"We Want to Become a Producer": Why TOCVAN is Daring to Dream Big as a Small Explorer.

CEO Brodie Sutherland sat down with me for a long and ranging conversation on what he wants to build down in Sonora, Mexico.

tl;dr:

Note: In a bid to improve an audio file that was too quiet, I reuploaded the video, so there may be some link discrepancies you come across.

Alright, so first off, I am off on vacation and so am obviously away from my office/studio and its consistent setup. So I apologise if the audio quality is a little inconsistent at times. I thought I had done an appropriate troubleshooting session before hand but apparently not. I think I fixed it enough for it to not be a distraction, but you will have to be the judge.

Regardless of the audio quality, the story quality here with TOCVAN (TOC.CN) remains top notch as CEO Brodie Sutherland discussed with me earlier this week. Not content with being just another junior getting bled out in a weak market, Brodie has an ambitious plan to get TOCVAN to small-scale-yet-transformative production within just 2-3 years. He discussed with me in-depth why his dream is realistic.

1. The Interview; 2. The Companion Article; 3. The Written Summary and Transcript

1. The Interview

Click Here for the Audio Podcast Version.

2. The Companion Article

This is a good one.

Part of your due diligence process as you sift through the seemingly endless number of publicly-traded resource companies you could theoretically invest in (and what a shell game keeping track of the bad actors can be sometimes) is identifying stories that stand out from the crowd.

This sector is crowded, probably too crowded, and it is a real risk that companies get lost in the shuffle. How do you differentiate one microcap with a few hundred thousand ounces of gold and a little bit of exploration upside from the umpteen others just like it? The reality is that many times you can’t.

The risk is that without a compelling narrative to drive sentiment, companies will slowly wither on the vine and die. Then, naturally, its orphaned property will be soon taken over by the next aspirational explore co. and the cycle begins anew. In the meantime, shareholder value gets completely obliterated.

So, then, how do you break the cycle? How do you increase your odds of success in this sector? Returning to my original point for me, at least, a huge part of it comes down to finding stories that are remarkable.

Now remarkable can come in many forms. This could be world-class size (Snowline) or Grade (Contango’s Manh Choh). This could be unexpected success (Hercules) or results that significantly outsize their market cap (NiCan). Find the stories that are remarkable and you will find investments that can offer remarkable returns. Which is the whole point of investing in this sector.

TOCVAN, if you ask me, is one of these stories. CEO Brodie Sutherland has no interest in being just another bog-standard microcap explorer fishing for a buyout against the odds and it shows. The story is simple and effective and the title of this article really says it all - Brodie wants to build TOCVAN and its Pilar and Picacho properties into a producing company.

That alone sets TOCVAN apart, but consider the rest of the story. I will bullet point it here for efficiency’s sake, but I don’t know if I can name a company that possesses the same set of characteristics as TOCVAN:

An excellent jurisdiction, with strong support for mining and substantial expertise to draw on.

Extremely cheap to explore (CAD ~$175/meter).

Extremely cheap to get to production (napkin math number of $25 million) based on “plug and play” modular mills.

Extremely low share count (just 42 million fully diluted after 4 years).

A conceptual deposit1 based on current drilling of perhaps 800,000 oz AuEq in situ at its original Pilar property.

True greenfield potential on a pair of unexplored targets (expanded Pilar and Picacho) that keep coming good with tantalising results from early exploration.

Just 2-3 years to production if things go right, targeting 50,000 oz/year for 7-8 years.

That production leading to potentially $50 million in annual FCF at $2000 gold.

Neighbouring projects successfully moved into production in ways that TOCVAN is looking to emulate. This of course means there is an extremely close analogue for TOCVAN’s vision serving as a proof of concept.

But the story extends beyond just that initial modest-if-highly-profitable production scenario. There is strong evidence - artisanal mining, extensive chip samples, emerging geophysical data - that the expanded Pilar package - not to mention Picacho - have strong odds to produce substantial future gold-silver deposits on their own. So this isn’t a “one and done” story on Pilar, but Pilar rather is meant to serve as the launchpad to a much larger exploration and production scenario. Exciting stuff.

Imagine if TOCVAN gets its original Pilar property up and running successfully and producing $50 million in annual free cash flow. How aggressively could they advance their other two projects (at just $175/meter in drilling) with that much money, and all without a single share of further shareholder dilution? Usually floats of developers get blown out - and shareholder returns escape through the back door - in the pursuit of production. TOCVAN is set up to potentially avoid that almost entirely, especially if they can secure bank financing for their initial production run.

Of course, just as critical as a project’s odds of success is its valuation - both current and potential. Here too TOCVAN is a compelling buy opportunity. It is one thing for a company with this plan to carry a $100m market cap, where success is already largely priced in. At its current market cap of just $15 million, a lot more failure than success has been priced in and TOCVAN is one of the best risk:reward proposals I have come across in today’s market. I will let you crunch your own valuation metrics and place your own multiples, but what is the fair value of 7 or 8 years of $50 million in annual free cash flow unlocking even further economic ounces?

