"On the Edge of Success: What Happens Next?" A Written Summary of Invictus Energy's M-2ST Fireside Chat With JRI

It is déjà vu all over again for Invictus Energy. Scott Macmillan joins me to explain why the knowledge they've gained is so critical for building a successful discovery, and what happens after.

tl;dr:

I once again display a bit of a propensity for mental self-harm as I build a written summary of my recent interview (all 2.5 hours of it) with Scott Macmillan of Invictus Energy. My hope here is the same as my recent summary of Giga’s PFS: To build a practical and useable piece of DD for current and prospective Invictus investors to utilise. Invictus, with all the challenges of frontier exploration, remains one of my top picks and my most overweight position due to the size of their prospective resource and the character of their Managing Director.

Links:

Unedited Transcript: Click here to access the transcript. (Note to enjoy how many different ways the AI manages to misspell “Mukuyu”.)

My New Discord, Shiny and Chrome: https://discord.gg/WbPaeEjWHD

The Interview

Overview

Scott Macmillan stopped by for another live conversation built around investor questions. Invictus is currently drilling out the sidetrack on the M-2 well in search of an agonisingly-elusive fluid sample to confirm discovery and allow Invictus to declare net pay etc. While the road thus far has been rocky, the destination remains as bright as ever. Scott shares openly on challenges and lessons learned so far during exploration, the potential Invictus' land holds, and his vision for the future after what appears to be imminent, successful, discovery announcements. No one ever accused frontier wildcat drilling of being easy, but the potential for blue sky valuation remains as compelling as ever.

(Notes:

First - apologies for the imperfect video setting of just focusing on Scott. This was a conversation only, so no visual information was missed. Also - please note that this is my interpretation only of Scott’s answers. There may be inaccuracies and gaps, though I tried to be thorough and neutral.)

Written Chronological Summary

1. Mukuyu-1 Data Update

Lots have come in, but some still outstanding. They’re a small team and need to spend their limited time resources on Mukuyu-2.

They will be integrating M-1 data into their M-2 data (both of which will reinforce understanding of the other).

Net Pay will be released, but will start out conservative and it will invariably grow as the project grows and they can add more high-confidence data into their model.

2. Invictus’ Philosophy Behind Sharing with the Market

Scott believes they release far more information than their peers do.

Very specific and detail-oriented updates explaining what is happening.

But at the same time, their strategic advantage is all the data they are collecting and collating and they do not want to unnecessarily publicise that until it is the right time.

Too early in their understanding and exploration of the basin to publish their data.

Scott wouldn’t go back and change his approach if he had the opportunity.

As pieces of the puzzle get filled in, they do and will continue to disclose.

Believes their overly detailed operational updates - including the challenges faced - has inadvertently contributed to investor fears.

3. M-2 Data Acquisition

From LWD they have:

Resistivity, Gamma Ray, Density

But not all the way to the bottom (tool failure from hole conditions)

Figured out the problem with some of their tools - was fixable and now ready for side-track.

Haven’t hit a water leg yet in the Upper Angua (UA) or Lower Angua (LA)

VSP and Sidewall cores still to come.

They have pressure data from the whole hole.

In regards to the residual gas from the Pebbly Arkose (PA) they brought to surface - they had gone in looking for a water sample to calculate resistivity and it came with it.

Not in the mobile phase and below net pay cutoffs.

The fact there is residual gas in the PA means there is a good chance that there will be net pay elsewhere waiting to be found.

They anticipate that the live gas encountered in the LA and UA are in the mobile phase and will be considered net pay.

Overpressure kicked in at around 3400 metes.

Above that there was a lower pressure gradient.

Vertical compartmentalisation caused by shale.

Thermogenic gas (not biogenic)

Good chance for liquids to be present as well as confirmed gasses.

No fluid contacts (no water encountered yet, no gas-to-oil zones yet).

Believe they tagged the edge of one in M-1

3. Source Rock

Multiple source rock sequences

Coals

Marine-type

Lacustrine

Humic

Very complicated charge history

All at different stages of the thermal maturity phase

Good problem to have, but so complicated it might never get solved

4. M-2 Drilling

First 3400 meters went well. Mud weight was good. Well design was good.

Deeper down the gas became overpressured and began seeping into the wellbore.

Had to weight up the mud about 1.5 pounds, which caused differential sticking issues in the PA above.

Coals started to get washed out.

Then the wireline logging run got hung up in the LA which necessitated a wiper trip.

Then in the needed to run the wiper trip, huge amounts of trip gas had built up, which caused more and more invasion, meaning they had to weight up their mud again, meaning in turn they caused more differential sticking.

