critical Metal Kickers

Lesson Learned: Focus on Quality

So this one… I mean the basics were obvious:

4.8m oz at 1.43 gpt Au P+P and 6m oz at 1.42 gpt M+I.

Bottom-Quartile AISC

Financing secured.

Good strip ratio.

Exemplary environmental clean-up efforts

Critical defence metal kicker in antimony (350m lbs over LOM)

It’s 10 million ounces of good grade with great economics a couple years away from production. And, to cap it all off, has a unique, powerful, kicker in the form of antimony.

Now, niche, critical metals are getting roughed up in the market, generally speaking. Graphite, vanadium, REEs, nickel, on and on. All critical in some or all western jurisdictions, all expecting outsized and exponential growth over the next 10, 20, etc years. And yet, none of them really catching a bid.

Lesson: Critical Mineral Kicker

There’s two key factors that turns antimony into a feature not a bug here to buck this trend:

It doesn’t drive the bus. 10 million ounces of gold will always and forever be the headline here. Much greater market stability, cost certainty, access to capital, reliable margins, etc, etc. The critical metal is a nice little sub-plot that augments an already tier 1 story. Phenom Resources, as a counter example from among my interviews, has America’s largest primary vanadium deposit, which could be a potentially compelling narrative, but because it can’t find a gold system to staple to it it remains stuck.

It’s of critical *military* importance. Not to go too grimly realpolitik in here, but… it of course makes sense. Huge supply of a rare metal critical for a range of essential military purposes, situated in the US heartland (and with 10 million ounces of gold on top of it, natch)? It even sounds American. That’s what separates antimony from, say, graphite, and helps Perpetua secure multiple tens of millions of dollars in government funding to date due to it.

(As an aside - extending from that idea, thinking about other projects I like that have critical *military* metals in them - Fireweed Metals comes immediately to mind. And it too has that similar feeling of inevitability to it.)

And - it sounds cliched - but there’s room for more growth here yet, as the P/NAV PPTA trades at (0.3 - 0.4ish) is still low compared to its peers.

Lesson: Focus on Quality

And as a final thought - This is a great example of how I think retail can be too smart by half sometimes- Perpetua offered returns of 4-5x in less than two years. If you can 5x your money on a company of Perpetua’s size and quality of project, it makes the “penthouse or outhouse” discovery plays ring a little more hollow.

1.9. GFG Resources (GFG.V), Bronze-Tier

Lesson Learned: Trust the Team

“Go with guys who’ve done it before and want to do it again.” That was basically the core of my investment thesis in GFG. CEO Brian Skanderbeg is clearly a smart and driven guy, and he and his team have won big before - Brian and other GFG teammates were also heavily involved in Claude Resources (Brian again CEO) who was teetering on insolvency before being turned around through new discoveries into a highly successful mine, and, ultimately, sold for CAD $450 million.

Even though he’s only been on for the one interview, I’ve bumped into Brian a few times now at different conferences and have passively kept up with GFG as a semi-local connection (Claude’s Seabee mine was a Saskatchewan company, GFG is HQed in Saskatoon. Brian is a prairie guy. Yes that’s called bias.)

When I came across them, they were just nicely pivoting from a Wyoming project into looking to uncover hidden gems in the historically prolific Timmins Gold District (so the same basic playbook as what worked so well at Claude - revitalise old areas. Companies switching flagship projects is one of those situations you ideally are never in, but boy if it has to happen, learn the lesson quick and pick smart.

And I thought GFG’s logic was extremely smart.

Which, not to be too cute, but that was honestly enough for me. Brian and his team were smart, had a proven, winning strategy, were (importantly) still driven and motivated by the prospect of success, and were in broad strokes reusing the strategy that brought them so much success the first time around with Claude.

“Let them cook” as they say these days. Let these guys recalibrate and execute.

