"I Love Big Copper": Why Prismo Metals Believes it Could be the Next Big Copper Discovery in the USA.

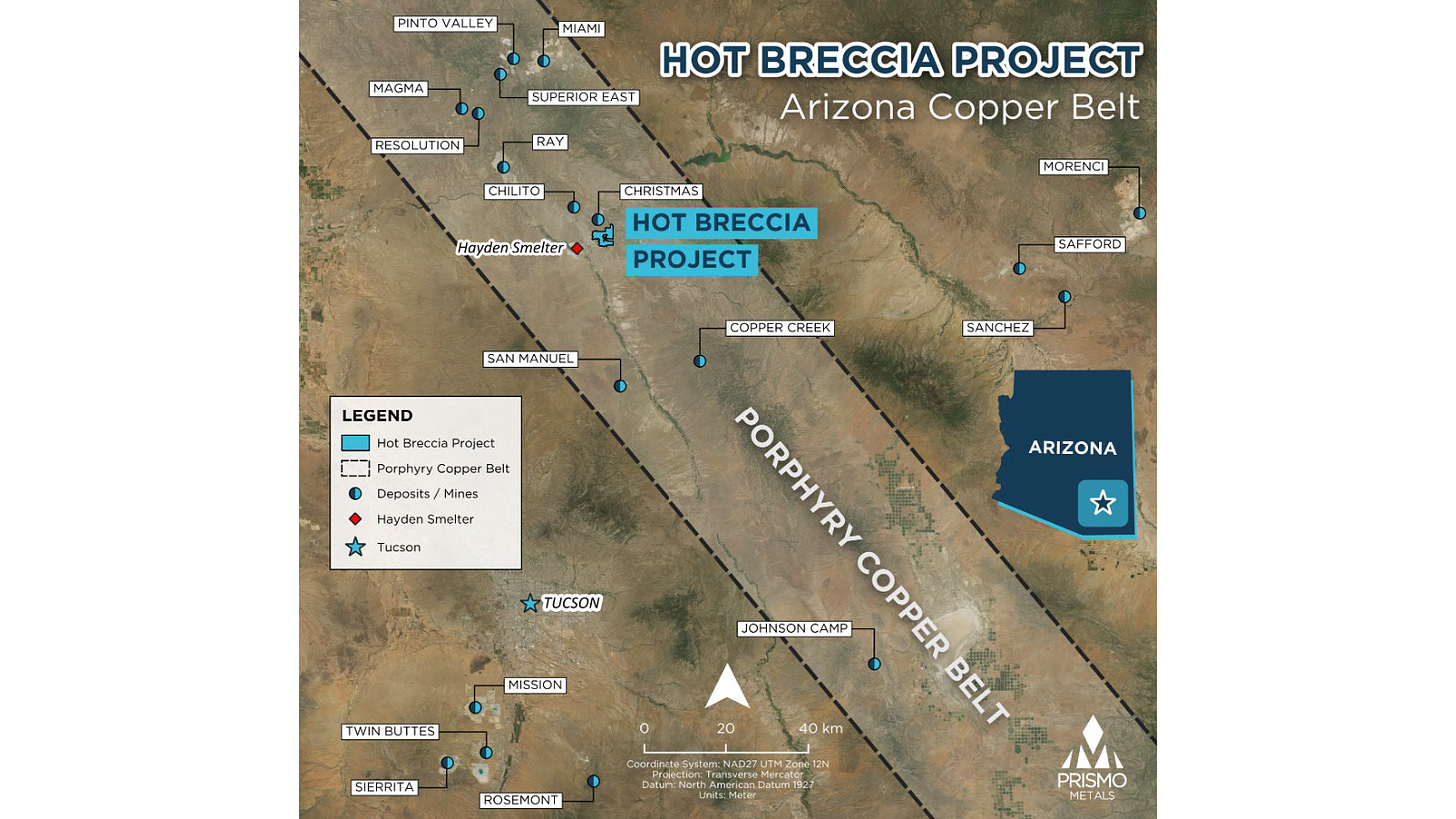

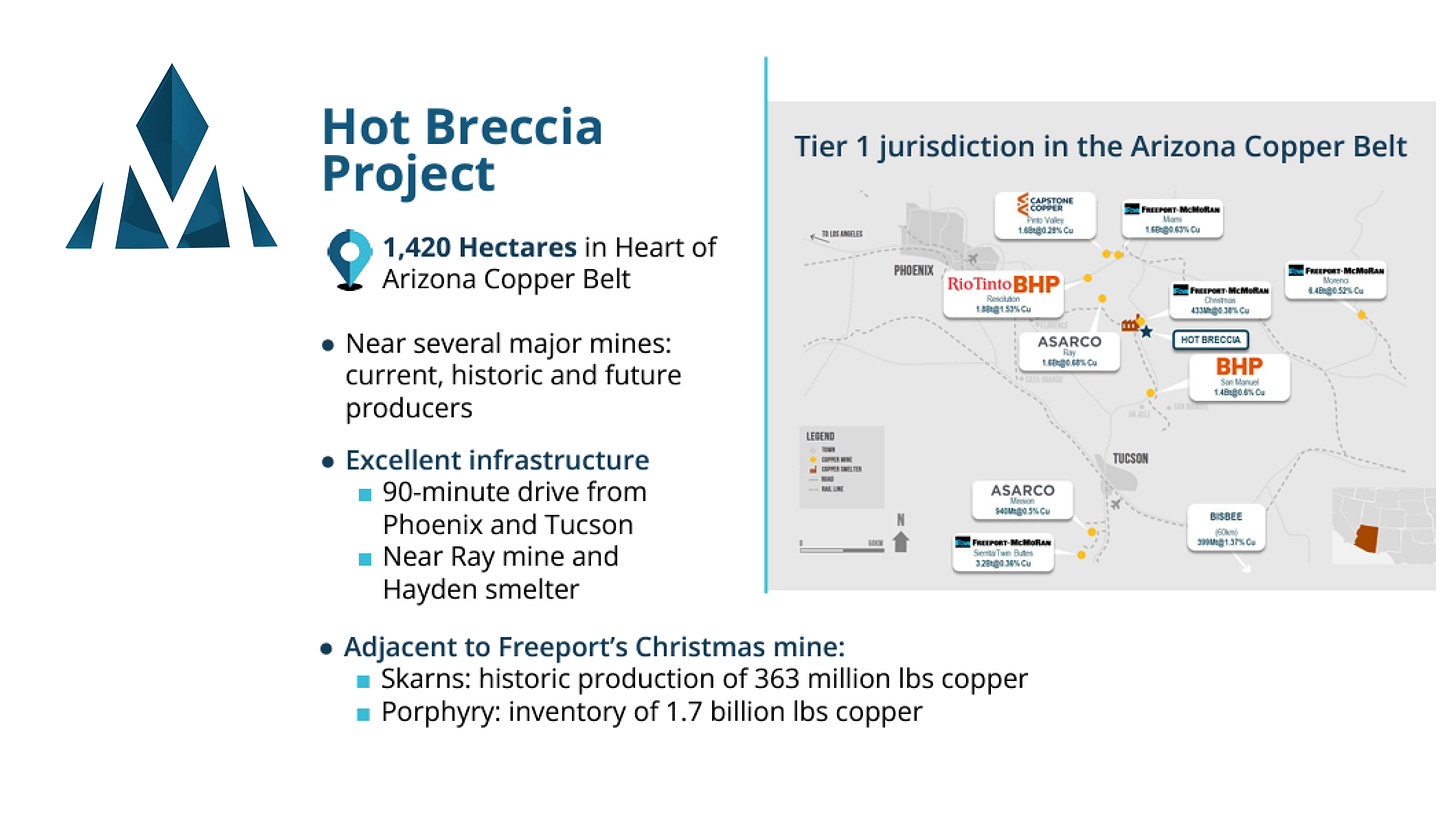

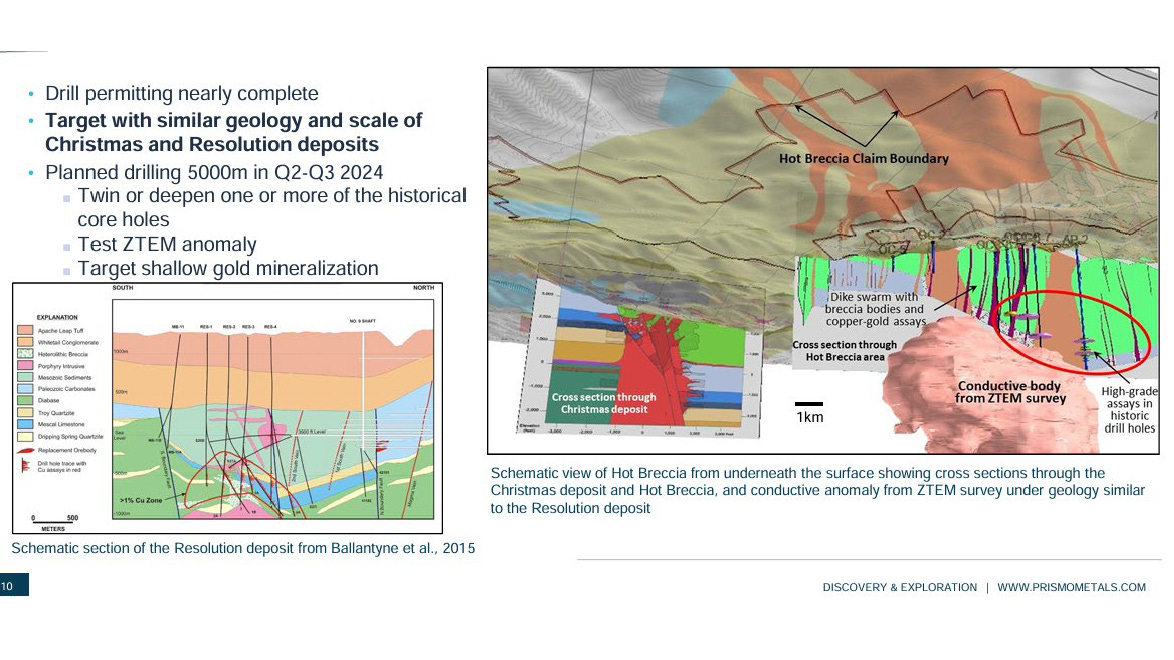

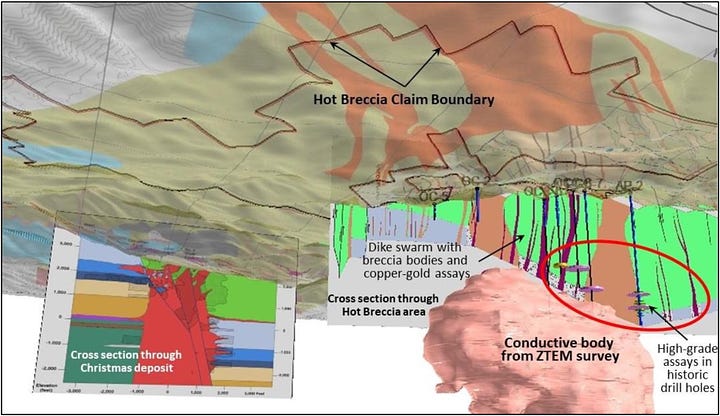

Exploring near an old mine in Arizona's famous copper belt, Prismo is planning a ~5000m drill campaign informed by new ZTEM survey and AI analysis to see what its Hot Breccia project is made of.

