Nickel: Irresistible Forces, Immoveable Objects, and Giga Metals

The green revolution is coming, but before it happens we first need a nickel production revolution.

tl;dr

Demand for nickel is set to possibly to 3X or more, while EV-grade nickel could 8X+ in demand by 2040. There just aren’t that many nickel sulfide (Class 1 quality) deposits left to be found in the world. Giga Metals Turnagain nickel project has characteristics - size, simplicity, location - that make it impossible to ignore. The price of nickel is going to have to rerate permanently northward to bring the amount of supply we are going to need online.

Okay, back again. This time to chat about Giga Metals (GIGA.V; GIGGF; BRR2). I wanted to set the stage a bit for why I believe Giga is such a potentially powerful project by discussing macro nickel scenarios for a bit. If you’re anywhere even adjacent to the mining industry you already know this narrative. There is going to be *a lot*of newly-mined metals needed to drive the green revolution. A lot. So I am not really telling you anything you don’t already know.

But still, I really don’t think a lot people – even in the industry – actually get just how huge the demand coming up is. Kind of like we all know the universe is really, really big but it doesn’t really click till you see one of those zooming-out visuals detailing its true scale. Or how a million, not to mention a billion dollars, is obviously a lot of money, but if you made a million dollars a year, it would take you fully 1,000 years to become a billionaire.

Have some fun with this scale of the universe.

Once you get past the existential dread come back to me and keep going.

My point is we know all these things; they are self-evidently obvious to anyone who considers them - however, if you don’t pause and place it in proper context and scale, the true enormity doesn’t really manage to properly click. Humans aren’t very good at properly conceptualising really big amounts of anything – be it the universe, money, or (more to the point) the amount of nickel demand coming on line in the next 20 years.

Let me develop things a bit from here.

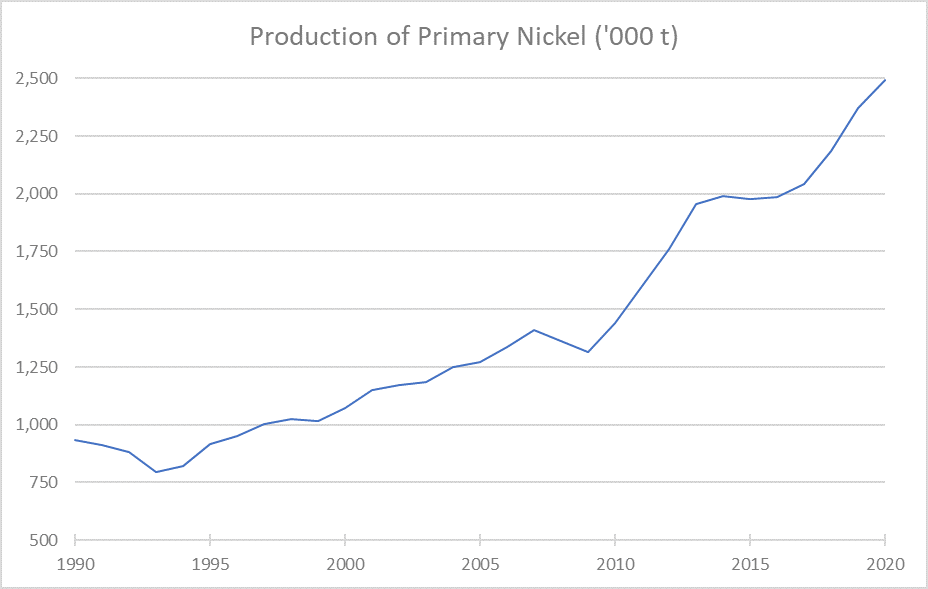

First: 30,000 foot view here. Consider the below graph that of historical annual production of nickel dating from 2017 back to 1900. It shows over a century’s worth of exponential growth and, to me, highlights how in a world of finite, shrinking supply of resources, our demand for these resources just keeps starkly growing faster and faster. (And wonder what the outcome could possibly be in a situation of shrinking supply and growing demand…)

