Exploring for a New Mine While Living in Interesting Times - iTech: A Year in Review + AGM Summary

In 2023, iTech Minerals kept its head down and worked hard to successfully progress its Graphite and REE-Kaolin projects amidst a market maelstrom swirling around them. AGM summary included.

tl;dr:

iTech leaves 2023 behind having made significant progress on all its graphite and REE-Kaolin projects even while their share price has faltered. Brutal sector sentiment has damaged the share price even though graphite specifically received bullish macro news.

However, amidst these stormy conditions, iTech holds a critical advantage of not needing money. Their series of financing one+ years ago has spelled them safely through some absolutely brutal sector sentiment and will importantly allow them to continue their 2024 plans to prove up further damage value undamaged while everyone hangs on for the market to change.

There will be two parts to this update:

Part 1 consists of my own thoughts on iTech’s year. Part 2 is my written summary of the AGM.

Part 1: My Thoughts on iTech’s 2023 Year That Was

iTech’s previous 12 months have enjoyed the mixed blessing of living in interesting times. There have no doubt been plenty of positive developments: Indeed, iTech’s exploration and metallurgical works have both driven very positive news releases.

But not all came out rosy as some of the positivity was tempered by some disappointing results from their Lacroma exploration more recently. Though even here, new targets now offer multiple opportunities to build out their graphite resource further, with hope lying to the South, North, and East of Lacroma Central.

Overall, it seems safe to say that the last year was a very positive one for iTech’s resource projects. This because they successfully significantly advanced 3 different projects along 3 different pathways towards positive outcomes at their Lacroma and Sugarloaf graphite projects as well as their Caralue REE-Kaolin project.

Toss in a $1m+ windfall in the form of a grant to pursue its Sugarloaf metallurgical study (how is that for conviction-affirming about the leadership of this company?), and tailwinds from recent significant graphite-related geopolitical announcements out of China impacting the graphite sector, and the year overall had some very strong positives for iTech.

And yet, iTech ultimately was not spared the same plight that has befallen so many otherwise strong junior resource explorer/developers. Which is to say, a badly flagging overall overall resource sector has dragged iTech-the-stock-ticker down with it.