Became a circular cascading effect and lead to the cable getting stuck.

Took 17,000 pounds of overpull to get it unstuck, which is a bad situation to be in.

Moving to Tough Logging Conditions (TLC) and logging through pipe caused more problems.

More wiper trips required

Which caused more invasion

Contaminated filtrate and water

Figures in the PA that they have 18%-20% porosity.

Gas in the LA and UA in multiple reservoirs.

Yes over-pressured gas causes problems now, but it is an awful good problem to have and future wells can be designed to mitigate that issue.

Still in a position to drill further down with a 6 inch hole into the LA to test it.

5. Changes from M-1 Design to Ensure M-2ST Success

M-1 Was highly deviated (33 degrees)

Took them 10 days and 4 tries to kick off M-1ST successfully.

M-2ST done within 24 hours on the first try.

M-2 12 degree angle

Prevents the cable from laying on a side of the hole (“key seating”) and cutting into the filter cake.

Bringing in more external groups.

Tullow with Lokichar in Uganda had to go fishing in 6 of their first 7 holes.

Implementing the same wireline standoff tool that Tullow did that reduced their issues to zero further wells.

Pipe-conveyed logging is extremely challenging if issues arise and time-consuming in general. Working to avoid having to try it again.

6. Geological Risk Remaining

Related to the washouts and the ledges and hangups that they create. Drilling on an angle makes it easier for the wire and tool to get caught up.

Also limits the ability to work on pipe as they can get caught up too.

Easy to break tools. Tool damage is greatest risk.

Global shortage of tools.

Tools and services are the expensive part, not the rig itself.

Having all the tools they could ever want on site on standby isn’t realistic presently.

7. Drilling Over-Pressured LA and M-2 Contingency Plans

They knew they wanted to get into the LA a decent way to gain some understanding.

It is over 2000 meters thick - lots and lots of different regions to analyse.

M-1 (incorrectly) suggested they wouldn’t need to up their mud weight as high as they did.

Over-pressured is a good thing!

From about 3400m to TD their tool failed and they didn’t have real-time pressure measurements.

Had to react instead of be proactive.

All tools they want for M-2ST are currently in working condition.

Some no longer have backups.

Worst-case scenario they would drill deeper with 6” pipe.

Could also push straight onto flow-testing M-2.

(From later in the interview:) Flow testing would occur in Q2 as they need order and acquire long-lead items. Cased-hole sampling would occur but not full flow test.

8. Petrophysics Discussion

They’ve reduced their uncertainty range of formation salinity in the PA for sure.

Allows greater confidence in their petrophysics.

Formation water seen in PA.

However, they still haven’t hit water in LA or UA.

New UK group bringing their own petrophysicists.

A large team working on log evaluations and real time operations.

They have experience working in the rift basins of Kenya and Uganda.

Independent QAQC overseeing assembly, running, maintenance of tools has been a huge positive change this drill.

Can’t leave service companies to their own devices - everything needs oversight.

9. Net Pay and Flow Testing

Net Pay, Net-to-Gross Ratio will be released.

Part of ASX discovery regulations.

M-1 Data will factor into M-2 Net Pay estimation

Initial numbers will be conservative. Will only calculate what they clearly know.

As more data gets added to their knowledge base, net pay will continue to grow.

Typically 60% gas saturation is your cut off, but might be lower in these rocks.

Flow testing will occur in Q2 post rainy season.

Working to weather-proof the rig so they can work through the rainy season in future years.

Working with their vendors to organise all tools and items into only 1 or 2 ports, as the current ordering process is long, expensive, and complicated.

