PDAC 2024 Trip Report: "The Audacity of Hope"

On the road trying to get this edited and released. Read below to see my thoughts on my trip, as well as some company picks that emerged from my time there.

tl;dr:

Two main parts (though split into 5 to help you navigate) to this one: The first general half will provide a brief trip report of traveling to PDAC 2024 March 3-6, while the second half is a brief rundown of the companies that caught my eye while there.

ASND.TO; COSA.V; EQTY.V; INCA.V; KDK.V; MAE.V; MUR.V; SASK.CN; SPOT.V; 92E.AX

Introduction to the Trip Report

Sections

1. My Thoughts - Quick Hits

2. VRIFY AI Launch

3. The Core Shack

4. Companies That Caught My Eye

5. Parting Thoughts

My second official PDAC is in the books. Definitely bigger crowds and a different general atmosphere marked this one. Overall the sense was a cautious, almost hesitant optimism. Gold staircased up seemingly every day into all-time highs, and the conference floor was abuzz with it, but people also seemed a little withdrawn, still waiting for equities to see the love as well. Read on below to get a sense of what I saw and heard during my time there.

It seemed quite a bit busier. Announced attendance was 26,926. That is 13% more than last year’s 23,819.

I noticed the bookend shifts were busier this year. Mind you, the blizzard delayed things last year but on the final day last year I saw empty booths and people packing up early. Not so much this year when there was foot traffic right up to the end.

There are sightings and conversations and chance connections you can only have if you’re down in the thick of it. Yes the VIP rooms and bars are where a lot of the quiet talks happen, but kismet and the happy circumstances of chance always present opportunities if you make yourself available.

Gold approaching all-time highs, the start of a baby silver run, and nickel’s hardships and controversies were common topics.

Sitting in cafe areas is a great way to watch and listen. And meet new faces as well.

Stopping by nation pavilions/booths especially can be a good way to gather intel if you have specific questions about jurisdiction or flagship projects.

REEs were noticeably absent, Lithium also less visible than last year. More Uranium companies.

They had a newsletter writer free stage down on the floor this year. Fairly intro level content (though to be fair what do you do with 20ish minutes), but some big name speakers and well-attended.

There is a direct correlation between “old kook” and “I can tell you how much money I have in pounds and kilos”.

On the other side of that - just because they wear a fancy suit doesn’t mean they know what they’re talking about.

There were a couple chronic no shows at their booths, which is a bad look.

The after parties can be an absolute meat market of schmoozing and tickets are in demand. Ask someone you know in the industry for an in if you don’t have one, or contact companies you know sponsoring specific events. Or just lurk around the Fairmont.

Again, can’t stress the value of face time with the companies enough. Easy, quick exchange of information.

On Monday, day 2, VRIFY launched their new AI data modelling system in a fairly large to-do on the outer corner of the L-shaped floor plan. Kodiak Copper (KDK.V) is a company I like and cover, so knowing they were one of the 4 original companies selected to work with VRIFY’s new technology, I had made my way over to see the goings on. From there I got pulled up into the launch “party” (thanks Nancy!) and had a nice chat with Claudia Tornquist, Chris Taylor, Nancy Curry, and Dave Skelton of Kodiak, along with JP Paiement from VRIFY. It was obviously a very interesting conversation.

I do admit to being pretty skeptical of a lot of “AI” applications as it’s pretty clearly an opportunity for low-quality pumpers to ride the next big hype train for a while while offering little real value.

But Claudia and Chris (and Kodiak) have always struck me as having an intelligent, data-driven approach, and, well, AI is a hype train because the potential of it is actually revolutionary. So JP, Claudia, and Chris took turns explaining what they found interesting about the core ideas that went into creating and using the tech and its considerable potential.

This is an application I actually believe modern AI potential is ideally-suited for. Resource exploration produces absolute mountains of data. Your job as the resource explore co. is to pick a path through those mountains of data that leads to a working model that can identify the discoveries your land package has hidden in it waiting for you. That process - iterative and reiterative, laborious, time consuming, complex and multifacted - can obviously be daunting at times, even for a team of experts.

So, having terabytes of analytical working potential does seem awfully appealing. Think about how much more responsive and efficient exploration could be if all that essential downtime work was effectively zeroed from 2 months to 2 hours as Chris described it in our conversation. What does that do for an exploration campaign’s effectiveness and efficiency?