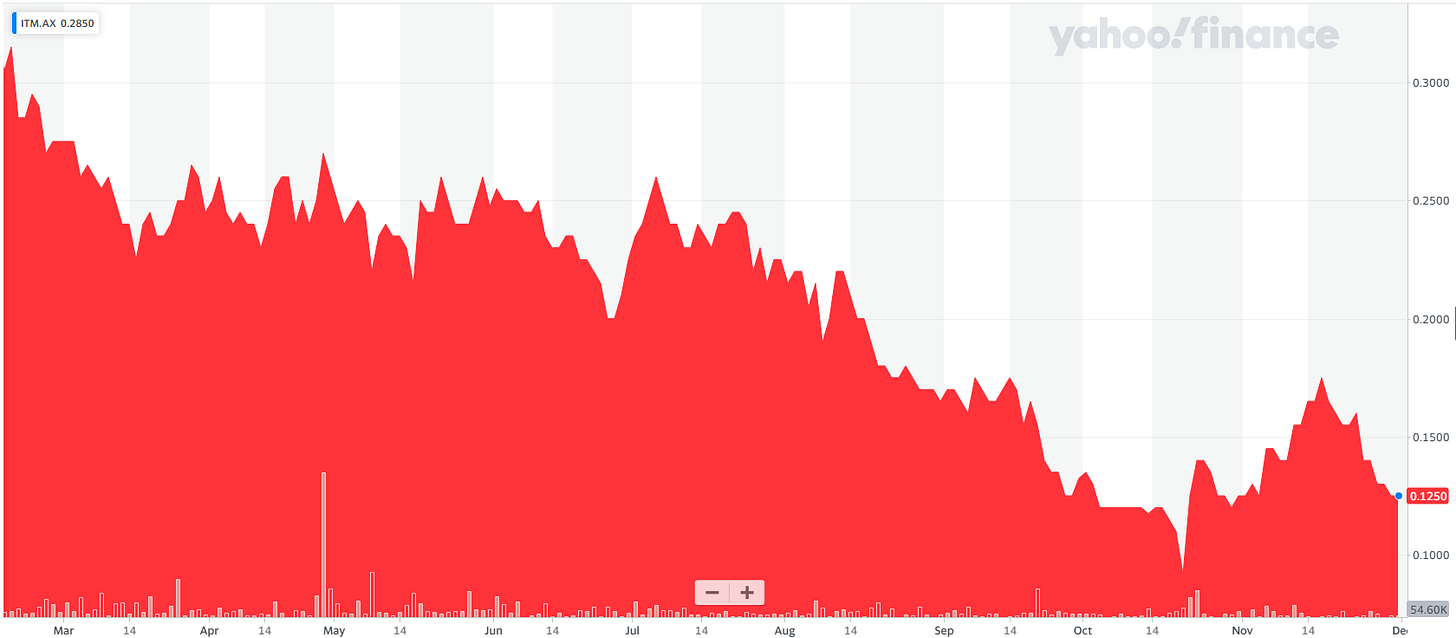

After trading sideways for the entire year, ITM finally began to break down under the weight of those weak overall sector sentiments in the fall. Of course, graphite prices in particular got hammered as China continually flooded the market with synthetic graphite to maintain its stranglehold on the global graphite market.

Then there was just plain old bad luck - those previously-mentioned batch of weaker Lacroma results (which are not a death knell by any stretch) came at the exact worse time. This is because they were puublished right on the heels of a slow-moving capitulation over the course of several weeks finally happening to ITM.AX. Look at the chart below tand the sudden crash into the bottom of the chart to see what I mean.

And yet, as you can see, ITM yo-yoed right back up. This because right after that balloon popping, graphite in general get a huge positive surge in sentiment injected into it. You might recall that China recently put out huge news in regards to graphite.

This news came out in the form of new export restrictions in its synthetic graphite stock. The significance of this to companies like iTech is clear. It reaffirms how critical they are to friendly/western jurisdictions looking to establish critical mineral independence, in this case graphite especially.

And yet, even that huge burst of fundamental bullishness has apparently been consumed by the current resource market black hole, as much of those recent gains have already been given back.

This is where it can be so frustrating for resource company investors. Good news is ignored and bad news is crushed. Go on long enough, and not only tickers, but companies themselves can be put at serious risk.

Luckily, iTech has a critical advantage that effectively shields them from this risk and allows its investors to keep heart. In addition to everything described above: Its strong technical leadership, positive metallurgical breakthroughs, and development of new graphite targets, iTech has what so many juniors dearly wish they did right now:

Money.

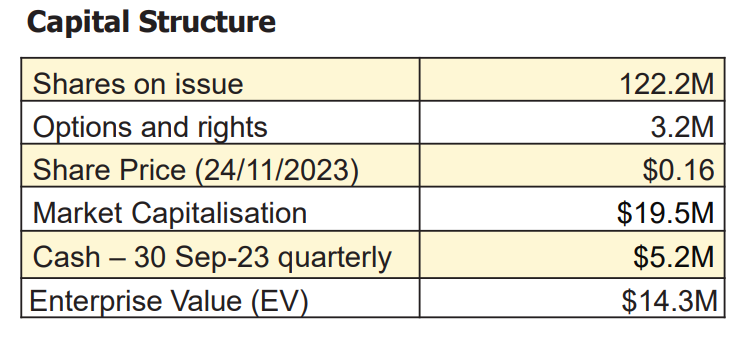

With $5.2 million in the bank as of September 30, and a super cheap exploration process due to its shallow, RC drill campaign, iTech remains a well-funded and lean operation. And don’t forget that $1.1M government grant here, either.

For advancing 3 separate projects, iTech’s burn rate is remarkably low - they sank from $7.8M to $5.2M in the 6 months preceding Sept. 30 financials. That means their current $5.2M should give them about 12 months of running room to build a catalyst to raise into strength off of. In this industry, that is an eternity.

So yes. If you’re just tuning into the resource sector, times are tough. And iTech hasn’t been spared. But the company itself continues to produce positive results, and (so importantly) does not have to try to raise money for the foreseeable future, saving the paper losses seen with their market cap from being painfully realised through heavy dilution to the float.