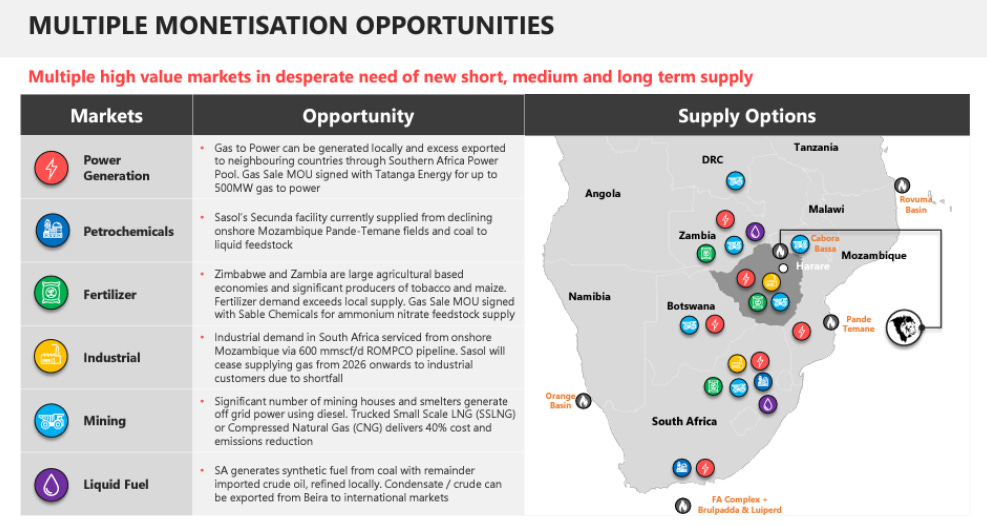

10. Farm-Outs, JVs, and Monetising the Cabora Bassa Basin

A complex question with no right answer.

Depends on what your interpretation of the end game is.

Where do you want to take it to? How far?

What does “the right offer” look like at each stage?

Obviously the deeper into the value curve you get the more value you create.

It is a balancing act between value and risk.

Given the nimbleness and speed Invictus can move at vs. a large operator, it makes sense to hold it for the next couple years and use that time as an appraisal phase to prove it up.

But potentially being able to JV with a larger company during that time to activate their increased ability to operate tools and talent in remote districts also makes sense.

Regardless of when it happens, they will just keep on the same path - proving and appraising.

Already have derisked it considerably. Both LA and UA look to be very nice discoveries.

In terms of the Data Room and bringing in interested parties, they’ve actually closed the data room, as they feel they can generate for more value in a short time from before re-opening it. It was a distraction of time and resources. Still too much in data acquisition phase to produce a finalised product.

Getting ready for a data room does have the benefit of making you be very rigorous in your technical work.

11. The Future

The strategy hasn’t changed.

On the verge of that critical first step.

Try to get to a monetization point (commercialised gas) as soon as possible.

Not intending to prove up the entire project before producing. Still looking at early pilot scheme to operate as a proof of concept..

They still have the Margin Play to explore.

Shoot 3D over Mukuyu.

Don’t want to be Uganda where oil was discovered in 2005 and no production yet.

Continue to make incremental improvements in their well engineering and drilling.6” extension into LA won’t come this campaign.

Will do it when they flow test M-2 next year all in one go.

Simpler, cheaper, more effective, less risky.

Rig has been booked (news since released - for the next 2 years).

Current rig is more than enough for what they need.

2D will be released once completed. They have some but not all data back.

Again emphasises that big companies are much slower moving - reviews and planning is very lengthy. Invictus can move much faster.

The crucial thing isn’t further well design - the next step is picking the right location.

Takes 6 weeks to build a pad now.

Environmental approval across entire license areas - can drill and shoot seismic wherever they want.

12. Finances and Costs for their Future Plans

6 inch extension, flow test, side track, etc. all obviously cost money.

When you string these projects together as part of a larger campaign their costs go down.

Mobilsation is more expensive than day rates.

Day rates get cheaper the longer you book as well.

Amortising over several wells improves economics considerably.

Well-testing is expensive and complex and so much more than just simple flow rate.

Testing connectivity to M1 is critical.

Plans to continue to drill appraisal wells in Mukuyu.

But also want to drill an exploration well in a new area.

Do you drill closer together and put together a contingent resource or do you step out more broadly and make fresh, independent discoveries?

Other funding methods become available after a discovery and the booking of net pay.

South African banks are lining up now.

Potential for bank funding.

Also prospective off takers for gas-to-power looking to make a down payment.

Yes stock dilution is painful, but it is necessary and unlocks further value.

Annoying methods to it, though, but hopefully nearing an end soon.

This hasn’t been done on the ASX in decades

Thanks for reading.

-Matthew from JRI

Possible variations in interpretation:

With regard to "(From later in the interview)"... IMO, from the discussion later in the interview at ~1:14:20, I am left with the impression that they will, if necessary, conduct a conventional DST in the immediate future i.e. next few weeks - but will need to mobilize personnel & some equipment. It was my impression that this was to be done in this operational stage and would not be left to the full flow testing stage in 2Q-2024.

"M-1 data will factor into M-2 net pay estimation" - my interpretation was that M-2 data will be included in M-1 rather than M-1 in M-2 - as IVZ didn't get a water sample in M-1 - thus no Rw value.

"Typically 60% gas saturation is your cut off, but might be lower in these rocks" - was my impression that SM was not being specific to "these rocks" but was speaking in more general terms for a cut off below 60%.

Cheers

Richard