Thesis Gold's New Global MRE: 4.7M+ AuEq Oz and Just Getting Started

CEO Ewan Webster joined me again to discuss Thesis Gold's newly-released MRE and why the best is yet to come for Thesis.

tl;dr:

CEO Ewan Webster of Thesis Gold discusses his company’s newly-released global MRE as it continues to tie together its formerly separate Ranch and Lawyers projects. Ewan discusses the successes and challenges of the MRE and highlights significant details that help make it such a powerful project that might be lost on a casual read through. Below is my classic “companion article and written summary” content for the video interview you can find below.

Tickers Mentioned: TAU.V

Index

Part 1: The Interview

Part 2: The Companion Article

Part 3: Time-Stamped Summary and Transcript

Conclusion

Part 1: The Interview

Part 2: The Companion Article

The nice thing about sustained bear markets is you don’t have to scrape through the back catalogue, “B-side”, resource companies to find good deals. Rather, you can find large, growing, high-grade deposits in strong jurisdictions and led by smart teams trading for pennies on the proverbial dollar for anyone patient enough to buy and hold for the inevitable better days ahead.

Enter Thesis Gold.

I won’t spend too much more time introducing them, as I have written about them plenty before now, but to me they are an obvious pick - lots of upside, (both valuation and exploration), reduced risk, and a clear path to M&A action.

Rather, this is meant to discuss their fresh-off-the-press MRE that was released this morning (May 1, 2024). This MRE is a critical step in finally, properly uniting the Ranch and Lawyers projects that were brought under the same roof during the merger with Benchmark Metals last fall. Advanced met testing and a renewed PEA (due in the coming months) will finalise that marriage.

Read on below to see my core takeaways from the news release.

The Highlights:

4 million ounces, almost entirely M+I from Lawyers

700,000+ Oz coming from Ranch

Rather, the purpose of this update is to explore Thesis Gold’s new, global, MRE they just released this morning (May 1, 2024).

4.7 Million AuEq Ounces (4 million M+I)

1.51 gpt grade in the M+I

Including inferred, 94+ million tonnes (82Mt without)

Silver makes up 25% of the resource (84M Oz AG M+I and 8.3M Oz Inf.)

90%+ recovery across the board

Even silver is up to 88% thanks to the simple addition of a flotation circuit to the flow sheet.

The Ranch project consists of high quality ounces - cut-off grade increasing from 0.4 gpt all the way to 1.5 gpt cuts the tonnage in half, increases grade by 50% (~2.1 gpt to 3.2 gpt) and only reduces total ounces from 642,000 to 491,000.

This gives Thesis lots of optionality in terms of having high-grade start pits to front load ounces and economics. (See graph below for more detail.)

Even a property-wide bump to a 1.5 gpt cut-off still sees 2.7M total ounces grading at about 3.5 gpt. Point being, they’ve got lots of high-grade material throughout the property. This is not a 0.5 gpt project that will live and die by spot price.

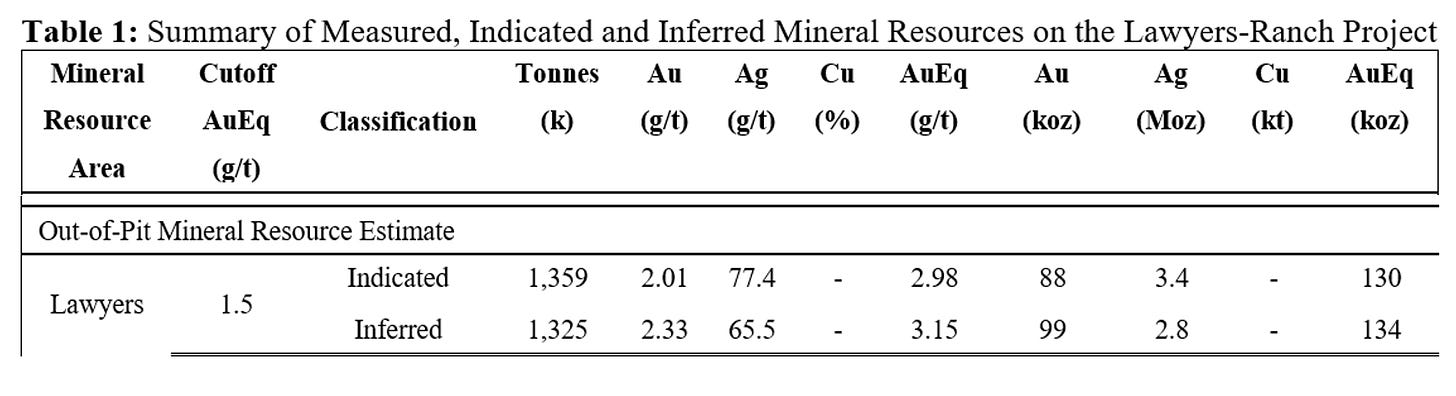

Their UG starter mine plan at Lawyers looks like it is good to go - they added 264,000 ounces beneath the current pit at Lawyers. However, this assumes the pit will go 400m down, which it almost certainly won’t. Pit optimization studies will assuredly be adding ounces to the UG mine plan - confirming again that Thesis has access to multiple high-grade starter zones to really juice the baseline economics. See the graph below for details.