As for the risks, I asked Brodie some pointed questions during our interview: The wisdom of pursuing production based only on a PEA that is not even complete yet. The ability for bank financing at such an early stage. How realistic his initial capex figures are. Each time, Brodie provided a reasoned, informed, and evidence-based response that quelled my concerns.

Fundamentally, TOCVAN is not forging new ground here, but rather attempting to replicate what has already successfully been done by their neighbour Minera Alamos. So that typical +/- 30% variance to a PEA’s numbers can in good faith be expected to be substantially narrower, given the fact it can build around real, tested, modern analogues. That, to me, is an absolutely critical aspect of this story. It has been done before. Now Brodie wants to do it again.

Is there risk remaining still after all that? Of course there is. Outstanding property option payments risk further dilution if there are delays to production. Delays and overruns in general can sap development projects of their profits and investors of their returns. But these are uniquely execution risks, not viability or discovery risks. We know it can be done, now TOCVAN just has to go out and do it. And with a smart team, a sharp CEO, and a successful proof-of-concept vision and operating mine in the neighbourhood, I like TOCVAN’s chances to make good on their plans a whole lot.

So, like I say, this is a good one - it just clicked right away for me (which is rare). The plan in place is compelling and makes sense intuitively to me. Brodie has the right idea in the right place and a short runway to success. And Brodie strikes me as an intelligent and capable executive. In the interview, Brodie said all the right things, and based on the way he is leading his company, he seems to be doing the right things as well. All that is left to do is execute. And if Brodie and his team are successful, this would become a remarkable success story indeed.

3. The Written Summary and Transcript

Underlined timestamps are links to the interview.

Brodie Sutherland, CEO of TOCVAN Ventures, introduces their Pilar and Picacho projects in Sonora, Mexico, emphasizing the transition from exploration to production. He highlights the cost-effectiveness of Sonora and the strategic management of capital and share structure to minimize dilution.

02:00 Discussion of Float and Company Strategy

Brodie explains TOCVAN's strategic share structure, with 42 million shares issued over four years of existence, focusing on shareholder value and avoiding excessive dilution. He discusses the resilience of TOCVAN in a tough market and their focus on mindful capital use.

03:45 Brodie’s Path to becoming TOC’s CEO and TOCVAN’s Team

Brodie, with his background in geology and extensive international experience, emphasizes the importance of a supportive jurisdiction like Sonora for project development. He notes Sonora's mining-friendly environment and skilled workforce as key to advancing mining projects.

05:45 Jurisdictional Advantages

The technical team in Sonora leverages the state's mining expertise and infrastructure. Brodie discusses the economic viability of mining projects in Sonora, highlighting location as a key factor in TOCVAN's investment story.

07:30 From Exploration to Production

Brodie shares the company's strategy for growth and the significance of community and stakeholder engagement. He mentions Sonora's regulatory advantages and the straightforward permitting process as essential for rapid project development.

9:30 Overview of Picacho

Detailed insights into the Pilar and El Picacho projects are discussed, including exploration successes, historical context, and plans for 2024. Brodie outlines the geological potential and targeted exploration approach.

16:30 Overview of Pilar

15:45 Exploration and Expansion Strategy

20:00 How Are You Developing New Targets

Brodie elaborates on TOCVAN's systematic exploration strategy, emphasizing the use of cutting-edge technology and geoscience techniques to delineate the ore body and expand known mineralized zones. This proactive approach aims to increase resource estimates and enhance project valuation.

27:00 Cost and Market Position

The cost-effectiveness of operating in Sonora is discussed, with Brodie highlighting the competitive advantage this provides. He also touches on the importance of leadership in building trust within the industry and attracting investment.

32:00 Cost of Exploration

33:45 Vision of Accelerated Path to Production

The conversation turns to the permitting process in Sonora, outlining a timeline for transitioning from exploration to production. Brodie discusses potential regulatory changes and emphasizes Sonora's capacity to support rapid development.

38:45 Mexico’s stance/perceived reluctance towards open pit mining

39:15 Financing and Development Strategy

Various financing options for project development are explored, focusing on minimizing shareholder dilution. Brodie expresses confidence in securing necessary capital, drawing parallels with successful financing strategies of other companies in the region.

44:30 Explanation of skipping economic studies

46:15 Community Engagement and ESG Efforts

Brodie highlights the importance of community engagement and environmental, social, and governance (ESG) principles in TOCVAN's operations. He details initiatives aimed at fostering positive relationships with local communities and ensuring sustainable development practices.