tl;dr

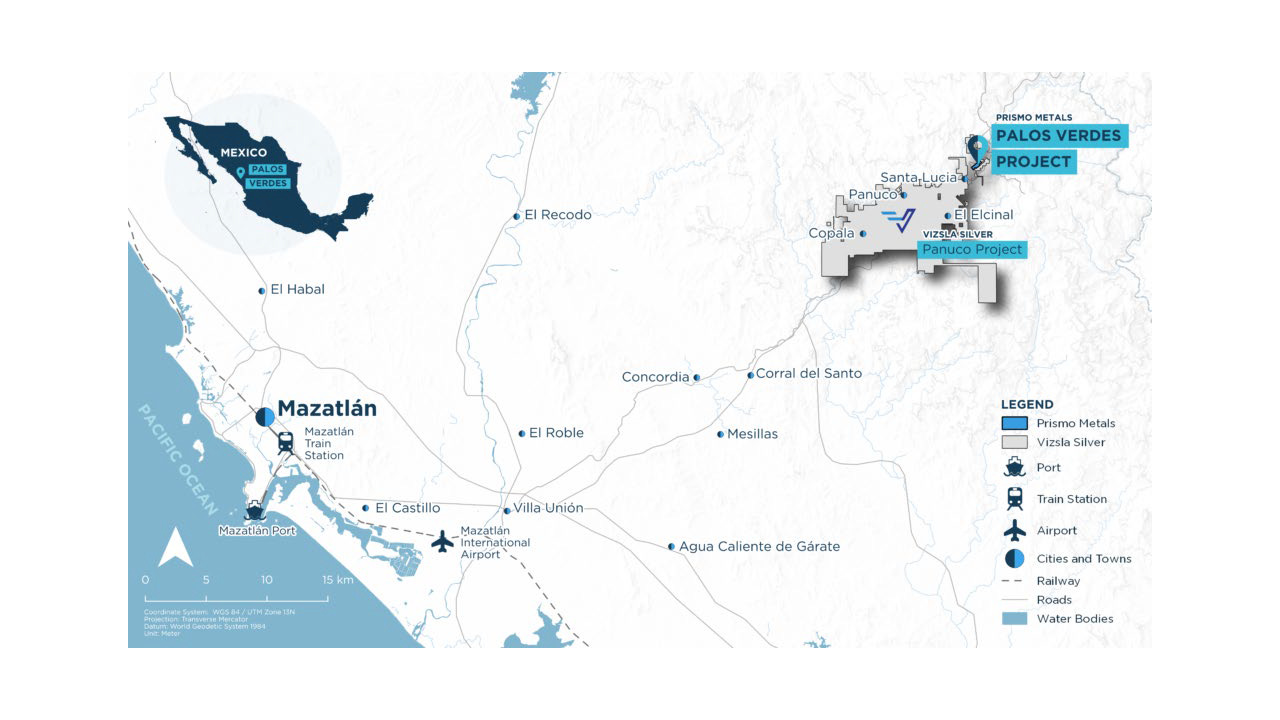

CEO Alain Lambert and President Steve Robinson join me to discuss their company Prismo Metals. Prismo had been advancing a high-grade silver+gold system in Mexico but have pivoted in the last couple of years to advance their new Hot Breccia property in Arizona's prolific copper belt.

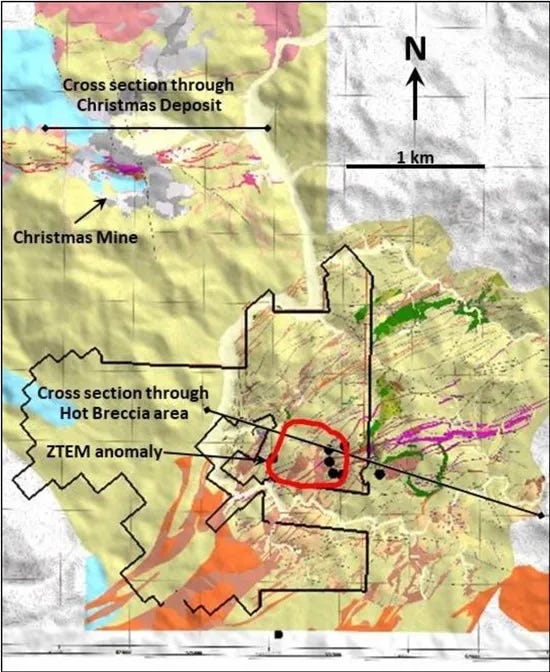

Next door to the long-lasting (and long-closed) Christmas mine, Prismo's thesis is pretty simple - they know there are more rocks mineralised like those of the old mine waiting to be found offset and deeper under some volcanic cover. Using modern ZTEM technology to identify highly conductive anomalies to target, Prismo hopes to leverage modern exploration advancements into modern discoveries.

Below you will find my interview, companion article, and timestamped summary.

Enjoy your July holiday/North American Independence Days week!

Ticker: PRIZ.CN; PMOMF

1. The Interview

2. The Companion Article

It seems like every successful mining project has a twist of fate in the story of how it came to be. How everything came about and what did - or didn’t - happen, on purpose or not, that allowed the project to continue forward. Prismo Metal’s Hot Breccia project has the feel of one of these stories.

Arizona’s Christmas mine that is Hot Breccia’s northern neighbour was exploited for nearly a century, starting at grades of roughly 2%-3% before gradually dwindling down to ~0.7% by the time it was shuttered in 1982. Rights to the mine were acquired ultimately by Freeport-McMoRan in 2007, who have since by and large left it on the shelf.

Around the same time as that acquisition, the land that comprises what is now Hot Breccia was also being staked by a private prospector.

