The Elements of Success: Intro to Cassiar Gold & Why it (Still) Has What it Takes to Succeed.

CEO Marco Roque joins me to discuss why Cassiar Gold is still on track to deliver on discovering - and selling - a major gold discovery in northern BC.

tl;dr:

I have on Cassiar Gold Corp for the first time. If you’ve been active in this space the past few years, there’s a good chance you have come across this one. They burst onto the scene with new management and a new land package just in time for the mini-bull run from 3 or so years ago. However, like many in the junior explorer sector, good work has fallen on deaf ears the past few years. CEO Marco Roque joins me to discuss Cassiar and why it remains on track to successfully discover, expand, and sell a major resource. With a new MRE due out by end of Q1 2025, the time is right for taking a serious look at Cassiar Gold.

Foreword; Part 1: The Interview; Part 2: The Companion Article; Part 3: The Written Summary; Final Thoughts

GLDC.V

Part 1: The Interview

Part 2: The Companion Article

Foreward - Writer’s Note

Cassiar’s story has prompted me to go “back to basics” with it. They came out of the gates hot a couple years back - star team, ambitious project, lots of positives that help with economic viability, and what looked like a pretty reasonable pathway to an impressive resource. But despite a pretty good amount of drilling and drill success since then, the share price has languished.

So I wanted to comb through the story fairly well to try to better understand why the company hasn’t been rewarded by the market. Was it simply because the past few years were extraordinarily tough for the sector (though there have been success stories), or was there something else that had gone wrong?

My write-up for Cassiar slowly turned more and more into commentary on the company at a general scale as I went through my investing checklist, fairly comprehensively sifting through Cassiar and its past, looking for the fly in the ointment. So much so that it prompted me to finish building my now-fairly fleshed-out “investing checklist and commentary” I had been working on for some time.

Because of this little side quest it set me up on, I ended up treating this update sort of as a mini-preview of a larger project I have in mind detailing my to-do list in all its gory detail.

So this update focuses less on more short-term conversations (like drilling - Cassiar is currently awaiting results from their recent campaign, cash on hand - Cassiar has $7 million+ in the treasury with a currently-open financing, or upcoming catalysts - drill results and a Q1 MRE.) and more on a macro analysis of “Cassiar the people, company, and project”.

But to cut to the chase - I think this is a good story that has taken a little longer to develop than the market was hoping for and has since been (unfairly) beat down making it awfully compelling as an asymmetrical risk:reward pick.

The Companion Article

If you’ve been around this space for a few years, you’re likely no stranger to Cassiar Gold. With a strong leadership team, mining permits in hand for significant swaths of their property in northern BC, a permitted mill, and a very large system to explore, they were darlings of the market during the last mini bull-run of 2021/22, peaking at a market cap of nearly CAD $100 million and share price of some $1.44. Since then, their fortunes have waned along with the market at large, settling back down to $30m market cap and 20-25 cents share price.

However, despite its sharing in the struggles of the junior market at large, the project itself continues to progress, albeit a bit more slowly than CEO Marco Roque and his team had hoped for due precisely to those same dismal market conditions.

Being involved in a brutal downswing such as what we’re still struggling throughout this sector can be hellish to deal with. It makes you question your knowledge, your decision-making, your investment picks. Deciphering between if the stock is the problem or simply a victim of macro market conditions beyond their control in these situations is critical.

To do so - to critically assess your companies and decision making - means a return to your first principles. You need to dissect your initial investment thesis into its disparate parts and ask yourself hard questions about them. Are you evaluating using the correct criteria? Are there biases in how you weight those criteria? Can you justify those biases and weighting?

And this also means taking great care to note any deviations (positive, yes, but especially negative) from that thesis the company has underwent.

Now, my investment checklist at this point is quite large and detailed - sort of a fractal project, where each detail just contains within it more details. But by and large, I would say my core, simplified, checklist is as follows:

My Deeply-Abridged Investing Checklist

1. Management

Have they done “it” before? (Whether “it” be successful discoveries, development and permitting processing, construction decision and production,

or on the flipside is their past more checkered?

Are they aligned with shareholders with investment and with their governance?

2. Infrastructure

What existing infrastructure (highways, electricity, workforce etc.) is already in place and how much is it going to cost to tie into it?

In terms of mining-specific infrastructure (mills, crushers, etc.), what exists, what doesn’t, and what would it cost to get (back) to production?

