“There's a much bigger system here and we're starting to unlock that.” Tocvan Ventures is poised for success in 2024.

CEO Brodie Sutherland stops by to discuss Tocvan's new drill campaign, its plans for 2024, and why Mexico remains a tier 1 mining jurisdiction.

tl;dr:

Tocvan Ventures is drilling again, ready to continue to rapidly advance its Pilar project to production. CEO Brodie Sutherland stopped by again for a drill campaign update and to touch on other recent news releases. Met work, the expanded land package, Mexico as a jurisdiction, neighbouring analogues, and the drill campaign in detail are all discussed.

In addition to the video interview, I asked Brodie a couple brief questions on Mexican jurisdictional risk. That Q&A will also be found below in part 2.

Part 1: The Interview Part 2: The Companion Article Part 3: The Summary and Transcripts

TOC.CN; TCVNF

Part 1: The Interview

Part 2: The Companion Article

I sat down with CEO Brodie Sutherland for an introductory interview back in early February. I liked the story then for the same reasons I do now - Tocvan is exploring in a very well-endowed region, have very cheap drill costs (CAD $170/meter), and have an ambitious plan to become a producer within just a couple years.

At the time of our interview, sentiment in Tocvan had maybe bottomed - it hadn’t drilled in a while (and we all know juniors need to drill to stay relevant) and gold had remained out of favour. However, those cloudy skies appear to be breaking up pretty quickly in recent weeks.

First off, on May 9 Tocvan closed an oversubscribed $2.1M financing (of which $1.5M was taken down by a single institutional investor). Full disclosure that I participated in this financing. Looming/anticipated financings, as followers of this sector no doubt already know, have a definite tendency to act as lead weights around a company’s ankles. And critically, that cash infusion can take Tocvan all the way through 2024 if need be. So that risk is minimized.