And, as a credit to that execution, GFG has been a very rare case of patience being rewarded in this sector. GFG made the called, executed the pivot, acquired a large land package, honed in on a few priority targets and… started coming up with some pretty darn good hits that look like they’ve opened up the potential for a significant new discovery and, suddenly, they’ve got some momentum behind them again. It’s very hard to get up off the mat in this sector, but GFG looks like they’re in the process of pulling it off and are touching up against their 3 year high.

Which, not to be too circular here, is a testament to the team.

Finding an experienced team that has a track record of success and execution but is still able to maintain the hunger and drive needed to effectively advance projects is a pretty smart filter. That’s the logic behind this one. And it looks like it may pay off yet.

1.10. EV Nickel (EVNI.CN)

Lesson Learned: Portfolio Composition

This is a strange one, to be honest. Bulk tonnage nickel. Lots of it. Fair shot at some high-grade tonnage. In the heart of Canadian nickel near Timmins. But things have been pretty tough with nickel for a while, and so you would expect EVNI to struggle along with it. And it did.

But then, in the fall of 2023 right after bottoming at 5 cents (and well into macro nickel’s extended decline) without any real catalyst, EVNI sort of quietly started going up and kept going up for 6 months, topping out above 80 cents. And then, spending most of 2024 above 60 cents, in the last few months the air has slowly come out of the balloon just as unyieldingly and EVNI is back down all the way to 25 cents. All under the eyes of silent new management.

It’s been a strange show to have cheap seat tickets for. And because it is a little mysterious I am cautious to ascribe any deep meaning or lessons to it. To go down 60%, up almost a 6X and then proceed to give almost all of it back, all without any catalysts or really even communication from management - this might be one of those outliers without much reasoning to garner from it.

Lesson: Portfolio Composition

Maybe the sole reflection worth speaking of from EVNI (aside from be cautious of quiet management) is in regards to optimal portfolio composition, specifically how many tickers you should own. Now, that’s an incredibly nuanced and fit-for-purpose question and answer, but EVNI’s story certainly supports the argument for a certain degree of diversification. There is fundamentally an element of chance in this game. Good and bad. Drill bit, geopolitics, community, plain old timing, whatever it was that happened here, etc. Man plans while God laughs, as the saying goes.

So, in theory, you expose yourself to more lucky/positive and also more unlucky/negative outcomes in this industry the more tickers you take on. But, due to upside potential inherently outweighing downside risk, ($10,000 can become $100,000 in gains but can only ever be $10,000 in losses) you generally come out ahead in the overall odds through owning more tickers over fewer. As stated above, single asset companies are extraordinarily risky and there is no key person insurance for investors in this sector. Unfair, impossible-to-anticipate bad luck happens all the time. And on the flipside, company-defining good news that just needed a little good luck to make happen also happens all the time.

And remember - not all wins are created equal. Power Nickel is an incredible success, but *nobody* was predicting what they found before they drilled it. These companies - no matter how much energy and expertise you devote to understanding them - remain at least in part lottery tickets. You just can never know till you drill. That’s part of the fundamental allure. You do your homework, make good choices, and sometimes you win, and sometimes you just get to get lucky and you win big.

So if you’ve got a good batting average in picking winners, there’s maybe some logic to more positions means more chances for the lucky jackpot payout.

I am certainly not going to say how many tickers this means, or even how fully convinced I am by this, but there’s meaning in there somewhere.

1.11. Fireweed Metals (FWZ.V), Bronze-Tier

Lesson Learned: Focus on Quality

Lesson Learned: Critical Metal Kickers

This is one I like a lot, then and now. Canadian. Huge. World-class. Critical metals all over. Multiple deposits of multiple metals. Overall an embarrassment of riches. Massive blue sky. Rock star geological team. Huge names involved. Etc. etc. I was hardly early to the game on it, but it has still progressed nicely and in very big ways since I started covering it. And, as I referenced somewhere above, I imagine this one is going to continue to be special for all the reasons that make it unique.

