Globex Mining - News Update Compendium

With hundreds of projects in its portfolio, there's always lots to catch up on with Globex Mining. This article looks to do just that - highlighting key news updates from the past few months.

tl;dr:

Below is a summary of major news out of Globex Mining Enterprises (GMX.TO) in 2025 thus far. Unsurprisingly, the newswire for Globex has been kept busy, what with literally hundreds of different projects represented in its portfolio with potential updates. The value is in the aggregate with Globex, requiring you to track many different projects simultaneously to understand it. In this recap is news on multiple gold, lithium, antimony, and iron projects, as well as multiple millions of dollars of revenue. It feels like - due to the huge number of cards it has in its deck - Globex always manages to have a winning hand.

Projects discussed (and companies): Mirage Lithium (Brunswick Exploration, BRW.V); Mont Sorcier Iron (Cerrado Gold, CERT.V); Kewagama Gold (Radisson Mining, RDS.V); (Antimony Resource Corp, ARC.CN), Duquesne West (Emperor Metals, AUOZ.CN)

Index

1. Globex News

1.1. 30 Years on TSX

1.2. Sale of Remaining O3 Shares

2. Iron Projects: Mont Sorcier Property

3. Gold Projects

3.1. Duquesne West Property

3.2. Kewagama Property

4. Lithium Projects: Mirage Property

5. Antimony Projects: Bald Hill Property

Conclusion

Current SP: $1.30 1 Year: +32.7% 1 Year High: $1.61 1 Year Low: $0.81

1. Globex News

Recent News Flow

March 26, 2025

The TSX Celebrates the 30 Years Listing Anniversary of Globex Mining Enterprises

January 28, 2025

1.1. 30 Years Listing Anniversary of Globex Mining

What’s in the tin is on the label. Globex has officially been on the TSX for 30 years (though went public even earlier in Montreal) and got some recognition from the big board. Not the most earth shattering news, but demonstrates the staying power of CEO Jack Stoch and his vision. This portfolio has been a long time coming.

1.2. Globex Receives Cash for O3 Shares

A big part of Globex’s success is the continuous-if-definitionally-irregular cash flow it produces for itself. Millions in revenue end up produced annually from Jack’s wheeling and dealing and there was another good example of this in Q1 2025.

With O3 Mining now officially taken out by Agnico Eagle, Globex announced $1,980,447.99 in cash paid out from the takeover from shares it received initially from O3 for acquiring some GMX land. Globex, naturally, maintains a 2.5% Gross Metal Royalty (GMR) on some portions of the project, and a 1% GMR on others.

Running tally of cash accrued: $1.98M

2. Iron Projects

Mont Sorcier - Cerrado Gold CERT.V

Recent News Flow

May 01, 2025

Mont Sorcier Iron Vanadium Update

Globex holds a 2% GMR on Mont Sorcier.

