A Graphite Primer

A critical, overlooked mineral that is shaping up to ride the green energy investment wave - if you know what to look for.

(Note - I am not a formally-trained graphite geo or expert! I welcome additional info or correction where needed. I tried to work only from reputable sources. Sources at bottom.)

tl;dr

Graphite is a poorly-understood resource that is going to serve a foundational need in the upcoming green energy revolution. Knowing a few critical characteristics of graphite as a mineral and as a commodity helps demystify this resource just in time for demand for it to skyrocket.

Intro:

Okay, so graphite both as a resource and as a market is large and complex and opaque. It has lots of characteristics that makes it a challenge for the layman to understand and compare companies meaningfully, which makes it ripe for pumpy narratives to work within. Add to this that for much of the past decade there has been chronic over supply. All this combined to make graphite a very tough market, despite its green energy credentials.

But, as we will get into, things are starting to change, and graphite as a commodity has a bright future head of it, so long as you mind a variety of considerations about it. This little write up is meant to be a brief overview of graphite. I will link you to a host of other articles that are more in-depth than my little primer here for further reading.

There are a few topics to cover here today: Demand, type, cost, market, and geopolitics.

1. Graphite: The Demand Matters

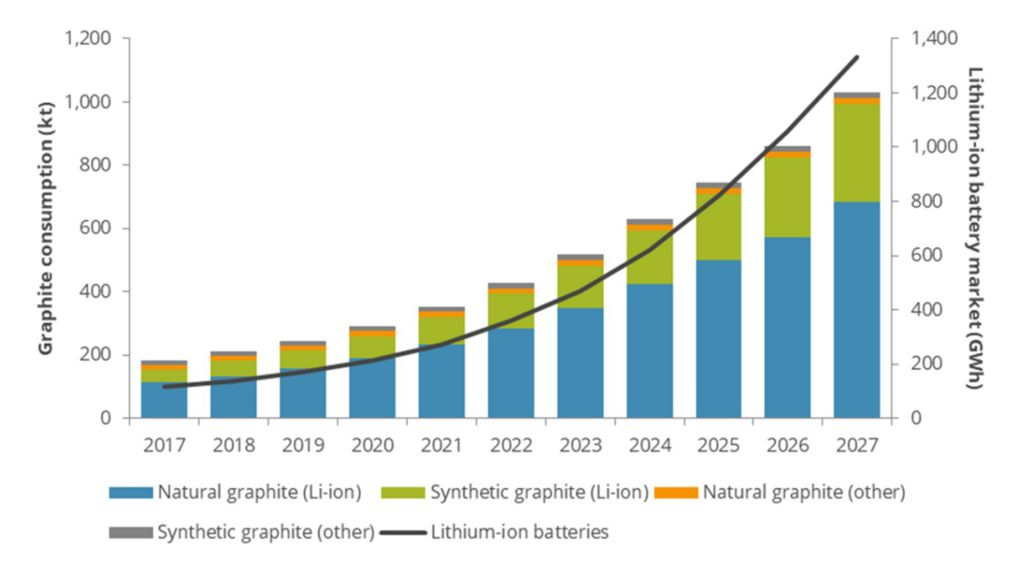

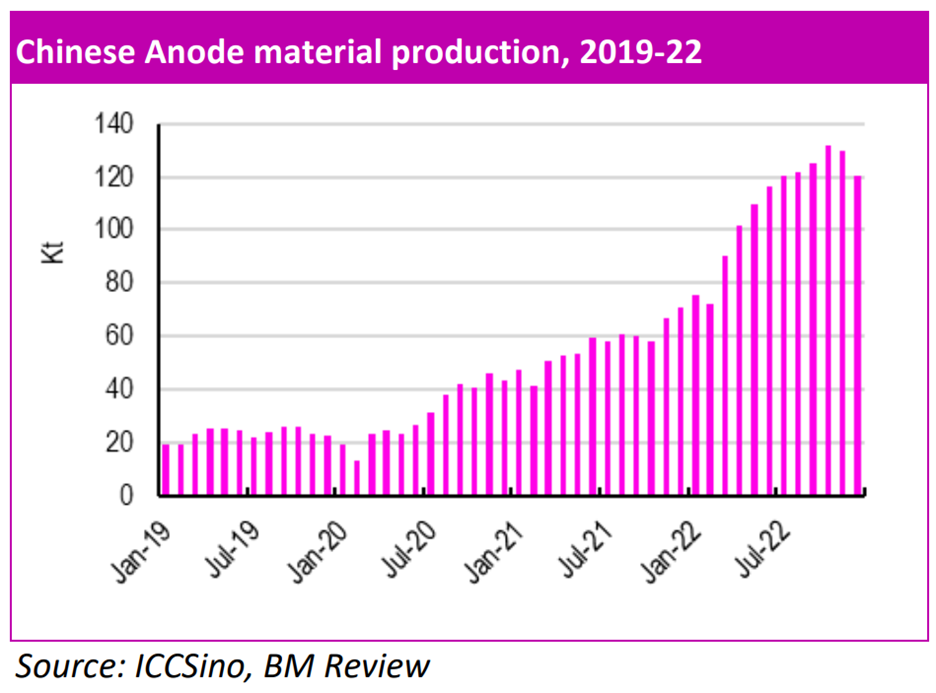

As mentioned, graphite has long been defined by oversupply issues - it is plentiful in nature and can be readily (if intensively) synthesised. But we are just on the threshold of massive demand for graphite coming online. Fir the first time ever, according to mining.com, the demand for battery anode graphite is expected to exceed supply this year.1 And graphite demand is going to hockey stick upward from here. There really is no real other way to describe it.