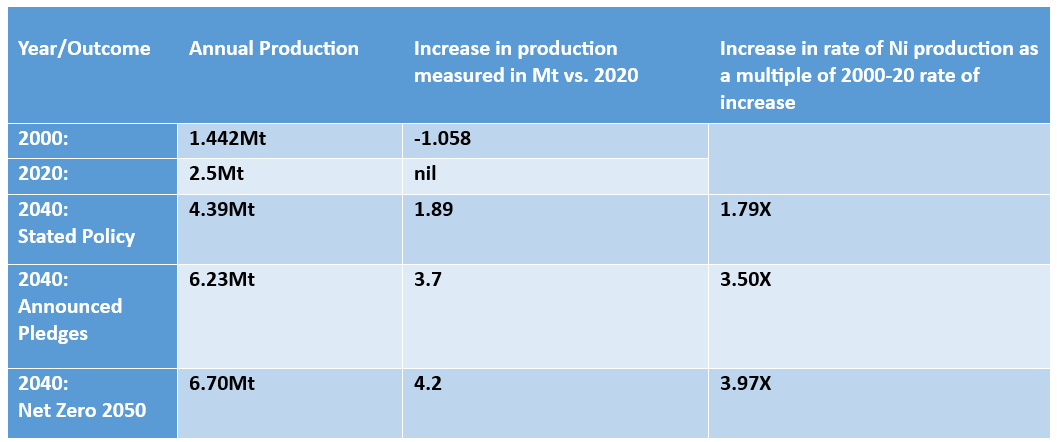

Note here that I am going to use the year 2020 as a “hingepoint” in this discussion. It captures 20 years of the most intense nickel demand in human history, and neatly sits 20 years from even more accelerated 2040 scenarios described by the IEA (we will get to them in a bit). I am going to do a little math here, so bear with me.

First - let’s nail down in numbers the rate of increasing demand from 2000-2020.

Production [grew] in 2000 to 1.442 Mt. … It has been increasing ever since, hitting almost 2.500 Mt in 2020.

So that is about a 73% increase, or in terms of raw tonnage, an increase of 1.058Mt of nickel production over that 20 year period. That’s a lot - that additional million tons of Nickel rate fed our technological, industrial 21st century economic demands.

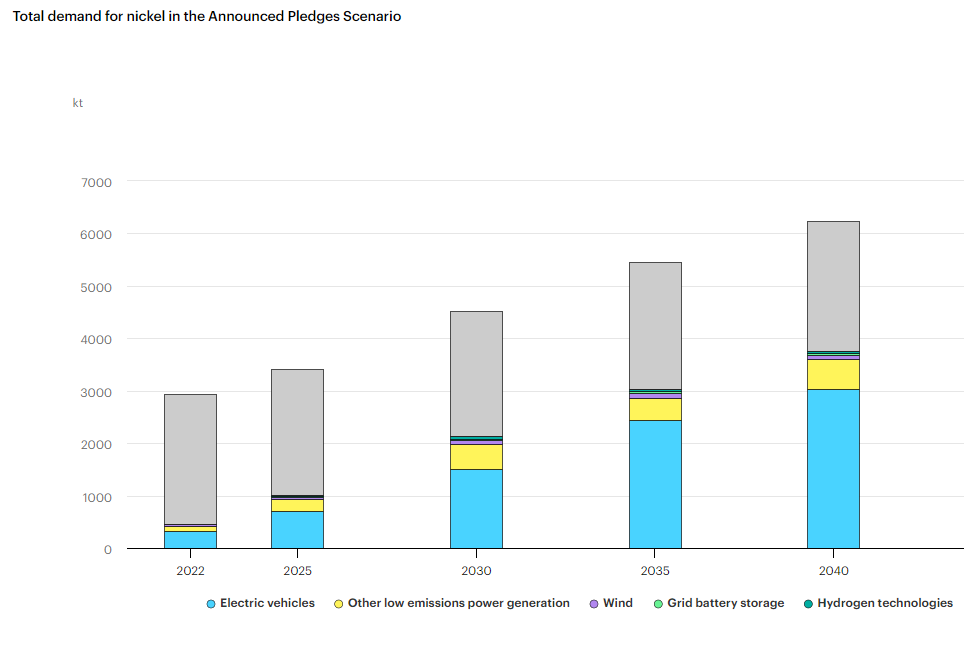

Okay. Now, let’s switch over from past growth to discuss possible growth scenarios, all sourced from the IEA. (Note that the IEA actually gives three scenarios in descending order of commitment: “Stated policy” which is of course official policy targets for countries and companies. The other two are the non-binding “Announced Pledges” and the global “Net Zero” target scenarios each representing different outcomes based on potential trajectories from now.

First, the Stated Policy Scenario:

Second, the Announced Pledges:

And finally, Net Zero:

So, obviously massively increasing demand is anticipated from here. You have more nickel needed at a faster pace, with demand for EV nickel even more accelerated.

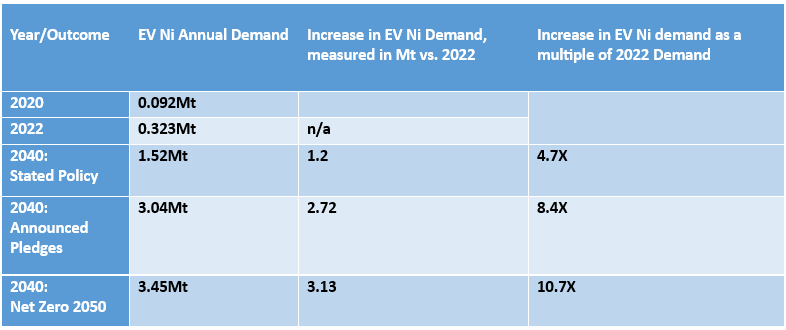

To clarify this point, I am going to produce two different graphs that will collate this data for you. The first graph will show the total increase in production needed over time to meet the 3 different scenarios. The second graph will focus on demand for nickel specifically and only for EVs in these scenarios.

