Globex Mining: Strong Buying Power in a Weak Market

In this update, I reflect on how important it is to hold cash for moments of market weakness - whether you're a private investor or a public company. I also briefly recap recent Globex headlines.

tl;dr:

Another check in with Globex Mining today. I will highlight recent headlines and upcoming news events (maiden resources from Kiboko, drill results from Brunswick, and more), but also wanted to use Globex’s Q2 ‘23 financials to reflect on potential outcomes for this company, specifically within the context of the overall (rather dismal) resource market.

Tickers Mentioned: AUOZ.V; BRW.V; IPG.V; KIB.V; RDS.V

Alright, I was hoping to release some data tabulation work I have done detailing Globex’s many royalties this week, but just like the now-mythical devco project (which I am working on this weekend!) it rapidly ballooned into a project spanning far more than just a few hours of writing could cover. And rather than destroy my sleep patterns and overall health grinding them out, I am trying to chip away at them as long term projects. Anyway, I am currently knee deep in annual information forms and MD&As and need time to get it done properly. Look for it in the coming down the road though.

Part 1: My Thoughts

As for now, I will do my typical “recent news highlights” treatment of the last month of Globex news. But before doing so, I also just wanted to shine a light on Globex’s current assets, in the hopes of making a point about timing in this cyclical sector.

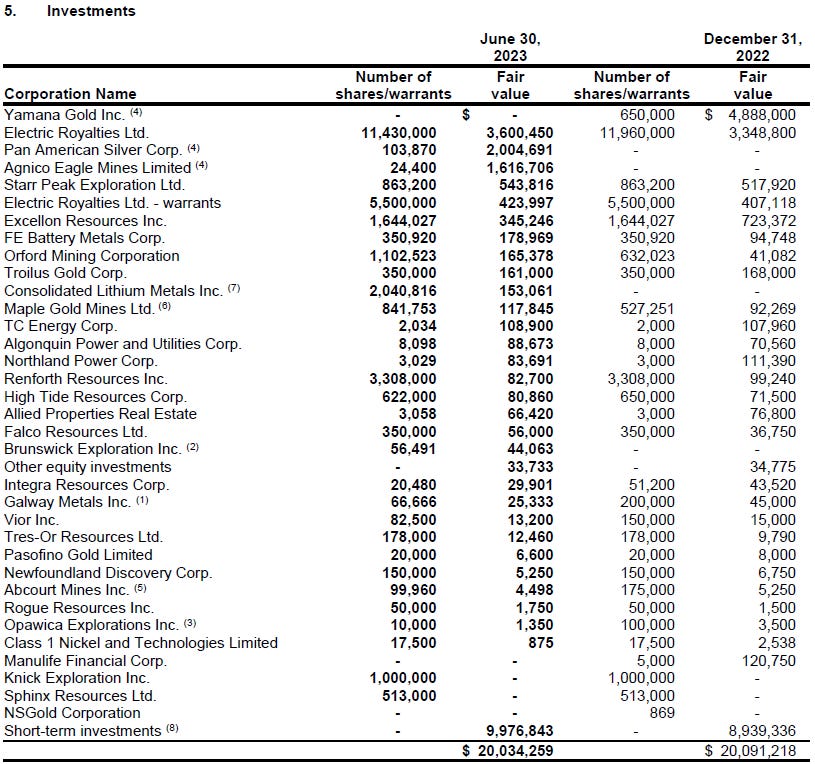

First off, here is the summary table for the interim Q2 ‘23 financials:

Put cleanly, Globex has:

$4m in cash

Nearly $3m in accounts receivable, and finally

A hefty $20m in equities

And just for the historical record, I thought I would also share their current investment Portfolio, from the same Q2 fins (note that Yamana Gold turned into ~$1.30/share and the Agnico and Pan American positions).

The point I am making is that Jack’s decades of wheeling and dealing - chiseling out edges here and there through acquiring and divesting a huge run of properties - have helped Globex amass a significant portfolio not just of long term Royalty opportunities, but also a lot of very liquid equity.

So then what’s next? What does all this ultimately turn into? Jack is aware of this question. He’s spoken on it before - that he’s reaching the definitive moment of execution regarding everything he has been building. The question that remains on everyone’s mind is what that looks like. I won’t speak to that, but let me repeat the point I want to make here before moving on: Jack has built a war chest of significant value and that provides Globex a lot of flexibility, opportunity, and options.

Globex’s Portfolio:

That is no doubt a large and productive portfolio.

Now, Jack’s wheeling and dealing has not been occurring in a vacuum. Rather, Jack has equipped Globex with this little horde of tradeable assets at a very opportune moment. This is because, as I have spoken to recently I think the junior sector is, finally, starting to see actual damage being done to companies from the sustained bear market they’ve been suffering under. Imminent bankruptcies, dropped options, incomplete financings, and more. The list of quality distressed (and potentially distressed) assets is only just starting to grow.

You can probably understand my point by now. Globex has a stack of cash at a time when projects and companies are vulnerable. Might we be approaching (over the next, what, 6 months? 1 year? 2?) a moment where the right project comes along at the right time and at the right price for the cheap-and-proud-of-it Stoch? It is pure speculation on my part, but the potential for a significant deal is undeniable. To torture an old cliche, in the land of the penniless, the man with a dollar is king. Jack’s long-form vision and patience looks like it might have a chance to pay off in a real and meaningful way soon.