So in reality, the strength of VRIFY’s AI is the strength of modern computing to brute force its way through raw information in rapid time - collecting, collating, and analysing at a rate difficult to approach through even coordinated human effort, and then synthesis the sum of that effort into interpretation and analysis according to set parameters.

And of course - if you’ve programmed it correctly - it can also help account for human bias. Rather than run the risk of even experts having blind spots, you assess all possible data points and origins objectively.

Applying AI analytics across a universal, project-level scale, with the potential to implement data from peer deposits, and growing its analytical potential with each new above and below ground data point seems pretty compelling. AI here has the potential to be cheaper, faster, better, and complement other human efforts. And fortunately, we will find out the effectiveness of its first round of targets in relatively short order. Kodiak already has targets developed from this they plan on drilling this year as they explained to Matt Gordon and Crux.

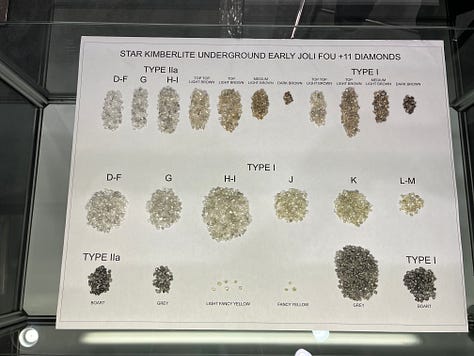

The core brought to these conferences has improved my geological understanding - where else do you have experts on hand to walk you through their core at whatever level of understanding you’re at? Geos love to talk rock. They can tell you what success looks like to them live and in person in a way you can’t anywhere else.

I tried to get a range of rocks below, but here’s some that stuck out to me during my travels. Notes below.

Of course, there are all the invisible industries that lead to those core boxes of glory waiting for you to go check them out in the other wing of the conference. All sorts of tech solutions and immense amounts of knowledge are waiting if you take the time to go speak to people and get to know their product. I admittedly didn’t spend as much time in this one as I have in prior conferences - meetings kept me a bit busier this year than last. But I still did a decent once over. Trade Show North is of course quieter, but the southern convention hall was crawling with people in every aisle.

While I showed up having a few already identified, I also enjoy sniffing out stories in real time on the floor of the conference. Below are the companies that caught my eye this time around. None are clients, and I haven’t completed my due diligence for any of them, but I own a couple already and would love to buy more. I will try to present their bull cases and ID any clear weaknesses I have already uncovered.

1. Atha Energy (SASK.V)

Big Resource - nearly 60 million lbs of U3O8

Huge Cash Position vs. MC ($64m cash vs. $167m mc)

One major merger (Latitude Uranium) completed recently, and another (92 Energy) due to be completed in the coming weeks.

Massive Land Package

Exposure to multiple U3O8 camps.

Projects at multiple stages from discovery to advanced development.

Arbitrage opportunity right now due to share-based offer at a set ratio if you have access to K92.

Atha Energy’s bull case seems pretty straight forward to me. What can you do with $65m? That’s a lot of kicks at the can in some prime U3O8 real estate. I get the sense the recently-completed merger is causing downward pressure and it could bounce back once complete. There’s arbitrage opportunities for people with access to ASX stocks currently. I also think Uranium will likely stay elevated, keeping interest in U juniors growing.

2. Ascendant Resources (ASND.TO)

Alright, Ascendant Resources… these guys are a polymetallic zinc developer with a feasibility study out for their Lagoa Salgada project in southern Portugal.

Brief thoughts:

80% owners of their project.

Post-Tax NPV8 of US$147M vs. US$164m in initial capex (not great for that ratio, admittedly)

~US$9m market cap (Which certainly makes for a better ratio: An economic project with a FS out trading at 6% of NPV.)

Average annual EBITDA of US$75.5M over first 5 years.

IRR of 39%.

14 year LoM but lots of room to expand current resource, which would obviously aid in economics

Only a couple years from production if they remain on schedule.

It has been named a project of national importance by Portugal (this is big to me)

AISC of $0.71 ZnEq

In an area that won’t have significant permitting challenges.

Cash position is awful - down to likely nothing ($181,000 as of Sept. 30). Likely the most immediate risk.

However, there are non-dilutive financing options available due to their being an advanced project. Debt financing? A stream? (I like polymet deposits for that especially - you can stream off a non-important metal and not ruin the economics or investor interest).