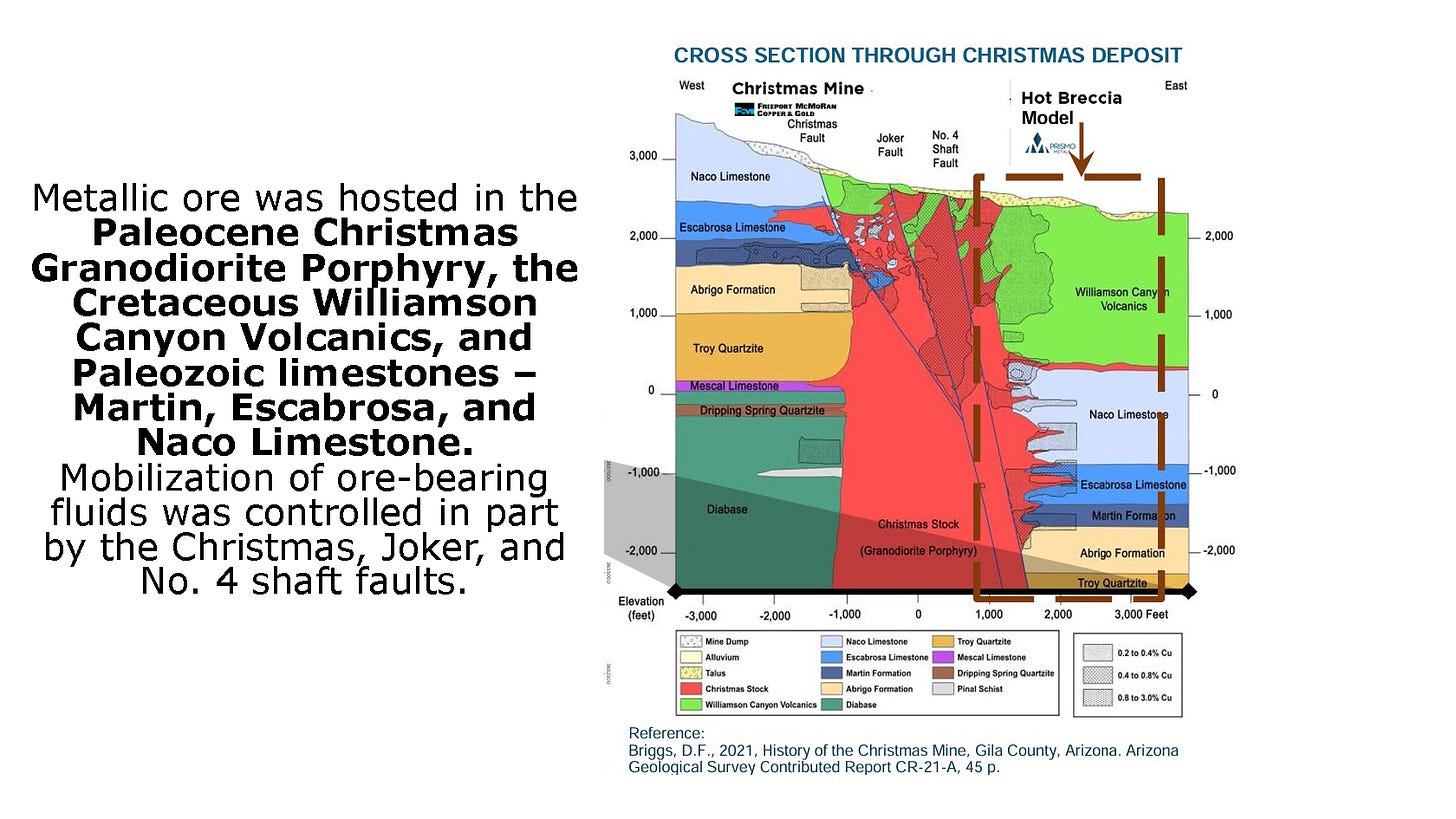

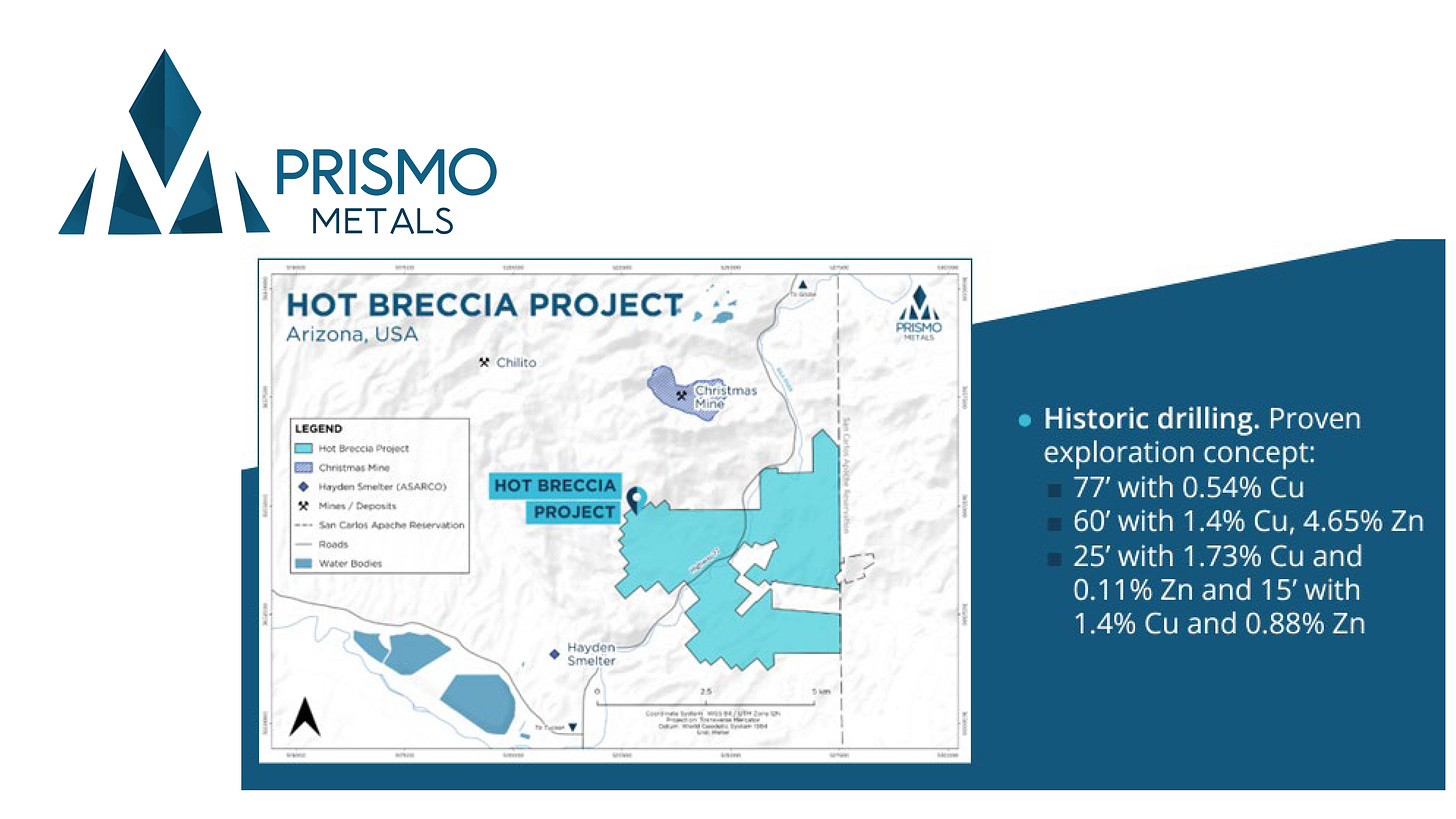

The basic premise behind this land package is simple and already well-established. The mineralised limestone center of the Christmas Mine extends onto Hot Breccia’s property, but at a lower depth. This faulting system is a geological mess in the target areas, complex and with heavy brecciation.

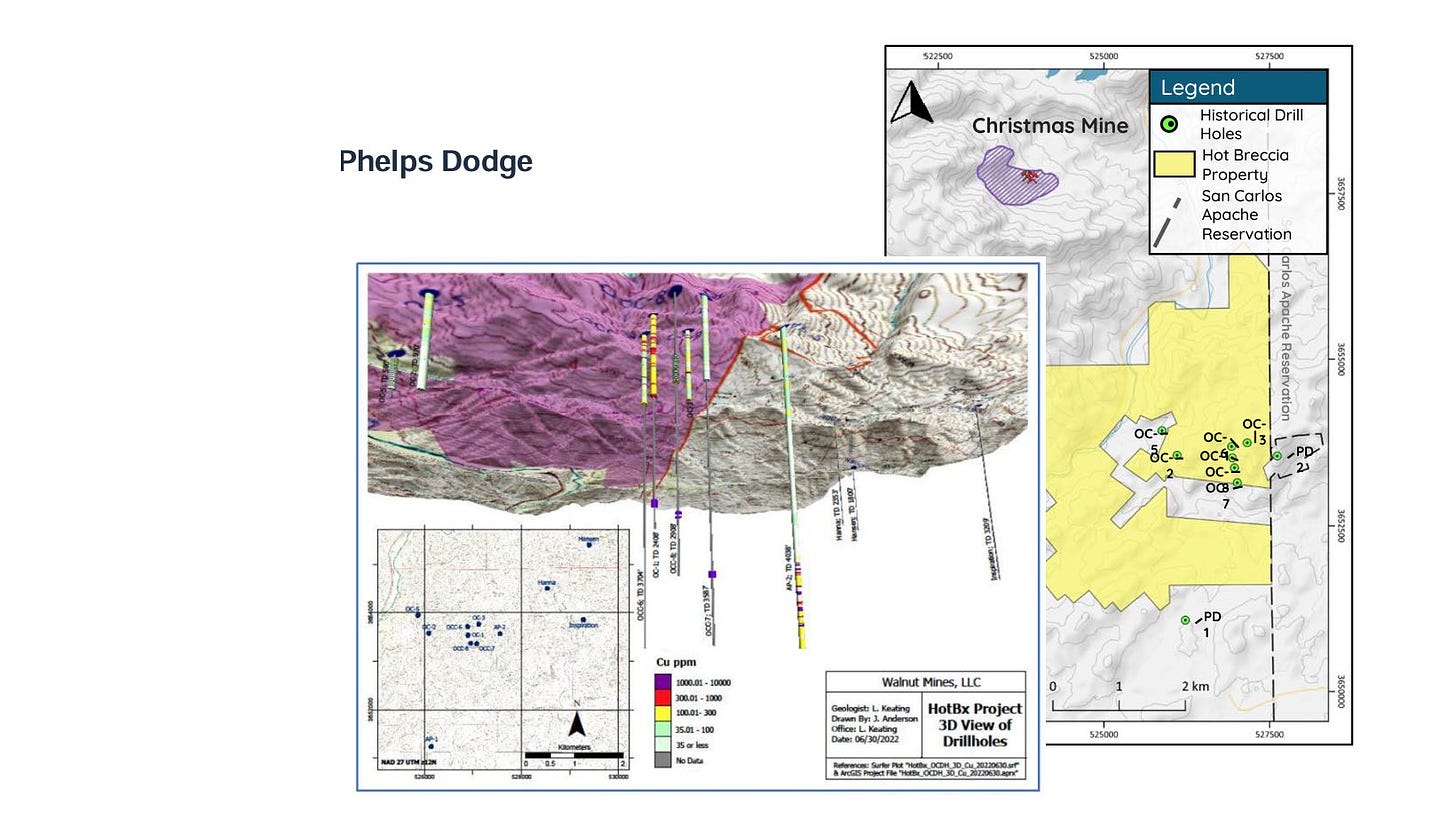

Current drill plans call for ~1,000m depths will be required to get fully into the ZTEM anomaly identified in the otherwise non-conductive limestones at that depth. You can see this visualised below as from a 2021 academic paper (the same source as the lefthand quote as well)

Historical exploration had occurred on the property through the 1970s and 1980s - roughly 10 holes, with highlights like 18.28m of 1.4% Cu and 4.65% Zn. But it was deep and drilling was mostly blind, especially compared to today’s advancements. And so Hot Breccia sat, uncracked - the forgotten offshoot of a shuttered long-lasting mine that shuffled through various ownerships over multiple decades.

And the data suite for that historical exploration matches this somewhat neglected status - incomplete assays, core logging, and even the core themselves (that ended up in the dump) make this land a mystery. Existing evidence is promising though - visual descriptions read very positive and worthy of follow-up, known assays have some strong intersections.