54:30 What is the size of the prize? Goal for ounces and tonnage from initial Pilar

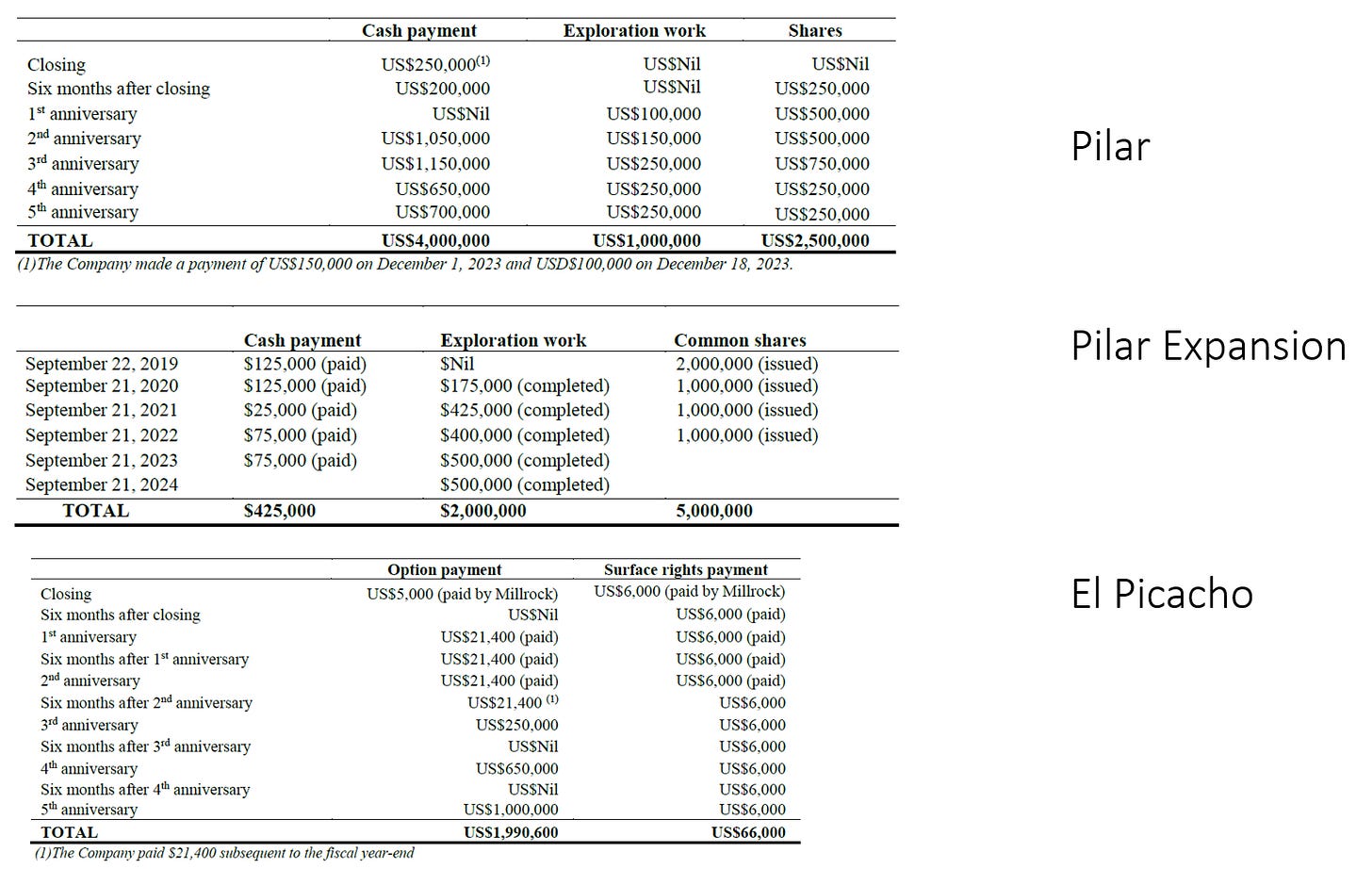

1:05:30 Option Agreements for Various Concessions

Plans to achieve 100% ownership of their projects are detailed, with financial commitments outlined. Brodie discusses the strategic importance of controlling the Pilar and El Picacho sites and aligning payment schedules with project development milestones.

75:15 Conclusion

Brodie concludes with a commitment to shareholder value and transparency. He encourages direct communication with investors and highlights the company's growth strategy focused on transparency and stakeholder engagement.

This is one I am currently scaling in on and plan to continue throughout 2024. There is a needle to thread in terms of getting to production before option payments come due to minimise damage to the float, but there is smart and sticky money supporting this company and you can see why they like it. TOCVAN is clearly looking to build something big down there in the Sonoran desert and I am excited to watch them develop.

Thanks for reading.

-Matthew from JRI

Important to note not yet a true deposit in terms of confirmation of economic viability by way of a technical report.