On that note: They are formally developing financing avenues for 70% of pre-production cost through UKs Export Credit Agency. (Their CEO Mark Brennan makes great use of these.)

This is one I am adding to my shortlist. Portugal wants it. Close to construction/production. Zinc is looking good. I will likely wait till positive movement with financing before buying in.

3. Cosa Resources (COSA.V)

Cosa Resources is another Uranium company. This one came to me from two smart people in the industry independent of the other. Definitely made me take notice. They’ve got the team, they’ve got the land, and they’ve got the cash.

Cash: C$8.1M (March, 2024)

Fully Diluted: 72.6M. So some warrant overhang but still in good shape.

Basically the team that built IsoEnergy into a $700m mc company has got the band back together again and Keith Bodnarchuk (formerly CorpDev with Iso) is taking a crack at leading the team as CEO. Also experience with Denison Mines (so this team knows winners).

CEO and Chairman hold ~4% of the company each and buy on the open market.

Uranium is attracting hype, but this is a serious company with serious plans. A good choice in such a setting.

3000m drill program in Saskatchewan’s Athabasca basin is ongoing.

Ultimately this one is a pretty simple proposition - this team has done it before in the same region. Now, they’re cashed up, have a pretty tight float, and have started drilling in a bid to do it all again. So they know what to do and want another kick at the can. A class “bet on the jockey” situation.

4. Equity Metals (EQTY.V)

So full disclosure - I bought into Equity Metals (and publicly announced it) over the last couple weeks. It is polymet - which again, I like. Very high grade. Resource of 85m AgEq ounces, and aiming for 120m AgEq ounces next MRE. Compare to other, larger BC silver explorer/devcos (Dolly Varden?) and you will see a pretty significant discount here. Lots of targets to continue to grow the resource.

Thoughts:

Cash on Hand: $2.7M (as of Jan. 2024)

Fully Diluted: 241.2M (as of Jan. 2024) (some warrant overhang here)

64% Ag/Au (40% Zn+Lb+Cu)

Good infrastructure - powerlines and road run through property

High grade - average grade of over 6gpt AuEq.

6,000m program is fully financed, hope to follow it up with another 6,000m program later in the year.

Cheap drilling, especially for northern B - $200-$350/meter

High-grade drills from the 1980s have never been followed up on before, opening up opportunities for new discoveries.

2 streams, 90%+ recoveries for all metals on both.

5. Inca One Gold (INCA.V)

Inca One. Alright, so I spent an inordinate amount of time building out a visual graphic for this one detailing different financial numbers, but it just wasn’t a realistic project to complete at this point/standard to set for the rest of the entries. I’m finishing this article off using my hotspot in Missinipe while visiting Fathom Nickel’s Gochager Lake drill site, so photo editing isn’t realistic anyway.

They’re a Peruvian ore processor for artisanal miners. Think Dynacor but tiny. It makes a lot of sense as a business model. 77 million shares out. However, they have struggled to get both of their small processing plants fully operational the past couple years and as such are still losing money on a quarterly basis. But the price of gold, of course, is at all-time highs these days.

So to be actually producing gold, right now, today, is to be in a pretty good spot, especially if you’re desperately trying to find ways to become profitable. As you might expect from a gold producer that isn’t turning a profit at $2000 gold, their financials are a bit of a mess. Furthermore, just turning a profit all on its own won’t solve their issue.

They need a cash influx to buy more/better ore to increase their throughput and margins further or otherwise risk being stuck grinding out small profits at narrower margins. So, long story short, they aren’t there yet and there is execution risk that would impact margins heavily, where they already struggle.

But, all that being said, at just a $6m mc an awful lot of failure is priced in. And their path to success - secure a financing, begin to buy enough ore to run both plants at or near peak capacity, and profitably, and do it on the back of current record high gold prices - isn’t unreasonable.

Haven’t bought in, but following.

6. Laiva Gold (pre-IPO)

Laiva Gold. Finnish developer. Still private. Ongoing financing. Taking over an open pit mine. Low grade. Bulk tonnage. Again, not an unreasonable path to success. And another way to play the gold bull run if you believe spot price is going to keep going up.

Owns the biggest mill (6000 tpd) in

Finlandall of Europe, built in 2011.43-101 resource of 2M Oz M/I/I of Au

Will be the 4th company to try to make this project profitable.

Acquired it cheaply.