Graph 1

This first graph above highlights an important point. The world brought online an additional 1.06Mt of nickel production between 2000 and 2020 increasing from 1.44Mt to 2.5Mt. So 20 years of the most incredible technological, industrial, urban advancement was accomplished on the back of 1.06Mt of additional nickel during this time period.

With this in mind, now consider the Net Zero scenario, which would have us producing 6.7Mt of nickel by 2040, an increase in annual production of an incredible 4.2Mt, which is nearly quadruple that 2000-2020 increase in production total I referenced previously.

Basically what I am trying to explain is that we are approaching the silly-season tail of any CAGR chart, where the same modest annual % changes end up becoming stratospherically large numbers compared to where you started. This is great when it is happening in your bank account. Not so great when it is the demand for a finite and already well-explored (and exploited) resource.

Graph 2:

The second, EV nickel demand, graph, measures from 2022. I gave global nickel production some credit that 2020’s miniscule .092Mt and even 2022’s .323Mt could be absorbed by current output. But even from there, we are looking at a possible 5-8X, and even 10X, in all-out demand for class 1, EV-grade nickel. The ““announced pledges” category of EV battery demand for nickel is as much nickel as the world produces in total right now. Today.

Consider too how the sulfide v. laterite nature of nickel deposits leaves its mark: All that increasing pressure for EV-grade nickel will fall on the sulfides that are able to easily produce it, narrowing the potential supply significantly. In terms of Giga Metals, this just means there is going to be all the more demand for large, safe, simple, nickel sulfide deposits.

Add on to this the chronic, worsening tension that we are running out of targets that are economic at current grades. Simply put, sulfides, like other metals, keep getting rarer as the easier/higher grade deposits are exploited. And again I say - you can begin to see all the reasons why I think a huge sulfide deposit like Giga’s Turnagain project could be such a big deal.

I have realised I have not been writing bear cases, and I should be. I am trying to keep these articles short and punchy (though not today so much) but I shouldn’t omit them.)

Contrarian Considerations:

Yes, I know that there are processes - notably used in Indonesia - that can upgrade laterites into EV-grade nickel.

Yes, I know there is a lot of technology coming down the pipe that could reduce or remove the need for nickel in EV batteries and other applications.

Yes, I know there is a lot of scrap nickel out there that will end up recycled.

The responses:

These smelters and the Indonesian nickel industry in general are an utter environmental catastrophe. As Net Zero growth increases in impact, this will loom larger and larger and make them impossible as a source.

Good. We need it. We need more of everything. The pie keeps getting bigger and bigger even if nickel’s slice gets smaller. More to the point, however, is that automakers operate in decades. The decisions and investments made today for nickel-dominant EV batteries ensure that they will be run through a generation of manufacturing before they might be replaced. Nickel also remains king of batteries designed for range and that seems unlikely to change anytime soon.

60% of nickel is already recycled (much higher than the 40%ish for Copper), so there is a narrower supply. But the vast majority of nickel that can be recycled is not suitable for use in EVs. So even with increased pressure to recycle, there just aren’t stockpiles of EV-quality nickel laying around waiting to be exploited. There simply needs to be more EV grade nickel entering into use before any future circular economy of battery metals can work.

Conclusion:

I hope I am starting to make my point. There is an increasingly huge proportion of minerals required annually to feed demand in contrast to overall historical production. Take a look again at the graph at the start showing historical product. How many million tons of nickel do you think have been mined in all of human history to date? 40 million? 50 million? (share in the comments if you know a semi-educated estimate!) Soon that will need to be what we can produce in a decade. Woah.

So once again I return to Giga Metals. And you know what, I am not even going to spend too much time comparatively discussing them here - I introduced them in my first article on them here. You can also check out their slide deck here. But come on. In light of everything I just explained, how are they not worth a position as a leveraged call on the future of nickel demand, EV growth, geopolitics?

Remember:

They have one of the world’s top 10 largest deposit of nickel.

It is clean and simple metallurgically and geologically.

Extremely low strip ratio.

Tier 1 (western-aligned) jurisdiction.

Advanced to the PFS stage (imminent publication).

Serious support in the form of a JV with Mitsubishi.

There are pathways to improving the economics of the project

There are lots of very prospective exploration targets

But it is also of course important to recognise Giga Metals comes with its own risks. At current nickel prices, its economics are average and there are indeed some expensive parts to it. They rely on higher nickel prices to be more compelling (but my goodness look at the leverage to higher nickel prices below. But there is also no doubt Giga would be a world-class nickel deposit were nickel prices to rerate higher over the coming years. And based on what you’ve read from me here today, you can guess what my thoughts are about that. If you’ve got the patience, there is a seismic shift coming in global Nickel production and demand.

Patience, but also intelligent entries and risk management with your positions remain a must, but for all the reasons discussed above, I believe that Giga Metals offers a unique opportunity for investors who believe in the future of nickel to take advantage of that conviction. Projects like Giga are exactly what the world needs to meet Nickel demand over the coming 5, 10, 20+ years.