Enter Prismo Metals and its optioning of Hot Breccia from Infinitum Copper in January of 2023. aPrismo is represented by its dual leadership of CEO Alain Lambert (and co-founder) and relative newcomer President Steve Robinson, and backed by the geological expertise of Dr. PeterMcGaw and Craig Gibson).

With results of the first-ever ZTEM survey (done over this land package coming in this past February, Prismo’s belief in the land package received some important confirmation when a large anomaly was very obviously detected in the same limestones as the original mine. Layering this new knowledge over existing exploration has provided Prismo with a much more nuanced and informed understanding of the mineralised system they are pursuing - where to target and how.

Prismo has been since working diligently and smartly (no standing salaries - hours-based compensation) to get targets finalised and permitting in place - with both nearing completion imminently and the hopes for two separate drill programs over the coming few months.

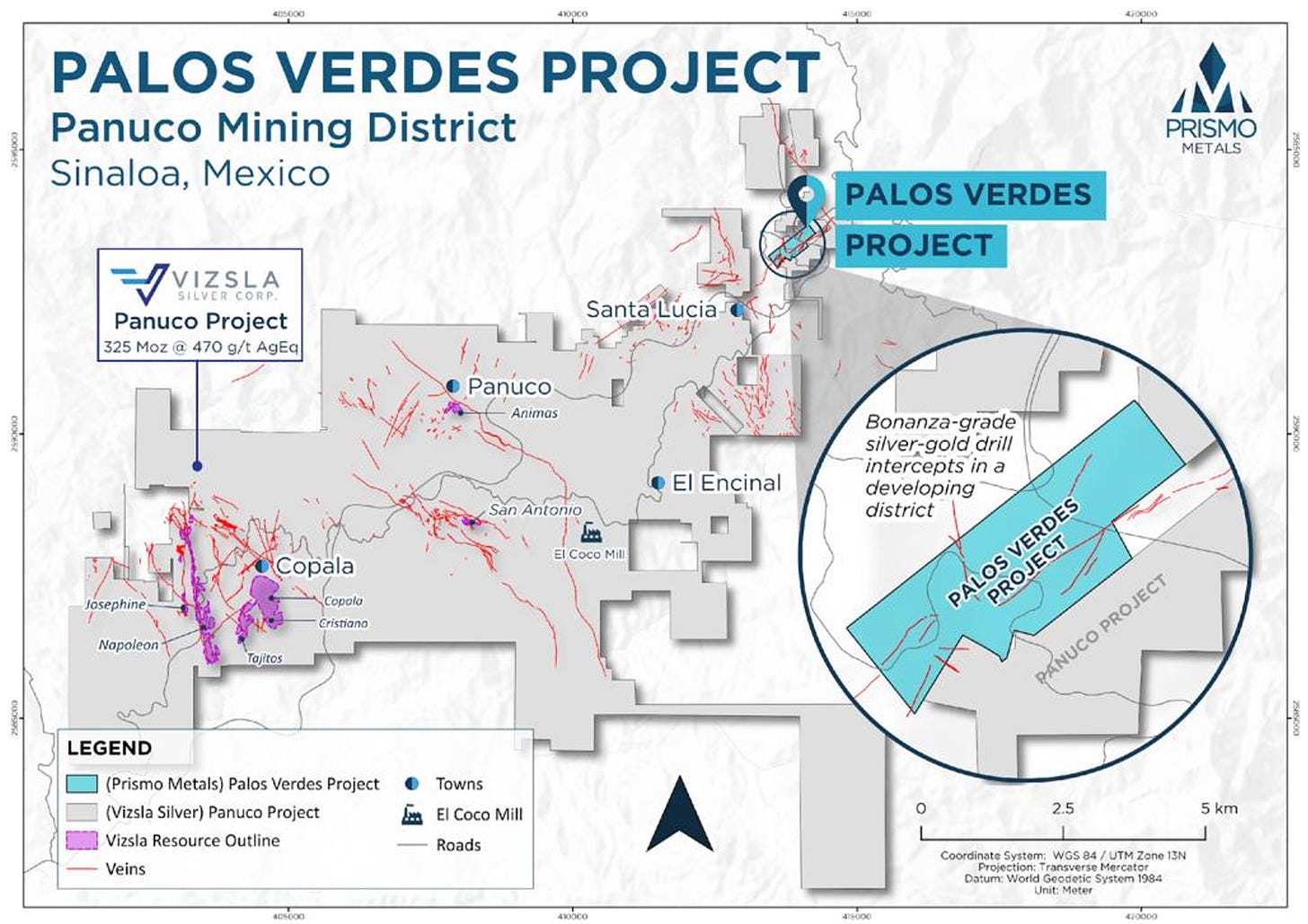

The first campaign will actually be at its cheaper, secondary target - Palos Verdes, a Mexican high-grade silver-gold target ripe for M&A (you will have to read the summary or watch the interview for more info). Then with those results in hand, a long-term, deliberate drill campaign informed by ongoing results will begin at Hot Breccia as they look to vector into the heart of the system.

This will take some cash to do, though, so watch for coming financings. The plan to start with the cheaper Mexican project to hopefully produce some zip seems smart. There is (very narrow) ultra-high-grade material on that project. And with Palos Verdes’ status of “bordered on 3 sides by Viszla Silver” in mind, there is the chance for some non-dilutive cash.

But still - this is one of those classic junior resource stories. A forgotten play, modern rejuvenation, compelling data sets, and a legitimate shot at a major discovery and the outsized returns they have to offer. It’s why you’re in this sector.

It of course comes with its own significant risks - with 5 bullets in the chamber, each drill hole will be critical. Drilling difficulties or lost holes would hurt. And even simply being a little “late” getting on the trail to the good stuff sub-surface have outsized impacts.

The market also understands that there is mineralisation there already. Proving scale and grade, then, is also key. Mediocre results - even if they are unquestionably positive within the context of a modern maiden drill campaign - can struggle to gain traction. Porphyries especially can be a tough nut to crack (even if they ultimately end up massive and with high-grade sections). Prismo needs to hit fast and hard.1

To counterbalance this demand somewhat, Steve and Alain also discuss the need to conduct exploration the right way and methodically, and not be beholden to short term market interests. And this is a smart and wise approach and one I agree with But results are nevertheless still required, something they no doubt know already.