So as a brief recap: They've got the grade needed up front to make the bank happy and the tonnage to make the mill happy for all the many years after - not a bad combination. Throw in what looks to be a fairly simple flow sheet with high recoveries, the optionality that a healthy silver kicker provides, and the oodles of exploration left to be had at Ranch and maybe you can start to understand why I like Thesis so much.

And yet, part of me is worried the market might throw a bit of a fit, something it does very effectively and with almost no excuse these days in this sector. Why? I fear this because I get the sense the market was hoping for that nice, round, number of 5 million ounces and despite all the obvious strengths of this release, not hitting that magic (arbitrary) number could see a minor sell-off occur.

All I will say to this point is that if my fears are correct that I will be buying into it. Thesis has the goods and will just keep getting bigger and bigger, because they aren’t done drilling Ranch - not by a long shot (and look for a drill campaign news release in the coming weeks as well!). Missing an arbitrary target by ~5% on a project of this scale is meaningless. Much more important is the execution of their vision that Thesis continues to demonstrate.

If it isn’t obvious by now, Thesis remains one of my favourites. From my view, this has all the makings of a future mine and is a classic M&A candidate - right jurisdiction, right area, right size, right grade, right stage of development. And this new MRE is definitively another step in the right direction.

Part 3: Time-Stamped Summary and Transcript

Timestamps are links to the respective section of the interview.

00:17 Introduction

Thesis Gold released an updated MRE with approximately 4.7 million ounces of high-grade gold and silver, including 4 million oz of M+I, which are valued at about $30 per ounce. The MRE includes a 75-25 split between gold and silver, which opens the door for non-dilutive streaming/royalty financing and there is high-grade optionality in the project.

02:37 Market Expectations

The market might be expecting 5 million ounces. The slight discrepancy was not the result of any failures or barren regions – Ranch is complex geologically and simply requires more drilling to get ounces upgraded.

05:00 Drilling at Ranch

Ewan Webster highlights the potential for expansion at various zones within the Ranch project, noting the mineralization is open at depth. The discussion also covers drilling metrics, with 70,000 meters completed across the project, focusing on connecting key zones and expanding the resource.

07:23 Drilling at Lawyers

Ewan Webster details the drilling efforts at Lawyers project, where 24,000 meters of deep drilling added half a million ounces to the M&I category. The high continuity of mineralization at Lawyers makes it a robust and predictable system.

09:39 High-Grade Optionality at Ranch

Discussion on the strategic approach to the starter pit at Ranch, which is planned with high-grade ounces at surface to enhance early economic returns in the forthcoming PEA

12:03 UG Ounces at Lawyers

Ewan outlines the drilling strategy to increase underground ounces in the resource calculation, aiming to optimize the pit designs and economic outcomes.

14:24 Balancing Development and Discovery

Further discussion on balancing advanced project stages with exploration to maximize resource potential. The conversation touches on how Thesis Gold intends to incorporate new zones into economic studies while continuing exploration. Ewan Webster explains how the current MRE forms a solid foundation for future economic assessments, with a focus on minimizing capital requirements and maximizing confidence in the resource.

20:37 Ranch Geological Challenges

Challenges in linking different zones within the Ranch project due to drilling density and geological structures are discussed, alongside the success and potential for expansion.

22:59 Met Work Update

Webster mentions upcoming metallurgical work expected to improve silver recovery rates significantly, impacting the economics of the project positively.

25:21 Near Future for Thesis

The interview wraps up with Webster reiterating the robustness of the M&I category ounces and the significant potential for growth, setting a positive tone for the upcoming PEA.

Conclusion

This is a very good company. I get the sense that maybe the market was confused by the merger when it was first announced. But to me it had a lot of obvious synergies, most simply and powerfully the sheer potential size and scale of the projects. Why have two 4 million ounce projects when you can have one 8 million ounce project (obviously Ranch isn’t there yet, but if you speak to anyone connected to the Thesis they believe the potential of Ranch rivals that of Lawyers)? To me, it always made sense as it instantly turned Thesis into a prime takeout candidate.

The hard work continues to happen to turn the two projects into one technically (and not just in the board room). And now that the MRE is complete, the PEA demonstrating all the economic potential up there in the Toodoggone won’t be far behind. I rather suspect that 2024 is the year the market begins to understand just what Thesis is building, and just how much potential it has.

Thanks for reading.

-Matthew from JRI