Some facts to support that claim: The Lithium Ion battery sector is expected to 4X in market cap between 2022 and 2030 according to Precedence Research. Meanwhile, the IEA states that production capacity for Li-Ion batteries is exploding2 – from 0.8 Mt/year in 2021 to a projected 13 Mt/year by 2025. And Benchmark Mineral Intelligence is projecting the graphite market to ~6.5X between 2022 and 2030. Point is, the demand for graphite is going to grow massively over the coming years.

Li-Ion batteries are already roughly half of graphite demand, according to BMI as – this is importantly changing the type of graphite being sought after (more on this later).

And to be clear - yes, battery technology is rapidly progressing in seemingly a thousand different angles. Yes this means some technologies will not require graphite. Yes this might technically shrink graphite’s share of the pie. Great. Because the green energy pie that we are baking is going to be massive. More of everything is going to be needed to meet projected demand.

So while warnings about a slumping sector were true in the very recent past, and we are still seeing sluggish pricing today, there are huge macro tail winds starting to blow in earnest that cannot be ignored.

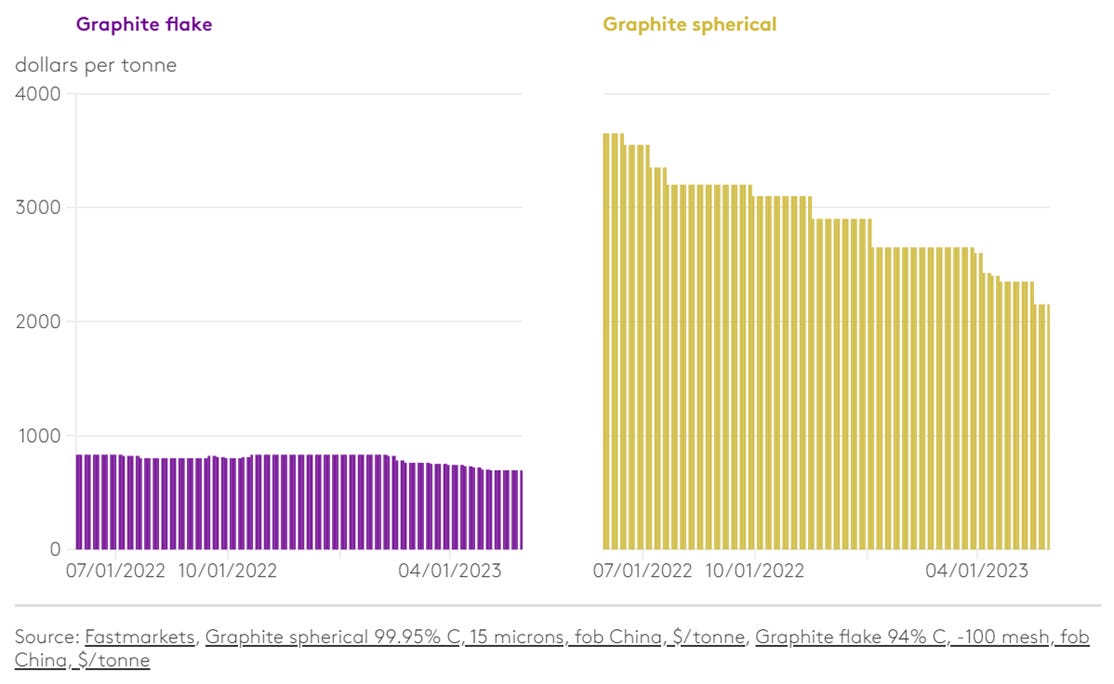

Interlude: Pricing Information Graphs

These two graphs do a good job capturing the current status of graphite pricing (note the elevated price of spherical vs. flake graphite, despite recent weakness):

Graphite: The Type Matters

Graphite comes in a range of sizes, shapes, and other compositional variables, and depending on those variables, the uses and value of the graphite can vary wildly. I will forego any further discussion of this in the interest of expediency, but flake sizes and mesh counts matter very much in graphite.