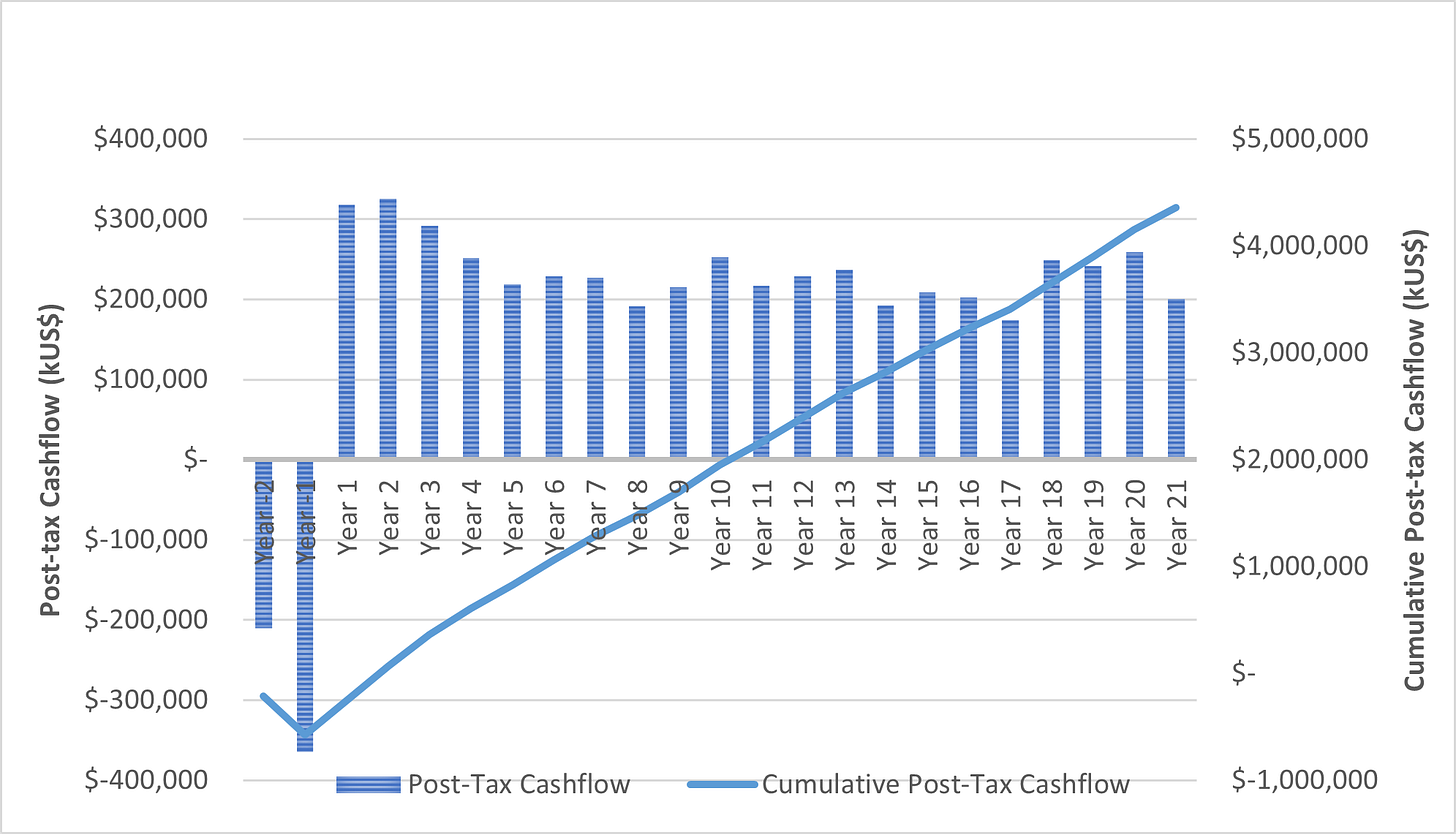

Brief update out of Cerrado Gold on their Mont Sorcier iron project. Taking the PEA numbers at face value, Mont Sorcier in production would produce some US $2-4M in annual revenue for Globex.

Met work and flow sheet design continues.

Reaffirms potential for 67% iron and lowered impurities.

Bankable Feasibility Study due Q1 2026.

Will build off 2022’s PEA w/ post-tax NPV8 of $1.6b.

3. Gold Projects

3.1. Duquesne West - Emperor Metals AUOZ.CN

Recent News Flow

January 08, 2025

January 30, 2025

February 11, 2025

Assays on Duquesne West Property Continue to Support Open Pit Potential

February 26, 2025

Globex holds a 3% GMR on Emperor’s project.

Summary and Synopsis

Duquesne West (DW) got optioned off to Emperor Metals (AUOZ.CN) a couple years back at pretty compelling terms for Globex, as shown above.

As the above links show, Emperor has had a steady string of good news come out of DW:

Reassaying using more accurate processes for coarse gold moved 2.5m of 57.8 g/t Au to 2.5m of 301.1 g/t Au material.

Assaying for the first time historical core logged as waste rock brought back results like 43.9m of 0.74 gpt Au.

An updated resource looking to upgrade the existing 727,000 ounces at a grade of 5.42 g/t commenced in April and will include 8,166m drilled in 2024.

Which is just fine by Globex - the better DW gets, the more likely it is Emperor will opt to hold onto it.

Having received already $1.5 million in cash (including $500,00 this past January) and 4.5 million shares, as the option agreement slides into the back half, suddenly the remaining payments start to get pretty darn big.

As it shows above, in the next 2 and a half years, $8.5 million in payments and 10.5 million shares ($1.47 million) are due to Globex.

Running tally of cash accrued: $2.48m

Running tally of shares accrued: 1.5m

3.2. Kewagama - Radisson Mining RDS.V

Recent News Flow

January 29, 2025

Globex Provides Update on Tyrone and Kewagama Royalty Properties

February 26, 2025

High Grade Gold Assays Reported at Globex’s Kewagama Royalty Claims

April 2, 2025

Globex holds a 1% GMR on some land claims and 2% on others owned by Radisson.

Summary and Synopsis

$105M mc Radisson has produced some positive results in its fully-funded 22,000m drill program, as has been reported over the past couple months. Globex’s GMR-related claims produced their own positive results, with a hole of 8.36 g/t Au over 15.0m on Globex’s claims headlines the numbers from February 26.