The Lundins firmly taking control of Fireweed was a little bittersweet for me and many other Fireweed followers. Former CEO Brandon Macdonald was an executive I have a lot of respect for. Smart, ambitious, articulate, honest, and generally not an asshole. I have interviewed and otherwise chatted with Brandon a number of times and I very much counted him as a big part of the bull case for Fireweed.

So when the knives came out in the boardroom this past spring and Brandon was swiftly removed from his position it was, yeah, a bit of a shock. The Lundins have a reputation for developed industry-leading projects. The way they have brought Fireweed on as a close member of the Lundin family of businesses is an exciting development seems pretty telling. But there was a price for it and making it theirs meant making it theirs.

The Lundins have since switched the focus for Fireweed from releasing an imminent resource estimate on its project(s) to delaying doing so and getting back to serious drilling and discovery-based exploration. And so far so good as the results have been very positive.

This feels like one of those rare companies in this sector where you can just buy it and stick it in the sock drawer for a few years and end up happy. Maybe not the 10X+ you dream of, but still lots to be happy for. And hey, given the Lundin’s track record, a 10X still isn’t out of the question.

I remember bemoaning a year or so ago to a friend of mine in the industry about how foolish in hindsight not jumping into Filo and NGex was. How easy of a decision it should have been in hindsight. Makes me wonder if this is that mulligan I was hoping for. You certainly can’t ask for a much higher quality team and project than here. All the hallmarks of one of those projects that just keeps getting bigger and better.

Group 4: TBD

Read on for an overview of core companies of mine that are down since my first interview, but who I still believe in.

4.1. Thesis Gold (TAU.V), Silver-Tier

Lessons Learned: Knowledge Is Patience

I am doggedly giving this company a silver badge as one of my favourite picks, both then and now. I’d give them gold, but considering that Thesis is actually currently decently red in the JRI portfolio thought that might go too far.

But down or not, I still feel awfully good about Thesis. 4 million M+I ounces of good grade, approaching 5 million if you count inferred. Steady exploration progress continues to yield new targets and discoveries. Very good economics. Still blue sky potential both at Ranch with more epithermal gold but also with the underlying porphyry lurking about (Amarc’s exciting new porphyry might be waking the Toodoggone region up a bit here). Great jurisdiction. Great location. Great team. Great metallurgy. High proficiency and nearing PFS-level data. No warrants. No debt. No streams. Small NSRs. Suffice to say, this ticks a lot of boxes that would make it a very good candidate for a mid-tier producer to take out.

Thesis the company is strong. Thesis the project is strong. That makes me confident that Thesis the stock will eventually sort itself out. I’ve spoken on this before, but I think Thesis has had to fight some shareholder churn coming out of its merger with Benchmark in the last year or two.

But the vagaries of market sentiment will never change the truth of what this company has. And that is a 75/25 gold-silver project averaging over 200,000+ oz/year for LOM with a $1.28B after-tax NPV5 and 35% NPV at $1930 gold. Checked spot lately? Closer to $2930.

And all this? Current market cap? CAD $132 million (at $0.62). That’s a 0.1 P/NAV for a company ~80% (my guess) of the way to a PFS in terms of cost. You tell me if Thesis sounds undervalued.

Because I know it does to me.

I like Thesis’ recent new additions too - a PhD for a new chief geo, and a sharp, experienced new VPIR. In-housing that knowledge and ability is certainly a positive sign. They’re the sort of moves whose impact might start small, but can produce big changes over time. When you’ve got a quality company and project like Thesis here struggling to get the attention it deserves, new blood can be a critical add.

Lesson: Knowledge is Patience

The only shield from panicking during crashing volatility is knowledge. Thesis is very much undervalued at these levels compared to its peers. However, if you haven’t done your proper due diligence on what Thesis is, odds are probably pretty good you’d have panic sold by now.