Permits. Though these could fit under jurisdiction as well. Regardless, what permits are in hand and required? What is the average permitting timeline for the jurisdiction in question, and how transparent/opaque is the process?

3. Jurisdiction and Location

Government support? Taxation and Royalty regime? Past actions?

What about community support?

Do communities have a history of mining?

Opposition?

Location-wise, how close is it to protected areas and watersheds?

Is it fly-in, fly-out (FIFO) or easily road accessible?

4. Prospectivity and The Rocks

What’s the size of the prize?

What data do they have to support their beliefs?

Metallurgy

How complex is the process? (Simple flowsheet or full of autoclaves and other expensive bits.)

What recovery rates do they achieve?

5. Cost

How much is it going to cost to test that prize?

How much does it look like it might cost to produce?

Applying the Checklist to Cassiar

So, returning to Cassiar, how do they measure up? Well, let’s take a quick look, using the metrics displayed above. Note that this will be a quick run-through of a much more involved process.

1. Management

The team and board here is full of impressive resumes. Chairman Stephen Letwin in particular has an exceptional record, but the rest of the board and team have excellent records as well. Extensive banking and market experience. Key positions in well-known, successful exploration cos. And of course the actual technical ability and experience needed to power this machine. Cassiar has an envious corporate roster-one that exceeds what you would consider is typical for a junior explorer.

This is one I don’t think I need to work too hard to prove. Just read the blurbs from the corporate slide deck below. They have many millions of dollars and ounces to their names collectively.

As for shareholder alignment - I would say they are generally positive. There was one recent-ish insider sell of $45,000 but there has also been consistent buying by other insiders well in excess of that amount. And to their credit insiders do participate in company financings very healthily.

An average RSU/DSU package has been announced new this year, with half vesting at 12 months and half vesting at 24. It remains to be seen how those end up treated, but there is generally good support and buy in from the company to make you confident.

There’s more that could be said here, but we will move onto the next topic for the time being.