Radisson has had several other high-grade results reported from its drill campaign beyond Globex claims that also highlight the endowment potential.

4. Lithium Projects

Mirage - Brunswick Exploration BRW.V

Recent News Flow

January 13, 2025

Brunswick Drilling Expanding Lithium Zones on Mirage(Lac Escale) Globex Royalty Claims

January 27, 2025

Brunswick Begins New Drilling on Globex’sLac Escale (Mirage) Lithium Royalty Property

April 24, 2025

Brunswick Continues to Intersect Lithium Mineralization on Globex’s Lac Escale Royalty Property

Globex retains a 3% GMR on BRW’s Mirage (formerly Lac Escale) Lithium project.

Summary and Synopsis

While lithium sentiment is in the dumps, Brunswick Exploration continues to successfully and substantially advance Mirage. A 12,000m drill program conducted in H2 of 2024 that had its final results released in January had success, continuing to expand known areas of mineralisation at depth and along strike. Results such as 37 meters at 1.14% Li2O in hole MR-24-87 and 1.15% Li2O over 23 meters highlight the January 13th results.

Shortly after 2024’s results were released, on January 27 this year Brunswick announced the initiation of a 5,000m program dedicated to new, undrilled targets on Globex-optioned land.

In April, Brunswick updated the market on the drill campaign. 24 total holes were drilled. 8 holes and ~1700m were announced in this release. Highlight assays such as 36 meters at 1.51% Li2O and 1.32% Li2O over 28 meters. Multiple dyke swarms have been identified now.

Primary goal remains to define a resource of at least 50Mt within 50km from infrastructure.

5. Antimony Projects

Bald Hill Antimony Resources ARC.CN

Recent News Flow

January 22, 2025

May 06, 2025

Globex retains a 3.5% GMR on Bald Hill

Summary and Synopsis

With antimony suddenly in the spotlight as a critical metal in recent months, Globex was a beneficiary, as its Bald Hill Antimony got optioned off to Big Red Mining Corp (now Antimony Resources - ARC.CN) last January.1

The deal in aggregate is 100% for $2 million, 1.1 million shares, and $5 million in exploration over 4 years.

The terms:

$375,000 in guaranteed payments over first two years, including $100,000 already paid, then,

$500,000 Year 3

$1,125,000 Year 4

GMR buyback of 1% for $1 million.

And then, in mid April, ARC updated that they were midway through their 2000m drill program and had intersected 20m intersections in multiple drill holes with assays due in about 4 weeks.

Running tally of cash accrued: $2.58m

Conclusion

I find this run of news to collectively be a good example of Globex’s business model and value proposition. Lots of minerals. Lots of partners. Lots of drill results.

And lots of money. Just in the curated list of news above covering the past 4-5 months, Globex brought in nearly $2.6 million in cash and a minimum of 1.5 million shares from its deals. Setting aside all the intangible value created by a successful drill campaign on Globex-optioned land, Globex just flat out constantly finds ways to make money.

Sometimes, Globex gets criticised for giving away the goods too cheaply (it happened with Brunswick/Mirage). But while it is no doubt frustrating to let a big win slip away, I think this complaint fundamentally misunderstands Globex’s strategy.

It is not Globex’s strategy to spend millions to drill out a project to understand its potential fully. That’s typical bog-standard explore co behaviour and just simply not Globex’s business model.

Rather, Globex works to minimise risk and guarantee exposure to any eventual reward, letting other people take on outsized exposure to risk and reward to live or die by. Sometimes that means what you get paid ends up looking light further down the road. But, critically, you still got paid. And with those hefty GMRs, let’s not pretend Globex is stuck with nothing. Even just extinguishing those GMRs (generally the classic “$1 million per 1%”) ends up being significant value creation for Globex.

I also know Jack gets critiqued that, because of his “little red paperclip” style and those GMRs, some funds or individuals just won’t do business with him. True though this may or may not be, he certainly doesn’t seem to struggle with finding people to partner with - as evidence by the constant flow of deals. And every new deal big or small starts a wheel of value generation moving for Globex.

Jack remains a bit of a divisive figure, happy to save pennies to turn into a dollars in an industry that generally struggles with fiscal discipline. But in an industry with its fair share of bad actors, I like him. He is sharp, shrewd, and the pipeline of news he has built out of his projects demonstrates his abilities.

Investors above all are always in search of value. For Globex, as the news update above demonstrates, the value it is building never really stops growing.

Thanks for reading.

-Matthew from JRI