There’s a few high quality development stories scattered across my top wins. All have managed to keep moving higher while advancing their project. I believe Thesis could and should become another one of these “easy” big wins.

And with a shortage of strong projects in safe jurisdictions, Thesis’ chance to be a market darling I am sure will come again. That tends to happen to good projects.

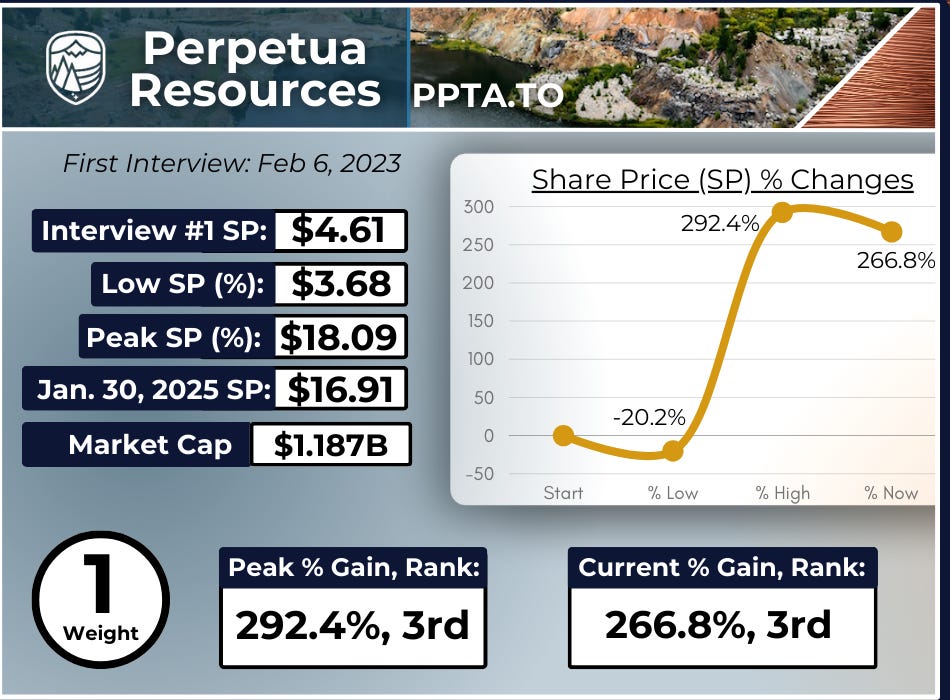

4.2. Fathom Nickel (FNI.CN), “Ask Again Later”

Lesson Learned: Bulk Tonnage Nickel Struggles

This has been a tough one for me. I like Fathom a lot. I have an immense amount of respect for CEO Ian Fraser and his vision. He’s studious, evidence-based, and sharp as a tack as a geo. I fundamentally believe there’s something special lurking in the Canadian Shield up there in their land and that Fathom is agonisingly close to finding it.

On a personal level, they gave me a job as their IR guy, and though we’ve mutually parted ways - evolving needs on both ends - it gave me important experience in this industry. Indeed, they are one of the top few companies I have worked closely with and I made that choice because I trusted Ian’s integrity and ability. And Ian will certainly still be featured on the show as time goes on as Fathom’s story progresses.

So yeah, lots of good things going on here, both on a personal level and (more importantly for you) on a market level.

But they are in a very tough spot now there is no doubt. They’ve had good results. Even very good, especially with the tight drill budgets they’ve had. But not the exceptional assays it was going to take to win over the current market. Nickel in general and bulk tonnage nickel in particular have struggled mightily in the wake of Indonesian HPAL turning the global market on its head over the last 2-3 years. Fathom as a fledgling microcap trying to revitalize old projects got caught up in it badly.