So the announced use of AI-based analaysis target generation to me is welcome as it demonstrates that Prismo is looking to make this drill campaign count. Will it work? There’s only one way to find out, but Prismo is using every tool in their toolbox to make this drill campaign the most effective it can be.

Conclusion

So yeah. I like this one. Timing an entry will be important for this one, though. There’s potential warrant clipping overhang to keep an eye on. As well, watch for the BLM permitting (only administrative hoops left, no opportunities for further comment or revisions as per my questioning), financing announcements, and potential M&A from Palos Verdes as catalysts to enter a potential position into around in the lead-up to the two drill campaigns. This is a good story but it isn’t fully green light time yet for the drill.

But if you’re looking for a chance at a rerating of the type that only this sector can offer that is backed by reasonable geological evidence to support that blue sky then Prismo is worth your time.

3. The Written Summary

Time stamps are links to interview section in question.

00:38 Elevator Pitch

Prismo has three projects.

Core focus is the Hot Breccia Project

Located in the famous copper belt of Arizona

They own another project in Mexico – Palos Verdes – which is surrounded by Viszla Silver

Viszla owns 9.6% of Prismo

Also own the Los Pavitos gold project in Sonora

02:13 Personal Intros

Steve

“I Love Big Copper”

Chance at a big discovery at Hot Breccia

Was part of Infinitum Copper who initially optioned the property.

Now here with Prismo to focus on it.

Anticipating it will be one of the top drill programs

Alain

Started as an attorney.

Been working in the market since the 1980s.

From Montreal, lived for a few years in Arizona.

Met Dr. Peter McGaw there as well as VP Ex Craig Gibson

Also very excited about the Palos Verdes project surrounded by Viszla Silver.

Believe they make a good team – a good balance.

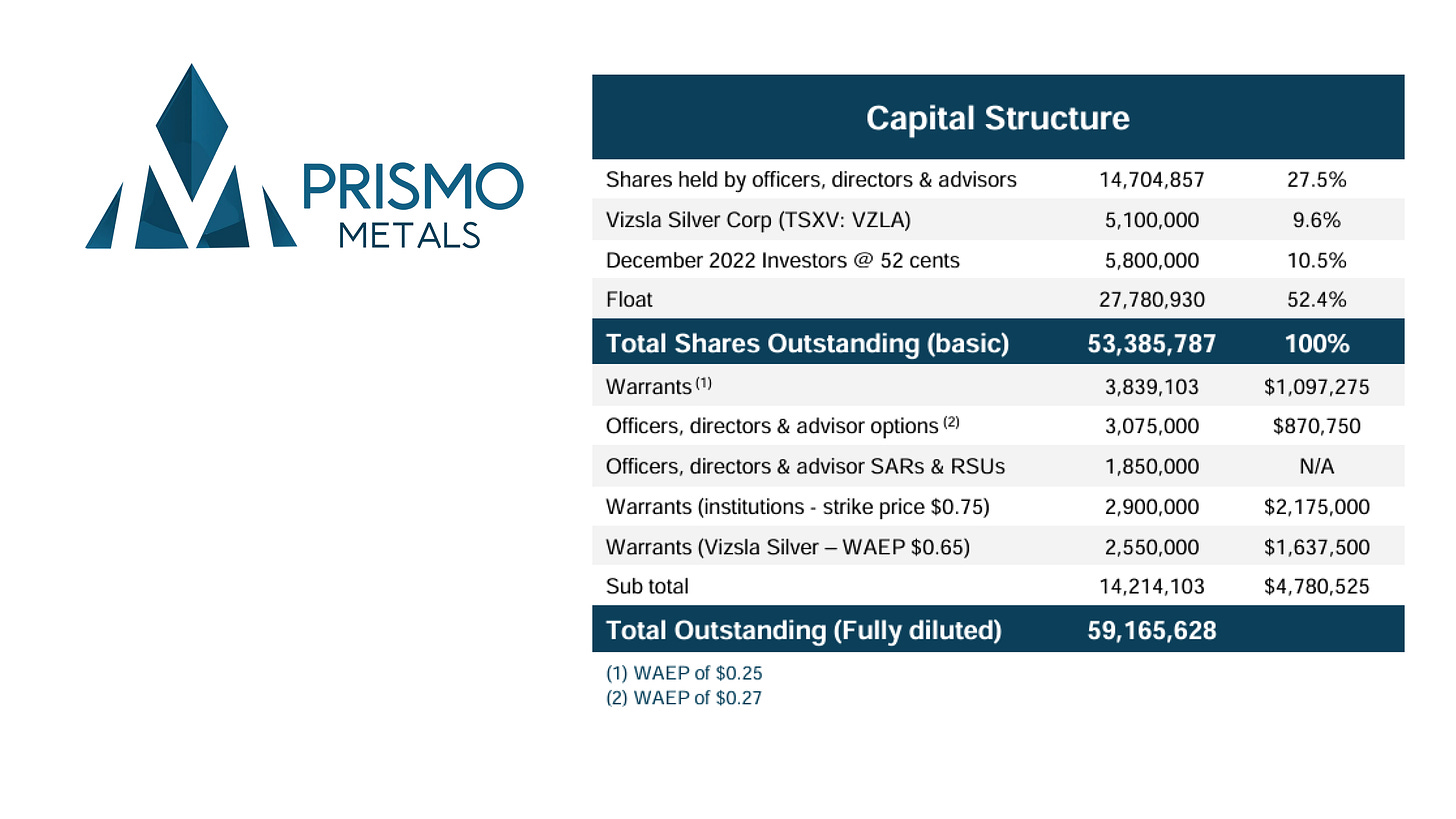

06:40 Capital Structure

Tight share structure.

Been around for 4 years, fully diluted 60 million shares.

No rollbacks

Only small amounts of short term debt.