2. Infrastructure

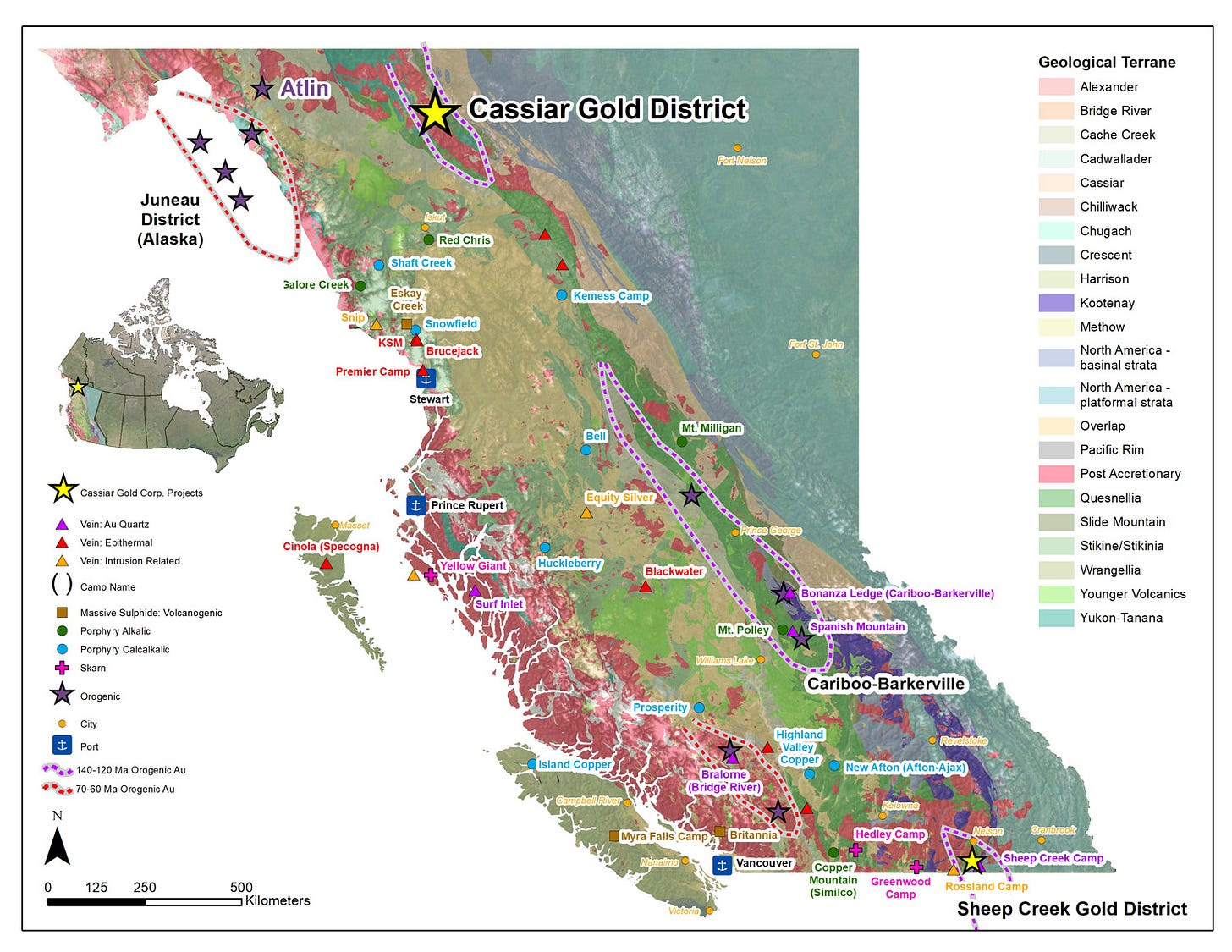

This is another one where Cassiar shines in a pretty obvious way. The Cassiar Gold District - which is amalgamated for the first time with this company - is home to an extensive history of mining and exploration into the recent past. Cassiar benefits from this in a variety of ways.

Underground workings, a (tiny - 300 tpd) mill on care & maintenance, electrical grid, road, even mining permits for much of the property, all with paved highway cutting the property in half. All the possible benefits of working in a brownfield scenario are present here - saving considerable amounts of time and money.

Now, the mill is too small to be of interest to majors, and would need an injection of capital to get up and running again. So the mill isn’t Plan A (that’s “sell to a large gold producer”). But it is a pretty decent Plan B, and, possibly more importantly, provides optionality and therefore strength in potential negotiations.

Again, there’s a lot more breadth and depth to get into this, but I also mark this up as a very visible and easy win for Cassiar. See the graphic below.

Now part of what I like especially about all this brownfield bonus is also where all this is taking place.

3. Jurisdiction and Location

Again, this is a clear and obvious (and significant) advantage for Cassiar. BC remains a world-class mining jurisdiction. And Cassiar is located in an area with clear (historical and contemporary) connections to mining.

Skilled trades are abundant.

Local First Nations show support for (responsible) mining practices.

Business, industry, commerce are all heavily built around supporting the industry as a primary driver of the local economy.

Far enough away from major urban centers or nature reserves or similar sensitive areas to avoid undue controversy…

But still close enough to infrastructure to keep costs down across the mining cycle. A bit of a “Goldilocks Zone” in my eyes, in terms of location.

These brownfield advantages are, of course, huge for economic viability. But you still need to have potential in the rocks and that is where brownfield projects can find their limit. It doesn’t matter how many advantages a region has if there’s no gold left to discover. So the prospectivity and exploration thesis strikes me as key to Cassiar’s story.

4. Prospectivity and the Rocks

Marco calls his shot on this one. He believes Cassiar has the potential to reach 5m+ Au Oz and become an attractive takeover target for mid-tiers or even majors. And - given enough meterage - I am inclined to agree. The whole Cassiar concession (North and South) seems to be littered with bulk tonnage targets that with a little luck and enough drilling could eventually be proven to be continuous. Which would make this project massive.

Cassiar has made some positive progress on this front - they increased their resource to nearly 1.4m oz in their last resource update (though much of that was actually gained by lowering the cut-off grade). And note that the resource is pit-constrained. They have since resisted releasing an updated resource or PEA for a couple years now. Presumably, they are holding off on a PEA till they’ve managed to tie larger sections of their land package together into discrete potential pits to help with constrained resource calcs.

As for an updated resource. Some thoughts:

Marco referenced that inclusive of this season’s 7,000 meters that there are some 47,000 meters of drilling not currently included in a resource. With the current resource built on 57,000 meters of drilling, you can start to infer a little about the size of the future resource update. And on that note, Marco said they are planning for a new MRE to be announced late Q1 of 2025.

Per the Q1 MRE release: I believe getting another data point out to the market on this front is critical. It allows for decently-evidence-based extrapolation on converting meterage to inferred ounces. It allows investors to track growth and make semi-informed predictions about how much work is left to get to the magical 5 million+ ounce mark. It lets investors cast about for peer comparisons and gain a sense of what the economics might roughly look like.