Lesson: Bulk Tonnage Nickel Struggles

My misplaying bulk tonnage nickel is a recurring theme among a few companies I ended up down significantly on and unquestionably my worst recurring trend. I thought tier 1 jurisdiction bulk tonnage nickel production was the future. And honestly, I’m inclined to think it still will be. But we’ve got to work through rapidly-expanded Indonesian glut first. So in the meantime, bulk tonnage projects have zeroed in terms of general market interest, credit, or mercy.

Is this a classic market overreaction? Absolutely. Will the pendulum swing back? Without a doubt. Slashed production quotas coming out of Indonesia suggest this isn’t that far off.

But for microcaps like Fathom in survival mode right now, those assurances are cold comfort. And the fact that I believe Fathom is only $5 million or $10 million of exploration away from making a potentially truly major nickel discovery similarly are cold comfort to a $5 million market cap company facing constant challenges to raise capital.

I’m rooting for Fathom. They have a great team and good land and feel like they’re on the precipice of putting all the pieces together. And nickel will turn. But when? So long as that uncertainty remains, good companies like Fathom are stuck in a damaging limbo. Right idea, Indonesian-induced wrong timing.

4.3. Invictus Energy (IVZ.AX), “Ask Again Later”

Lessons Learned: Jurisdictional Risk

Ah, Invictus. My old flame. My biggest loss - realised and unrealised - by total dollars. Huge natural gas (and more?) discovery, Managing Director I like, lots of offtakes signed, massive retail support, quick path to production in an area desperate for it. Where? …Zimbabwe. I’ll give some time here for people to shuffle out of the auditorium with that little detail disclosed. But I still believe. I think.

I came across Invictus while it was bouncing between 15 and 25 cents (AUD) in early 2022 and immediately ignored it due purely to jurisdictional risks associated with Zimbabwe. You know - international sanctions, rampant corruption, political killings, repression, etc. etc. But man was the potential of their Cabora Bassa basin project huge.

Chatting with MD Scott Macmillan (a Zimbabwean national) and Aussie bullboard HotCopper posters convinced me of the “100 Very Good Reasons why Zimbabwe Wouldn’t Mess With This Project”. And they really are legitimate reasons to be cautiously optimistiv. The greatest hits:

National Zimbabwean pension plans invested big in it,

There are deep Zimbabwean connections in multiple leadership roles,

Massive potential energy project which could revolutionise the country and its standard of living,

And even that if Zimbabwe were indeed to rug pull Invictus out of their project somehow, doing so to such a high-profile project would likely put a serious chill on any further foreign investment in the country for a while, which runs counter to the post(ish)-Mugabe regime’s stated goals.

Reasonable right? And those willing to go against the crowd and pick out early stages of major changes (like, say, Zimbabwe becoming investor friendly) can be handsomely rewarded.

And so after an automatic no for so long, I drank my own kool-aid. After summarily passing on Invictus for nearly a year, I listened to Scott (who after many hours now of speaking with him I am still confident is a smart, solid all-around guy who for years has put his heart and soul into making Invictus work) break it all down and I was convinced. So I put some money in and he started coming on my show.

And the bet worked. Invictus made their discovery. It took more time and money than was anticipated, but they did it. And yet, here Invictus finds itself, down big on its chart and stuck in neutral, even with the start of what looks to be a major discovery under its belt.

How did this happen? How did one of the biggest o+g discoveries of the past decade or so end up so down? Take a guess. Hint: It rhymes with “shmurisdictional shmisk”.

Because Invictus is stuck. We don’t know exactly what the issue is, only that the Petroleum Production Sharing Agreement (PPSA) that the government has been “imminently” about to sign off on for about two years…. has just never happened.

Without the PPSA there is no governing taxation/royalty agreement with Zimbabwe. No PPSA, no JVs. No PPSA, no further offtakes. No PPSA, no further funding or exploration. No PPSA, no more progress. What was at one point the hottest resource stock in Australia is now stuck in limbo thanks precisely to those jurisdictional concerns I ignored so I could buy in big. Oops.