Property owners/contractors are wanting to be paid in shares.

Since IPO they have raised $10 million.

Insiders still own 27.5%.

No one has an employment agreement – no set salaries. Paid only when active on the project.

Reduces burn rate.

09:30 Decision to focus on Hot Breccia

Alain

Property was optioned in January of 2023

Same initial above ground work happened at that time.

Felt that now was the right time in the market for a big copper project with the risk:reward dynamics Hot Breccia has to offer.

Hot Breccia is a big project – different than their other two.

Palos Verdes is a much cheaper project to explore and drill out.

They still intend to drill at Palos Verdes this year, but the ~3000 meters planned down there has much less capital requirements than the $3-$5 million/~5000 meters they want to put into Hot Breccia.

Viszla has a ROFR on Palos Verdes

Any positive developments there would help with non-dilutive capital for Hot Breccia.

Steve

All 3 projects will get what they need to continue to be advanced this year. Mapping and prospecting and geophysics work will be done at Los Pavitos.

Palos Verdes – next step is to get a little deeper into the vein system and understand what’s happening at depth. Again, big benefit is the cheap cost of exploration there.

However, bulk of the news flow for the next 6-12 months will be Hot Breccia.

14:40 History of Hot Breccia

Hot Breccia story starts in 1970 when breccia was discovered at surface.

1000m+ drill holes were even more challenging back then

6 deep drill holes were drilled and they ended up hitting the exact same rocks (and similar mineralisation and grade) as the nearby historical Christmas mine (25mT at 1.5% Cu), just deeper and under cover of volcanics.

Resolution discovery was very similar – was next door to a small, high-grade mine (Magna - 20mT at 5%) and exploration offset and at depth created the massive discovery at Resolution). Took a few years but Resolution is now 1.6bT of 1.6% Cu. Extremely similar geologic setting here with Hot Breccia/Christmas.

Hot Breccia is shallower than Resolution

Weak copper prices shut down Christmas mine in the early 1980s.

Opportunity to pick up where they left off in the early 80s.

Believe lots of positives have stacked the odds in their favour.

20:30 Plan for Upcoming Drill Campaign

Drill targets haven’t been pinpointed yet.

Will be using a 2023 ZTEM survey to help guide – tech not available last time.

Excellent for identifying deep conductors

Where there is supposed to be (non-conductive) limestone, there is instead a conductor

Good chance its been mineralised with copper.

Becomes a great drill target.

Using an AI company to optimise the geophysical response from that survey and otherwise hone their targeting process.

Don’t have all the assays from the old holes – drilling a little bit blind, but do have the geological descriptions.

Helps Prismo to understand where the most intense alteration is.

The heart of the property is heavily brecciated.

Geology gets very complex.

Lots of dikes

Chance for a heat source producing all that.

Hope to have the drill program finalised in the next month or so.

23:40 Use of AI

Alain

Prismo has hired an AI company – Exploration Technologies – to help.

Zero intention is to replace geos – it is designed to give them the best, purest, least-biased data to work with.

Helps immensely with even smaller things, like final orientation of the drill hole.

Steve

The AI company is run by PhDs and geos. They understand the process.

They actually came to site to understand the rocks and how they fit into the model.

They understand the exploration process.

Taking compensation in 100% stock. Staged payments.

27:50 Has the ZTEM anomaly been hit by historical drilling.

Steve

In the area, but off the mark.

If they had had the ZTEM survey, they wouldn’t have drilled in the direction they did.

Confident it will let them hit the hot part of the system and achieve strong grade.

Twin Hole – there is a likelihood of drilling one near a historical hole.

This is because they don’t have the assays of some of the holes and want to be able to cross reference assayed grade with mineralised descriptions.

So they will drill into a highly-altered part of the system to get a look for themselves.

Also even missing some historic core – was thrown out.

Want to get some core that reflects the system again so Prismo can do its own analysis with its own rocks.

Alain

Junior exploration companies need to have a long term focus and make decisions about what is best for data and knowledge and discovery, not simply try to excite the market.

This is about advancing a project for institutions and especially majors to take notice of, and not as much focus on retail demands.

33:00 Is this project too big for Prismo to conquer?

Alain – Steve has found something big before and taken it all the way to production.

Steve – it isn’t our goal to be a producer.

Our goal is to create value through the exploration and discovery phase.

Alain - Companies like Hercules Silver shows the market will respond to big projects being discovered successfully.

Hot Breccia is surrounded by majors and operating mines and smelters.

36:20 Cost of Drilling

Good time to be drilling in Arizona as a junior

Business has slowed on the junior side of things.

Lots of diamond drillers with parked gear right now that are hungry for work.

Hope the bidding process will be competitive.

Budgeting $500,000 per 1000m drill hole (which is likely conservative)

41:10 Palos Verdes Plans

Palos Verdes – ultra high grade silver with gold.

Want to go a little deeper and chase the vein system a bit

Fault running through system means chance for an offset.

Surrounded on 3 sides by Viszla.

Viszla actually allowing them to drill from Viszla land

Palos Verdes will be drilled before Hot Breccia

Hot Breccia has some administrative work due before permitting is finally/formally approved.

Waiting for final approval to begin financing and other work – some fears over BLM permitting in Arizona that need to be calmed.

49:30 Final Thoughts

Look for good property, good people, and good timing in this sector. Prismo has all three.

Conclusion

Hope you liked this one. My “partial hiatus” from JRI will continue for a few more weeks yet as I continue to renovate my new home. In the meantime, I hope you’re all able to find some time to get outside and enjoy the summer. Look for renewed attention and output for my written work and interviews by the end of July or so.

And thank you - as always - for reading. It remains a great privilege for me that I get to do what I do. So yeah. Thanks for helping make that possible.

-Matthew from JRI

If you follow my work, I’m of course thinking here of Sendero Resources and its struggles despite hundreds of meters of modest-but-very-reasonable grade (some ~0.5 gpt AuEq) but that may also be partly a result of failing to meet overheated investor expectations, something I don’t as yet see at Prismo, which is much more under the radar).