I get the sense Cassiar needs some fresh blood and a bit of a shake about the shoulders, market-speaking. From what I can tell, this remains a good story. A positive resource estimate - even if it is still just a milestone on the way to a larger destination - could be very beneficial from this perspective of waking the market back up to it.

5. Cost

Another big advantage here - due to the extensive jurisdictional and infrastructural advantages, drilling is quite cheap. CEO Roque quotes it at CAD $211, plus G&A (which is about $1.5-$2.0 million/year based on the last couple years - see MD&A excerpt below). So on a 10,000 meter campaign, that adds $150-$200/meter. Now, $/meter (and AISC, for that matter) can vary so much in what’s included in it can be difficult to do fair comparisons, so credit to Marco for being clear.

So, $400ish a meter (assuming a 10,000 m campaign - the ~20,000m campaigns Cassiar has run in previous years reduces this number to $300ish) is about as good as you’re going to see in Cassiar’s corner of the world. That’s pretty darn good.

The downside, such as it is, is that while the “per meter” cost is low, the macro project cost is going to be rather high. These huge, bulk tonnage systems are greedy things. They’re big. Which is a good thing. But it also means that they demand a lot of meterage to get sussed out enough to get to a resource.

Conclusion

My sense is this need for meterage has become a bit of a stumbling block for Cassiar, where poor market conditions have prevented Cassiar from feeding its project the meters necessary to achieve the critical mass needed to overcome those same miserable market conditions.

Bulk tonnage projects can be supremely successful mining operations, but they seldom produce the exploration results needed to grab the market by the lapels and force it to pay attention with a single news release. (And yes, Cassiar has higher-grade potential, but the bones of the project for the time being remain bulk tonnage tonnes.)

Marco alludes to this in our interview, stating that they’ve had to throttle back their drilling a bit due to market conditions. And so you get in this scenario where Cassiar can be aggressively drilling (in context of its market cap) and having exploration success, but because it is a slower go than initially anticipated by a hot market, with still a lot of meters needed left, you get the current situation Cassiar finds itself in.

To be clear here - it can hardly be said that Cassiar hasn’t been active - they’ve had large - 10,000m, 20,000m, or more - drill campaigns every year. It’s just that they haven’t been able to hit this as hard as maybe the market had expected them to. Stretching timelines also stretches investor patience.

My Take

Ultimately, then, with all the above in mind? My take is that the story here largely remains intact. Management is a strength. They don’t seem to be overindulging themselves in the float. There’s active management participation in financings.

Jurisdiction and location are clear and obvious advantages.

And I don’t see any death knell in the exploration results to date that would explain the flagging share price. Maybe no massive, unexpected surprises that can redefine a company (looking at you, Hercules). But, importantly, they keep finding what they expect to find - that is long, low-grade swaths of mineralisation close to surface interspersed by moderately high-grade veining. And finding what you expect to find is generally a very good thing in this industry.

And Cassiar certainly does have a strong understanding of their mineralised system (Marco made a point to emphasise their very strong hit rate, and he is right to). Which means that as they continue to expand the footprint of their drilling across their large land package, odds are good they will continue hit mineralisation where they expect to. Which helps us get a bit of a peek into the future regarding future drill targets.

It is just taking a little bit longer than the market expected it to, causing the negative feedback loop mentioned above. Which sucks for current investors.

But these past issues don’t define the potential of Cassiar. Cassiar is by no means in dire straits, but in reality have considerable strength. They remain fully cashed up. They have excellent geological understanding. They have a huge amount of targets. They have upcoming catalysts that I believe could spark some much-needed love. And, importantly, they have an improving macro backdrop to work within.

When it comes to assessing investment opportunities, that sounds pretty darned good, doesn’t it?

See my Final Thoughts section below my summary for the end.

Part 3: The Written Summary

1:00 Elevator Pitch – The People

A team that has discovered, developed, built mines all over the world.

Steve Robertson-instrumental in the development of the Red Chris more.

Steve Letwin is chair. Was president and CEO of IAM GOLD for 10 years

James Maxwell- VPX for First Mining, former director Exploration for Sabina

Others with lots of knowledge, like Chris Stewart, Jill Maxwell

4:30 Elevator Pitch – Infrastructure

past-producing district

fully-permitted 300 tpd mill

25km of underground workings

powerlines right up to portals.

160km of roads

40 person camp

would cost 100s of million

2 mining permits in place-Taurus and Table Mountain

Remote-but-accessible

08:10 Met Work

Historical production at various zones gives us a lot of confidence.