But all hope is not lost. This remains a massive project with massive potential. If whatever inscrutable process that is happening behind closed doors ever gets resolved and the PPSA signed and the gears start turning again, I fully expect there to be hype return to this ticker. Full credit might not be given till first revenue dollars are in Invictus bank accounts and trasnferred out of country, but this is a big name with a big story and a big following. Tail winds will do it a lot of good.

So that’s why I still hold out hope and am still rooting for Scott and Invictus to come good. They’re a story that could help Zimbabwe increase its standard of living for a generation to come.

4.4. iTech Minerals (ITM.AX), “Ask Again Later”

Lessons Learned: Beware Niche Metals

Another Aussie stock that has gone seriously down under on me since I started covering it. I like MD Mike Schwarz. For one, he’s a good guy. But he’s also a smart and shrewd operator - he knows how to maximise the value of investor dollars (smart financings, cheap projects, millions received in government grants).

Even though the market has clearly determined via share price depreciation that iTech is struggling, I still don’t think I made any stupendously incorrect error in judgement on it, aside from taking a bet that graphite would run soon.

I mean, it still sounds good, doesn’t it? Consider:

Right jurisdiction and infrastructure,

Clever management with proven ability to maximise their dollars

Critical metal with acute exposure to Chinese geopolitical risk,

Clear path to sufficient tonnage for a small-but-sufficient graphite mine

Strong metallurgy,

Cheap to drill, cheap to mine, cheap to refine.

Lesson: Beware Niche Metals

But graphite has been just mercilessly crushed by Chinese production. iTech has a natural graphite product that can be economically refined and purified to readily meet battery standards. Exactly the sort of project you want to see develop and grow in a world looking to increase western supply of critical minerals while also reducing its energy intensity.

And China? They’ve got massive industrial capacity to produce synthetic graphite, and are willing to sell it at a loss precisely for this exact reason - to undercut international supply and continue to maintain their monopoly.

So iTech’s graphite is a good project. Indeed, it is the exact sort of project the Chinese are very intentionally trying to throttle in the crib with their policy to maintain their dominance.

So yeah - graphite is a critical mineral the west needs more of, full-stop. It’s also a very niche market, with obscure pricing mechanisms, and outsized Chinese dominance. Its tiny size and exposure to Chinese control makes it prone to manipulation and suppression. So there’s a lesson here around exercising caution when investing big on niche metals. The market moves and is moved by forces you don’t necessarily get to see or understand.

Here in the today, iTech is shifting gears a bit. Their graphite project is good, well understood, and, unfortunately, stuck in limbo. So, rather than fight a losing battle against macro realities, iTech is accepting that graphite as a market will have to change before their own graphite will get its due valuation.

So they’re currently working their way through a newly-acquired land package that holds potential for a few different metals. There’s a similar story at this point to GFG - in a perfect world, companies never need to pivot. But this isn’t that perfect world. So if your company is pivoting, you need to be able to trust management to make smart choices. And, this is back to where I started, I trust Mike Schwarz and his ability and work ethic.

iTech is a bit of a work in progress at the moment, and certainly doesn’t find itself where it thought it would be a few years ago. But they’ve got a steady hand on the till, new land to explore, and a quality graphite project in their back pocket. And Mike has a demonstrated ability to create value through his efforts. There are certainly worse places to be than that. So for these reasons, I still hold out hope here.

I will be brief as this isn’t really the end. This has been an important, if lengthy process for me. But it felt like something that was necessary to accomplish. Look for the second half of this company-by-company discussion later this week. I have found value in many of the themes and lessons identified. Maybe you have learned them already. Maybe some were new. If you have thoughts on this content and my ideas, I welcome your input. My goal is to learn and grow. Correspondence with my followers is an opportunity for that.

Thanks for reading. I work constantly to get better to identify better projects to become a better analyst. I hope you have found value in my work thus for.

Till next time.

Thanks for reading.

-Matthew from JRI