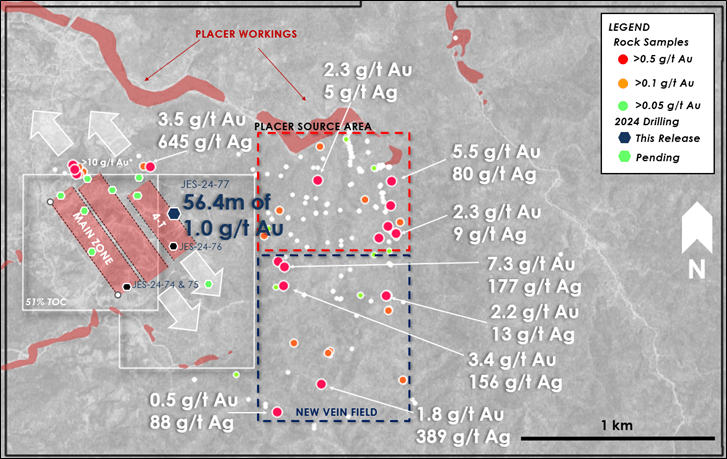

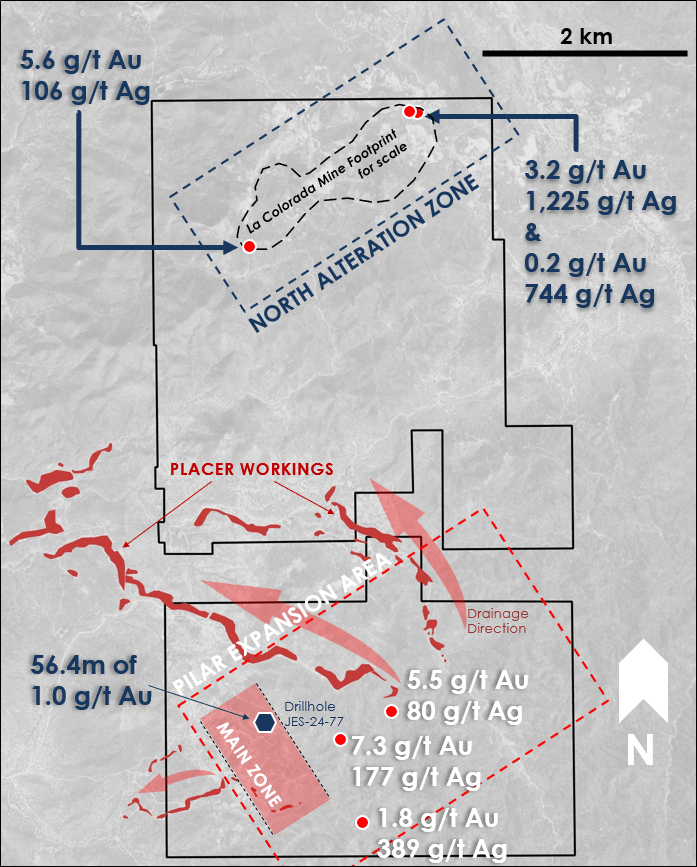

Also importantly, Tocvan is drilling again, and even have results out (56.4m of 1 g/t Au) as of May 13 and with 11 more holes in the lab. Notably, that result comes from a zone 400m away from the main zone running parallel with it, unlocking potential a whole new area of similar endowment. And at least another 5000 meters and 40-50 meters left in this campaign. So lots and lots of opportunity for further impressive results, especially when you consider that Tocvan has announced they’ve discovered the source of all the placer gold in their land package.

So where Tocvan maybe suffered from lack of news which caused its share price to slowly flag, now that weakness is a strength, as 2024 suddenly promises to be a news-filled year, with dozens of assays, further met work, and a maiden resource due by end of year.

And this has all come at a very opportune moment, as junior explorers are finally starting to feel some love from the market as maybe, just maybe, generalists are returning to the space in the last few weeks.

And the share price has certainly responded quickly. Pictured below is TOC.CN’s one year chart, with the closing of the financing marked in red. The response has been swift, moving from around the financing price of $0.36 all the way up to a Friday close of $0.49. The market certainly knows Tocvan has a lot of potential to be extremely successful, but no news and no money is a lot of headwind to beat out. But now, as I say, what was weakness has become strength.

It feels as though things have all come together for Tocvan - fully financed for the year, drilling new areas and finding success, identifying the source of the placer workings, and even burgeoning macro tail winds. You start to imagine what might happen if this drill program is an undisputed success right as the bulls are beginning to run again and it is hard not to get excited.

Brodie walks through the drill campaign - what’s been done and what’s to come - in detail in our interview, so make sure to watch it above or read the summary below.

However, there is one more detail I want to touch on before I close off here. If you’re like me, you have been watching news out of Mexico with something of a wary eye. Mexico is obviously a top-tier jurisdiction in terms of potential and history, but AMLO’s proposed open-pit ban gave me pause in recent months. If such a law came to pass that would of course stop projects like Tocvan’s Pilar dead in its tracks.

Importantly, though, further digging made this threat less realistic than I had previously assumed. But rather than discuss why myself, I thought I would give Brodie himself a chance to speak to it. Below is the written Q&A I had with Brodie shortly after our interview that discusses this aspect of Mexican jurisdictional risk.

Q&A With Brodie Sutherland

Q1.

JRI

Mexican president AMLO made the news in recent months proposing an open pit mining ban in Mexico that obviously has investors concerned. However, I have also read that it is extremely unlikely that it would be able to pass into law and would even have the chance of being struck down by the Mexican Supreme Court if it ever was. Can you discuss this a bit?

Sutherland

AMLO has a long history of making anti-mining comments yet through his tenure mining and mine builds have continued across much of Mexico, especially Sonora. Any ban on open pit mining or change of mining regulations would require constitutional reform, meaning two thirds of the vote in both upper and lower houses and a majority of governors in favour. In May of 2023, AMLO also made proposed unconstitutional reform of mining regulations that did not include a ban on open pit mining but tighter environmental standards, the Mexican Supreme Court has suspended and is expected to overturn and nullify the proposed reform as it needs the approval mentioned above.

Q2.

JRI

AMLO is being term-limited out, but his successor and her opponent are both more mining friendly. With his successor the likely winner of the election, can you provide some evidence that she is more moderate in her approach to mining?

Sutherland

There have been recent comments by AMLO's successor, Claudia Sheinbaum, encouraging lithium and copper production for a green future. Mining both of these commodities relies heavily on mining and specifically open pit mining in Mexico. Time will tell, but I think we will see a more moderate approach.

Q3.

JRI

Is there any other context about this debate you think the average investor might not know and should?

Sutherland

My opinion is that there are much higher risk jurisdictions that inhibit project advancements, including where I live in Canada. Mexico is ruled by law not individual political agendas. The mineral endowment and long history of mining in Mexico make it an ideal jurisdiction for project development. Like anywhere, there are certain regions in Mexico where mine development is challenging due to social and environmental aspects. Sonora has shown a long history of accepting and encouraging mine development, just look at the operators around us for proof.

(Note: Brodie also shared this article with me that displays some of the more pro-mining sentiment in Mexico currently.)

Conclusion

There you have it. I still really like Tocvan, just like I did 4 months ago. Admittedly the proposed open-pit ban scared me off a little but there’s lots of emerging evidence to genuinely believe that it isn’t a serious threat.