Recovery rates of 84% or more.

10:20 Exploration Potential and Current Drill Campaign

Goal is to continue to expand mineralisation in all directions

99% hit rate in their exploration

The goal isn't to upgrade the resource but expand inferred.

Lots of current drilling looks almost like infill but is actually serving to connect disconnected resources together

They don't have zero grade but have to be treated us such till being drilled.

47,000m now drilled since their last resource

Half of the 47,000 M is in the immediate area around Taurus.

The historic resource was built on 56,000m

14:00 Cost of Drilling All-In and G&A: Exploration Ratio

Cost per meter is $211/meter CAD (in addition to G&A)

Q&A to expenditure ratio is typically about 4-5:1

G&A is fairly fixed, so in years of more aggressive exploration it can be 8:1

16:00 When can we expect a new MRE and explain your strategy going for inferred vs upgrading ounces (would you get more market love from M+I?)

All drill results will be out likely by January

Hoping for resource update by late Q1

Typically yes you will see higher valuations for M+I vs. inferred.

However the market isn’t valuing any resource fairly at the moment, save for a few.

Cassiar’s vision remains to get to 5m+ ounces.

Our project has a potentially massive footprint – 15km trend and about 10km wide.

Majors want size like this and have cash and declining reserves

Want to continue expanding size rather than developing a couple million ounces

20:00 Why did the previous operator move on?

Previous operator Hawthorne Gold invested $36 million into this project.

They were the ones that amalgamated the district.

Their mistake was trying to rush it into production.

They ran out of cash as the gold price started breaking down.

They were a smart team but not as much experience in Canada and regulatory hurdles, permitting, etc. also tripped them up a bit.

They remain shareholders and believers in this project.

23:30 How do you effectively explore such a large land package

You tackle this size of a project systematically and prioritize targets appropriately.

As long as you have the right process and you know what you're doing you will be okay.

However, you have to go at reasonable speeds (given existing market conditions)

problem.

Would love to have 50,000 or 100,000 meter programs but this isn’t that market.

So they have to be strategic in where they target in hoping to move the needle.

They continue to do the work that majors want to see.

26:45 Rationale behind no PEA yet

No PEA yet – they want to focus on getting the resource more complete.

Would cause unnecessary expenses/dilution

They can be useful for marketing purposes but they also pigeon-hole you.

Majors will want to do their own tradeoffs and optimisation work anyway.

There’s no specific number of ounces that would trigger the decision for a PEA>

32:45 Is there anything you would do differently in hindsight over the past few years?

Looking back, Marco believes they made the best decisions they could have.

Not a reasonable answer, but in hindsight, raising more money at higher prices is one thing.

Surprised by length and extent of bear market.

Don’t have any regrets in terms of decision-making.

Confident this is the project and team that will come good.

38:00 Has your strategy shifted away from the mill?

Don’t think the message has changed.

The mill option is still there, and it is good to have optionality.

Some are more interested in the mill, some less.

For banks and brokers, though, the mill doesn’t move the needle – they want far more annual production than a 300tpd mill can provide.

But it is part of their story and part of why it is compelling.

We will continue to advance it conservatively.

Want to go faster but they also won’t risk too much dilution or the project itself.

Believes they are operating in a way any prospective takeover partner would want them to – keep expanding the mineralisation.

42:30 Final Thoughts

They have the social licence needed to operate.

$7 million in the bank at a $30m market cap.

Next time, would like to discuss exploration and the land package more.

Final Thoughts

In the end, this is a good company with a good project at tough valuations. Lack of share price appreciation due to brutal macro conditions, despite aggressive drilling and apparent success, has lead to some investor burnout (at least that’s my take).

But, frustrating though I am sure it is for investors and insiders alike, that doesn’t reflect on the potential of this project. Because I come out of this believing in the company’s vision of 5 million+ ounces. Just that it is going to take a little longer than a hyped up market thought it would to get there.

If you read my work, you know a core aspect I ask of companies is their risk:reward ratio. Namely, how much risk and how much reward is baked into the current valuation? With Cassiar, as is generally the case with companies I end up liking quite a bit, downside risk seems to have already been significantly baked into this share price. If Cassiar continues to hit and expand its resource, and confidence is very high it will, there can be almost nowhere to go but up.

And, in my eyes, that makes Cassiar a very compelling pick.

Thanks for reading.

-Matthew from JRI

Where can I read about Equity Metals?