Luckily for iTech, they’ve got some of the good stuff at their Lacroma target they are currently pulling RC assays out of. It is small flake, sub-15 micron graphite. Most importantly, it is free of any deal-breaking impurities, and is amenable to the spheroidization process required to ready the graphite for use in Li-ion batteries.

Just as a quick aside: Synthetic graphite has been the standard for use in anodes for some time. Currently it is roughly 80/20 split between synthetic and natural anodes. However, natural graphite is projected to increase how much of the anode market it captures. There are a couple reasons:

For one, synthetic graphite is extremely energy intensive, requiring coking coal and 2500 degree Celsius temperatures to be produced. This is obviously a disadvantage to natural graphite that can be cheaply milled and refined. This disadvantage is made even more glaring by the increasing need for carbon neutral resources and supply chains.

The other reason this is changing is recent improvements to technology needed to “roll” natural graphite into consistent spheres rendering them suitable for use in anodes. 5 or 10 years ago, the consistency of spherical natural graphite was much less consistent than what it is now.

Graphite: The Cost Matters

Okay, so we’ve established graphite is going to be needed for the next generation of technology at least. So we know there is going to be lots of demand. The problem is that there is a huge number of potential sources of graphite.

Importantly, in-situ grade isn’t the core issue with graphite economics, but one of milling. There is a lot of graphite available to be exploited. It is the cheap deposits – cheap to mine, mill, and refine – that are going to be the winners. How easily and cheaply can your graphite be refined to the 94%+ purity that is required for Chinese upgraders? How easily can it be refined further to the 99.95% purity needed to be used as battery-grade spherical graphite? These are the questions worth asking of prospective graphite producers.

This is important because it means that the winners of the coming graphite demand race are going to be ones that are simplest , fastest, and cheapest to mine. At or near surface. Bog standard extraction method (no fancy – or toxic – milling or extraction processes needed). Clean and thus easy to purify. Accessible infrastructure. Near to demand. Easy permitting. Government support. All those factors that get put into the mix of figuring out “all-in, all-in” AISC are going to be especially important for graphite.

Graphite: The Market Matters

Understand that graphite is a little different. The global graphite market isn’t actually global in the way other metals are. There is no global spot price and it is much less unified and standardized, and more subject to regional supply/demand constraints and local contracts and offtake agreements. This of course makes it a challenge to readily gain understanding. Chinese upgraders are the majority of global demand presently and as such, their prices are the closest thing there is to a global spot price. Not only the type of graphite matters, but where your deposit is located helps to determine your economics and pricing presently. Having industry in need of your type of graphite within shipping distance matters. As part of your due diligence with would-be graphite producers is to identify regional production and consumption. Who is selling what to where, and for how much?

Graphite: Geopolitics Matter

For those of you who read or know my work, this is getting a little repetitive, but geopolitics plays a massive role in my secular commodity bull thesis. If you believe that “The West” will onshore its access to critical minerals as international relations increasingly cool, then procuring domestic/friendly sources of graphite near production is an absolute must. Because China has what can only be described as a chokehold on graphite presently.

Take a look at the graph below, but the IEA states that 70% of natural flake graphite in 2022 came from China, while spherical graphite - key to EV batteries - is almost entirely manufactured in China. If resource nationalism and the regionalisation of supply chains and continues to grow alongside rapidly accelerating green energy demands, there is a massive, looming supply crunch in the west, among the worst of all critical minerals. Graphite is a critical mineral and the West does not have anywhere near the supply to meet their own demand. And for investors, that is the definition of opportunity.

Conclusion:

So there you have it folks. I hope you found this informative. There is of course so much more to it - I really just scratched the surface - but I hope this helps aid your understanding of a resource that can be a bit of a challenge. There are pitfalls in this sector. There will be losers, but there will also be winners. Knowing how to ID inefficiencies in lesser-understood markets (like graphite) can be an extremely lucrative skill, as it lets you get there first. And there will be big winners in graphite in the coming years. Know how to recognize them.

Sources for you to check out:

1. A strong, though now somewhat dated intro to graphite by Ben Kramer-Miller:

https://seekingalpha.com/article/3911106-why-invest-in-graphite

IEA’s 2023 Energy Technology Perspectives:

https://www.iea.org/reports/energy-technology-perspectives-2023

IEA’s 2023 Critical Minerals Market Review

https://www.iea.org/reports/critical-minerals-market-review-2023

Battery Metals Review

https://www.batterymaterialsreview.com/

This one kept ballooning on me. I was hoping for a nice, easily readable, 600 word primer, but it just kept growing and growing. Even here I feel I abbreviated critical information! Please share any additional info or knowledge you think is important.