Finding the Source: Why Arizona Gold & Silver is Poised for Success

After suffering through some classic permitting wait-time doldrums, Arizona Gold & Silver has permits in hand and are on the verge of a high-impact drill program targeting the source of their success.

tl;dr

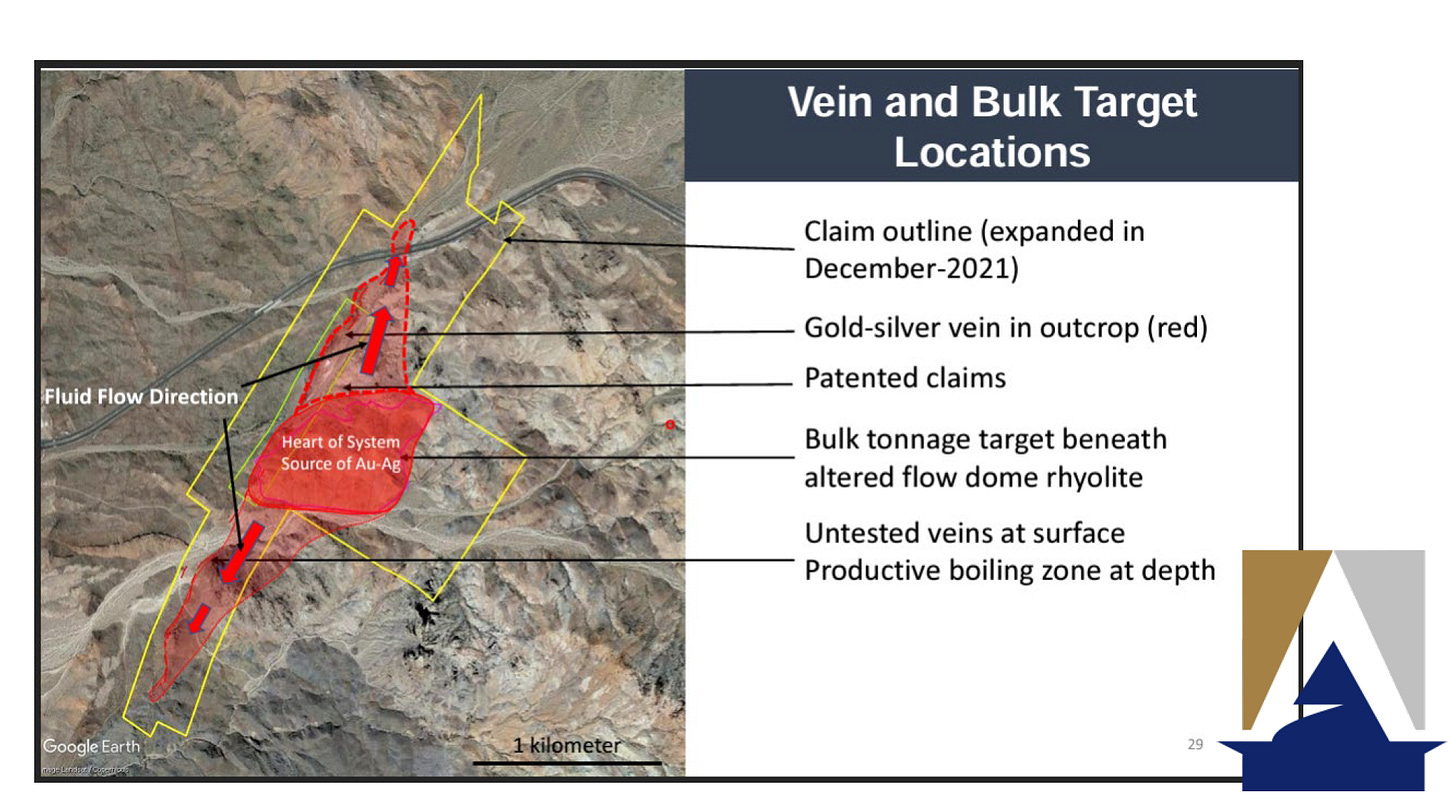

Arizona Gold & Silver (AZS.V; AZASF) is an efficiently-run explorer working through its Philadelphia project in the Oatman district of northern Arizona. Having worked its way along a high-grade vein surrounded by disseminated mineralisation, Arizona believes it finally will have the opportunity to get to the source of the matter - that is the Red Hill target. Lying on BLM land and thus subject to additional permitting processes, this prime flow dome target finally has drill permits in hand, and AZS is currently advancing towards what is certainly an exciting drill campaign and are permitted for up to 40 holes from two pads to be begun in the coming months.