Part 2: Globex News Headlines

The following is a brief recap of the headlines from Globex-associated projects from the last month or so. Lots of small companies working to advance decent projects, including announcing increasing resources, new resources, and awaiting high-impact assays:

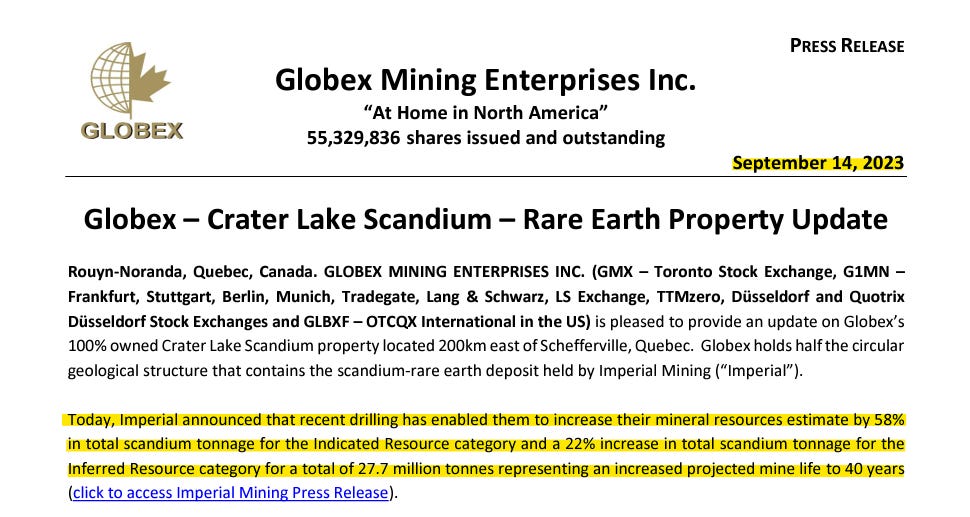

1. Imperial Mining (IPG) Announces 58% Resource Increase

Globex owns the SW half of a very obvious Scandium-REE target whose geological twin half belongs to Imperial Mining. Imperial recently announced a 58% increase in their deposit, representing 27+mt I+I and a 40 year mine life. Image below.

Headline economics for Imperial’s PEA are strong: $1.7B after-tax NPV10 and a 32.8% after-tax IRR. Scandium itself is a presently a very niche, low-demand mineral, but forecasted growth in demand is enormous, with demand potentially almost 6Xing by 2030.1 So this is one for Globex that might ripen on the vine quite nicely over the coming years.

2. Radisson Mining (RDS) 10,000m Drill Campaign Starts

Radisson announced its 10,000 meter drill program is now underway. Radisson is currently looking to up its I+I resource which currently sits at 674,000 oz of Gold at a 3 gpt cut-off. Globex retains a 1% NSR on one part of the Radisson property, and a 2% NSR on another. Positive intersections have been announced already not yet in an updated MRE.

Globex owns the 2% NSR on a couple of fruitful vertical trends (amongst 8 or 9 across the whole O’Brien property) that has seen active drilling done into it this campaign.

3. Kiboko Gold Closing in on Delayed Maiden Resource

Kiboko Gold has stitched together a little land package that has never been cobbled together before that has an upcoming new universal MRE. With 85,000m including 11,000m+ drilled by Kiboko, there is the potential for some decent numbers coming down the pipe.

Kiboko is in an ideal position with low hurdles for economic viability. Any delays always spark unease, but the only proof there is is in the numbers.

With positive numbers, Globex’s 2% NSR of course becomes a juicier buyback target for any potential suitor operator that comes Kiboko’s way. Kiboko gave an update on Oct. 18 explaining the wait will take a little longer.

4. Brunswick (BRW) Intersects Spodumene, Core in the Lab

Brunswick Exploration has been catching lots of positive attention lately for news coming out of its Mirage Lithium property, acquired initially from Globex. Globex retains a 3% GMR on the project, with a 1% buyback option priced at $1 million, as well as cash and share payouts.

With long lengths of Spodumene intercepted on its Mirage project, any significant grades could command very positive attention as Lithium Mania 2.0 keeps trying to get up off the ground again.

5. Emperor Gold (AUOZ.V) Assays 15.8 8/t Au Over 10.8m

Emperor Gold has bounced back decently in recent weeks, with encouraging news coming out of its program, including this nice headline intercept. 8,000+ meters of drilling are now in the bank, and with recent news and assays showing decent mineralisation targets that play nice with preexisting mine plans, Emperor is hoping to continue to create value.

The project is not optioned to Globex specifically, but to Duparquet Assets, a company owned 50% privately by Jack Stock and 50% by Globex. Duparquet retains a 3% GMR, with a 1% buyback available for $1 million.

That’s it for now on Globex. Watch out for my weekly update tomorrow, as my streak of busy weeks continues. I’ve got lots more I am excited to announce so stay tuned.

And as always, thank you for reading.

-Matthew from JRI

page 4 from https://imperialmgp.com/investors/presentations/