In all other aspects, this is a solid company and a solid pick - I like the CEO, I like how cheap it is - both to explore and to produce, I like that the met work is a huge positive, and I like the aggressive plan to become a short-term producer. Conventional wisdom suggests skipping feasibility studies to be risky - and it is - but Brodie Sutherland’s assessment that there are plenty of peer analogues to learn from is valid. And regardless - with risk comes reward. If Brodie and his team can pull it off, Tocvan would become a sector darling, and portfolio returns for people willing to buy into it now (which I have) extremely outsized.

This is a good one.

Part 3: The Summary and Transcripts

Time stamps are links to the interview section in question

01:05 Discuss recent 56.4M @ 1 gpt Au from 18M result

Brodie believes it is one of their most exciting drill results to date due to the location.

Good chance there is a whole parallel trend similar to the main zone (400m away)

Hadn’t hit high grade outside the main zone (26+ gpt Au over 1.5m) until now.

Potentially even more to the East but they’re surface sampling it for the first time ever now.

04:25 How far away from historical drilling and other TOC holes was this hole?

Historically there was a collection of holes in the 4-T zone but they now know they were angled away from the mineralisation.

That failure helped Tocvan reevaluate how to approach the target.

300m away in 2021 they drilled 15m of 1.1 gpt Au.

When it was drilled previously in the 90s the price of gold just wasn’t high enough to support bulk tonnage operations.

07:30 Where were the hole locations of the drills that missed in the recently-released batch

If you can hit good grade on 20%-30% of your holes in exploration that’s good.

But all the “misses” still showed the right kind of alteration and structure - all the things you wanted to see to demonstrate a healthy gold-bearing system were present.

Misses are visible on the map provided.

09:45 Why are you confident you’ve find the source of all the placer gold? (plus expanded land package discussion)

Spent a few weeks mapping and sampling

Obvious in the geology.

Very high grade samples, especially for first pass sampling

Benefit from having this land for a few years as they’ve come to understand it well.

No real doubt that it is the source.

There’s actually another, different, drainage area to the South of the source they discovered

Will continue to explore, but the goal is getting to production quickly

12:30 How many holes have you drilled in this program as of May 16

15 holes so far. 1800 meters.

Sent crew home for a break which also gives them time to get results back to guide further drilling.

Will keep drilling into late June but the Sonoran desert gets to 50 degrees Celsius so they have to stop during July and August.

Goal is a minimum of 7,000 meters

14:30 What targets do you know will be drilled out this campaign

The placer source will get drilled where high grade samples were collected.

It has road access.

Still lots to do around Pilar itself. Would be drilled in the fall.

16:10 Financing Discussion – Can this previous financing fund all of 2024?

Yes it could. Main goal remains to get the technical evaluation and maiden resource complete this year.

Drill costs of CAD $170 are all in - fuel, assays, everything.

The rig being mobile makes it easy.

Raising further capital could help accelerate the process, though.

18:20 What is a Technical Justification Study

Related to EIA

Looks at the metrics around a mining set-up. What would the open pit look like, where would things get placed, where would you draw water from, etc.

Once it is approved they are officially permitted to mine.

Mexico has a fairly streamlined process compared to other jurisdictions.

Open-pit, heap leach set-ups in Sonora are very cheap - you can get a modular plant for $15-$20 million.

20:40 Met work recovery – what’s your preferred path/flow sheet at this point?

Data shows you can recover the gold anyway you like.

Great recovery at low cost.

Tells you the nature of the gold and silver here - liberated and easy to extract.

Difficult to not seriously consider a gravity circuit if it gets you to 95%-99% recoveries.

Regardless of the final flow sheet, it is going to be easy to extract the metals.

23:15 2024 Catalysts we can expect

Maiden resource in Q4

Met testing

Channel sampling

Drill results will obviously be key - those will be rolling out over the next few months.

Soil work

Resource will focus on original Pilar as it can be expanded and upgraded quickly.

Paper work and permitting for mine development and getting into that queue.

Picacho their other project also has a lot of potential and deserves attention.

25:45 Final Thoughts to Brodie (Mexican Jurisdiction)

There’s been lots of negative rhetoric about Mexico as a mining jurisdiction.

But attitudes are starting to shift again.

We should be bullish on Mexico.

The election this year - both challengers are more pro-mining than AMLO.

Mexico remains a top-tier jurisdiction due to the cost, endowment, and technical expertise in it.

We are starting to see miners and explorers charts improve but it hasn’t fully trickled down to companies of Tocvan’s size yet, making it an opportunity for investors.

Thanks for reading.

-Matthew from JRI