Part 1: The Interview Part 2: The Companion Article Part 3: The Summary

Part 1: The Interview

Part 2: The Companion Article

Sometimes, timing is everything.

Arizona's Philadelphia Property is a gold and silver combo vein/disseminated bulk tonnage target located in northwestern Arizona’s Oatman Mining District (which historically produced over 2 million ounces of high-grade vein gold).

Under Mike Stark as CEO, AZS has continued to efficiently and effectively advance a meaningful, though still unofficial, resource at this project since acquiring it over the course of 2019 and 2020. The high-grade vein has paid off over the course of previous campaigns, to the tune of headlines like 51m of 1.52m gpt Au within 50.30 m of 2.894 gpt Au from just 10m down hole, or 78.7m of 0.96 gpt Au, or 48.8m of 1.14m gpt Au. I have interviewed Mike before, and we’ve had an ongoing correspondence since then, and I’ve always respected his hustle and how much value he gets for investor dollars (91% of all dollars go into the ground, as per my chat with Mike).

Unofficially, Mike and VPEX Greg Hahn figure Arizona as-is is not that far off from proving up 1-2m oz of gold at Philadelphia. They’re clearly onto something here.

However, while Mike and the rest of AZS have had some significant success, a critical part of that effort has been partly on pause for the past couple years. This is because a critical portion of AZS’s local target - the Red Hill (the suspected source dome the high-grade vein leaked out of) - lies on BLM land. And as you no doubt know, BLM permitting takes time.

And while Arizona certainly seems to have a supportive investor base, that sort of time commitment can take the wind out of even the most exciting story’s sails. And so, fair or not, Arizona’s story has flagged a bit recently.

However, critically, all that is now in the past for Arizona, as the BLM permitting, finally, is done. If you look at the larger overall land package, this process will have to start all over again if Arizona wishes to explore other anomalies. However, 2 drill pads and 40 holes into the Red Hill will keep Arizona plenty busy in the meantime, and success in those 40 holes will redefine this company in a serious fashion anyway.

The first step in that success is the planned 4 hole drill program, each of which would be the deepest ever hole drilled by AZS on this project. These will fan out into the heart of the Red Hill and will critically test the continuation of what already is a very large, thick, band of mineralised material. The money for this is in hand and lead items and drill contracts are being negotiated while we wait for the relentless Arizona sun to become a bit more forgiving.

So, returning to my original point, timing can indeed be everything - in life or in investing. The right idea at the wrong time is often the same thing as being wrong. And the time is certainly right for AZS.

The BLM question that has hampered Arizona Gold & Silver is answered and it is difficult to understate how important that is. All those nagging doubts about when or even if drilling will be able to continue are settled. If the Red Hill comes good, the tonnes added to Philadelphia will fundamentally rerate Philadelphia it as a whole.

There are of course risks. Those 40 holes will require financing(s) to accomplish, so entry points (as always) matter. So far, Mike has done a great job of managing financings, but that doesn’t prevent their necessity. And strength is weakness here as well - Arizona’s exploration thesis about Red Hill being the source is very credible. However, drill results - to the upside or downside - will define this company’s future tack. If the dome for whatever reason is barren then this story unravels. I believe that won’t be the case, or at the very least that the odds are significantly in Arizona’s favour, and Arizona is in my portfolio because of that belief, but it obviously isn’t a certainty.

However, risks considered, this story is getting exciting. After the BLM lull the focus can finally, properly, return to the considerable exploration potential that the Philadelphia project possesses, and how near-at-hand drilling and first results from the source dome are.

The next few months promise to hold significant news flow for AZS, as a strong project with effective management looks to come back fully online after a period of dormancy. And for investors, that sort of timing often ends up a winning combination.