Believes previous operators were sloppy.

Improved block modeling/mine plan can reduce dilution by 1-20%.

Pipe for pumping tailings was suppoed to be 16”, but they installed 12”. Became a major bottleneck.

New owners have since twinned it to remove the issue.

3Mt of low-grade stockpile (by my calcs ~0.7 gpt) ready to go. (That’s 500 days of production)

Further exploration upside

50k oz per annum production target, ramping up to 80k oz per annum

Plan is to IPO once they’ve got the initial kinks worked out and are steady state

Ongoing $10m financing - 80 cents/share.

Post-financing implied valuation of $50m market cap.

I haven’t participated in the financing yet, but I am leaning towards putting a small position in. Again, if you think gold is going to stay elevated, this is a good, leveraged play to participate in.

Maritime Resources (MAE.V)

Oh hey, another gold company that has a chance at being a near-term producer. I’m starting to detect a theme here. Maritime Resources own a couple fully permitted mills, including one right next to New Found Gold. They have a collection of small, high-grade deposits that could be exploited quite easily.

Owners of the only two fully-permitted mills in Newfoundland.

Both mills require some capital investment to get started back up again.

Toll milling agreement with NFG

@2150 Oz project has a NPV of $185M and IRR of 80.3%

AISC of $912 USD at Hammerdown

CAD$75M in Initial Capital Costs. Acquisition of Pine Cove reduces this down to $55-$60M

They produced and sold a 281 oz dore bar of “found” gold in their mill Shows a good eye for taking advantage of the assets they have.

Similarly, they have about 50,000 Oz of Au in tailings at 2-3 gpt which could be exploited cheaply and be a boon in the early stages no doubt.

$5m of debentures from last fall and 11.3% Interest (overnight + 6%)

They do plan roll back their significant share count, but are awaiting the right catalyst to pair it with so it doesn’t trend back down afterward.

They’ve stayed lean and quietly progressed their projects but are approaching a point where they want to start ramping up their efforts as they get closer to construction and production - hiring on more expertise in that area, increased marketing efforts, etc.

This is another story where the short runway to production at these elevated prices has me thinking there is an opportunity here. If they can get the mill(s) running and start feeding their own ore/toll milling for others, they could capture significant value at reduced risk compared to traditional explorers.

Murchison Minerals (MUR.V)

Murchison Minerals is a polymetallic (there’s another running theme from these companies) explorer in northern Saskatchewan. So a little home town bias for me. That being said, they’ve got a deposit and a working model to expand it.

2 projects - one in Quebec (“HPM”), one in Saskatchewan (“BMK”)

Currently drilling 3500M at BMK.

It is in Saskatchewan’s north - so isolated - but as close to accessible as you can get up here - site is less than 2 km from the (gravel) highway.

2018 43-101 Resource on BMK puts it at 9.7Mt I+I at ~7% ZnEq. (Zn+Cu+Ag+Pb+Au)

It is a VMS deposit, and their thesis is that there are multiple pods around the original deposit waiting to be found. (Valid!)

They do have to go deep - 800M or so on BMK.

Their HPM project in Quebec has pulled 121m of 1.02% Ni, 0.56$ Cu, and 0.15% Co out of the ground before. It is awaiting permitting and community consultation resolutions.

They have Dr. Peter Lightfoot as a technical advisor, who I know from my work with Fathom Nickel. Having him on board gives this project an extra dose of legitimacy.

It is about 50km from where I am currently typing this in Missinipe.

There is an energy to being at conferences that can be pretty fun. People all around you are excited - and expect - to talk shop. Being a metals sector investor is an awfully niche industry, and I am going to guess that many of you reading this don’t know many other resource investors in the real world unless it is a family affair or you’ve deliberately fostered industry connections (which is smart). I read a stat the other they that they figure there are only 30,000-40,000 metals sector investors in all of Canada. So yeah. There just isn’t that many.

Point being? Go to a conference. You will meet like-minded individuals there. You will talk to CEOs and insiders. You will form opinions on companies based on conversations face to face with CEOs’ demeanour and answers and non-answers. You will have chance encounters - people, words, ideas that will make your trip more enriching. And as life threatens to return to the idea of another resource super cycle waking up, smart research and application of learned knowledge can position you to benefit from stubbornly negative junior sector sentiment. You just gotta have a little hope.

As always, thanks for reading.

Matthew