Part 3: The Summary

Note as always that timestamps are links to the moment of the interview in question.

01:30 Slide deck intro

$30m mc

Cash in hand

Share count

Exploring the edges of their system over the past couple of years while waiting for BLM permits

BLM finally permitted up to 40 holes this past month

03:50 Red Hill permitting – what it is and its significance

So far, 1.5km+ strike length has been established

Vein system along the Arabian Fault

Ranges from 30-115m in thickness.

North end has high-grade silver

South end becomes more gold-dominant

All signs point to the Red Hill being the flow dome source of this vein/disseminated mineralisation.

Will significantly increase AZS ounces if it hits.

Clay cap on Red Hill prevented outflow/kept it contained.

Arabian Fault gave it an opportunity to express itself, is great evidence for what they believe is there.

the feeder zone, the source of all what you've been drilling so far is in this red hill.

Their next 4 drills will fan out from the same pad and for the first time ever lance what they believe is close to the heart of Red Hill.

The closest they had got previously saw grades increasing at depth from 1 gpt to 3 gpt.

Have drilled 130 holes now.

VPEX Greg Hahn very much believes in the Red Hill being the heart.

Want the results of those 4 holes ASAP

“TSN Turning Point”

10:15 Non-economic Results from Rising Fawn and Risaka gap drilling

Some still weren’t bad – but not ultimately part of an underground resource.

They just didn’t hit the cutoff grade.

Veins can swell and pinch off or otherwise move

Gain of knowledge, though

Historical adit that is still exposed provides great access to face of vein system.

Would cost $1m to do today.

Hanging wall vein of 20 gpt can only have come from below.

Mike is proud of their burn rate

91% of their money goes into the ground in some way

14:30 What Size is the Resource?

Greg Hahn on record as being “Very close to being able to quantify one to two million ounces” is a quote from him. How much more work will it take to get there?

In terms of holes – most companies take 400-500 to get up to 2m oz.

This is the most “aggressive” system Greg Hahn has ever worked on.

Close at 130 holes – they estimate that at 200 holes they will be ready

But still – don’t want to name the resource until they are confident they are hitting its limits, which they believe they haven’t yet

With Red Hill upcoming the whole time it also never made sense.

7+ CAs have been signed

They still have to work to make that number 43-101 compliant, though.

18:00 The timing is right for AZS right now. What are the immediate drill plans.

They are drilling the next 4 holes and plan to raise off their backs

They can drill aggressively and cheaply but will need money to do so.

They hope to do all 40 holes BLM has permitted them, which would cost several million dollars

If they can raise enough capital, they would bring in a second rig

And if Red Hill is a success, why wouldn’t they expand their horizons and look at other anomalies on their property to the west

They are potentially huge

Investors need to be patient while these projects are accomplished in a sustainable way

Management has never sold a share

He’s building to the buyout for the premium

RC rig has been used up till now to keep costs down.

21:45 Cost of drilling and when will the 4 hole fan program occur

Final arrangements with the BLM permitting process are underway.

But the heat is an issue right now.

Reaching up to +52C

Huge safety concern of course

Tarps and misters can be brought in to drop it 10-15C

24:30 Switching to diamond core and lab timing

Starting to reach the limits of their RC rig

It is time for “show and tell” anyway

Only have 1 hole currently in lab

Previous turnaround was 8 weeks which wasn’t great

But it also changes – average around 1-2 months.

Can always put a rush on it if important

26:00 Addition of Philip Yee as special advisor – someone with a very strong track record – and how it came to pass.

Came to them through one of their directors – Jim Engel

Phil was attracted to the way the company was being run and the quality of the project.

Potential for future spot on the board.

Great deal of respect for Phil and his work (lots of success)

Other great additions like Kathy Fitzgerald

He also brings a lot of wisdom and his connections with some very, very large institutions as well.

Kathy Fitzgerald joined AZS just before him. What a dynamic young lady.

29:30 Final Thoughts

Mike wants to get the holes to the lab quickly and start demonstrating shareholder value to the market

Will be the longest holes AZS has ever drilled.