That decision to raise big and explore cheaply is one I tip my cap to MD Michael Schwarz and his team for having the foresight to make, and those decisions are certainly looming large now.

Battered by the market but unbent, and now possessing plenty of opportunities to achieve real, material, positive results - iTech Minerals continues to work effectively.

What’s more, while I am treating this as a year-end review, iTech is hardly closed up for the holidays. Rather, they remain hard at work, with many multiple drillholes in the lab or being actively completed and the rig still active. I rather expect there to be at least one more big dump of drill results before the end of year. Value creation through discovery is ongoing. I am hoping to get Mike on for an interview to serve as a geological wind up for the year, so stay tuned.

Now, onto my AGM notes:

Part 2: Summary of iTech’s AGAM

Below is a condensed summary of iTech’s recent AGM which can be found here.

Slide 3: Key Projects

Overview of ITM’s graphite and clay-hosted REE-Kaolin projects. Focus on two projects

100% interest in both

2023 Focus for graphite: Expand the resources

2023 Focus for REE: Cracking the metallurgical code to know if they can be extracted economically.

Slide 4: Achievements

Sugarloaf Graphite Project

Total of 1840m RC drilled at Sugarloaf.

Main focus was to collect metallurgical samples to determine if they can produce a good concentrate from it.

Sugarloaf strike got extended from 2km-4.3km

Awarded a CRC-Project grant worth $1.1M for Sugarloaf met work

Lacroma Graphite Project

Lacroma graphite resources also expanded.

6,500m RC exploration at Lacroma.

Defined graphite strike length of over 3.7km.

Zone of 1.6km as the best spot for a resource.

Currently 8,000M of infill/resource drilling has been completed.

Lacroma met work underway. They know from historical work that it produces a high-quality con but want to confirm it themselves.

Caralue REE-Kaolin Project

Achieved a breakthrough on REE extraction.

86% of TREO and

87% of MREO (higher value)

Technique not yet economically viable at scale, looking for way to reduce costs.

Break through: Able to get rid of 49% of bulk material while maintain 75% of REE.

Slide 5: Board and Management

Introduces board and other C-Suite members

Capital Structure:

Low share count of 122.2M Shares

Little overhang: Only 3.2M options

MC: $19.5M; EV of $14.3M

Cash up: total of $5.2M at end of latest quarter.

Slide 7: Graphite & The Electrification of the Economy

67% of Demand Coming from EVs

27% of demand from Consumer Electronics

5% from battery storage systems

Breaks down the above further

06:15

Slide 8: Campoona Spherical Graphite Project

Lacroma graphite fits nicely into the category that can be upgrade to be used in EV and energy storage purposes.

Looking to grow current JORC-compliant resource (8.55mt @ 9.0%).

Mining lease already granted.

Processing and Water infrastructure leases already granted.

Campoona ore can be purified into high quality concentrate

94% with 80% recovery.

That concentrate can then be refined into and 99.99% battery grade.

Now they need to expand the resources to achieve an economic mine life.

Two targets:

Sugarloaf: Prospective Target of 158-264mt @ 7-12% TGC

Lacroma: Resource drilling underway

Slide 9: Bulk Sample Metallurgy Results

Bulk sample met tests have achieved fine flake graphite.

This is what you need to produce purified spherical graphite (PSG), or battery-grade graphite

Doesn’t need to be grinded - cost-effective.

Just needs to be refined.

Processing steps reduced from 11-8

96%+ of graphite flakes are less then -75μm (small flake)

42kg of final con was produced from 407kg of proceed material (94% con)

Conventional flotation process (advantages of no chemicals, no heat)

Slide 10: Purification and Spheronisation

Can be done with standard practices.

Does not require hydrofluoric acid leaching - cheaper, simpler, safer.

Caustic reagents can be recycled - economic benefits.

Product meets or exceeds PSG industry standards.

Purities 99.99% achieved

47% yield

Slide 11: Uncoated Purified Spherical Graphite Process Flow Sheet

8.5Mt @ 9% TGC existent resource gets them 50,000 tpa concentrate for 10 years

A little small yet to be economic

Pathway to Resource Growth

Two-pronged approach of Sugarloaf and Lacroma

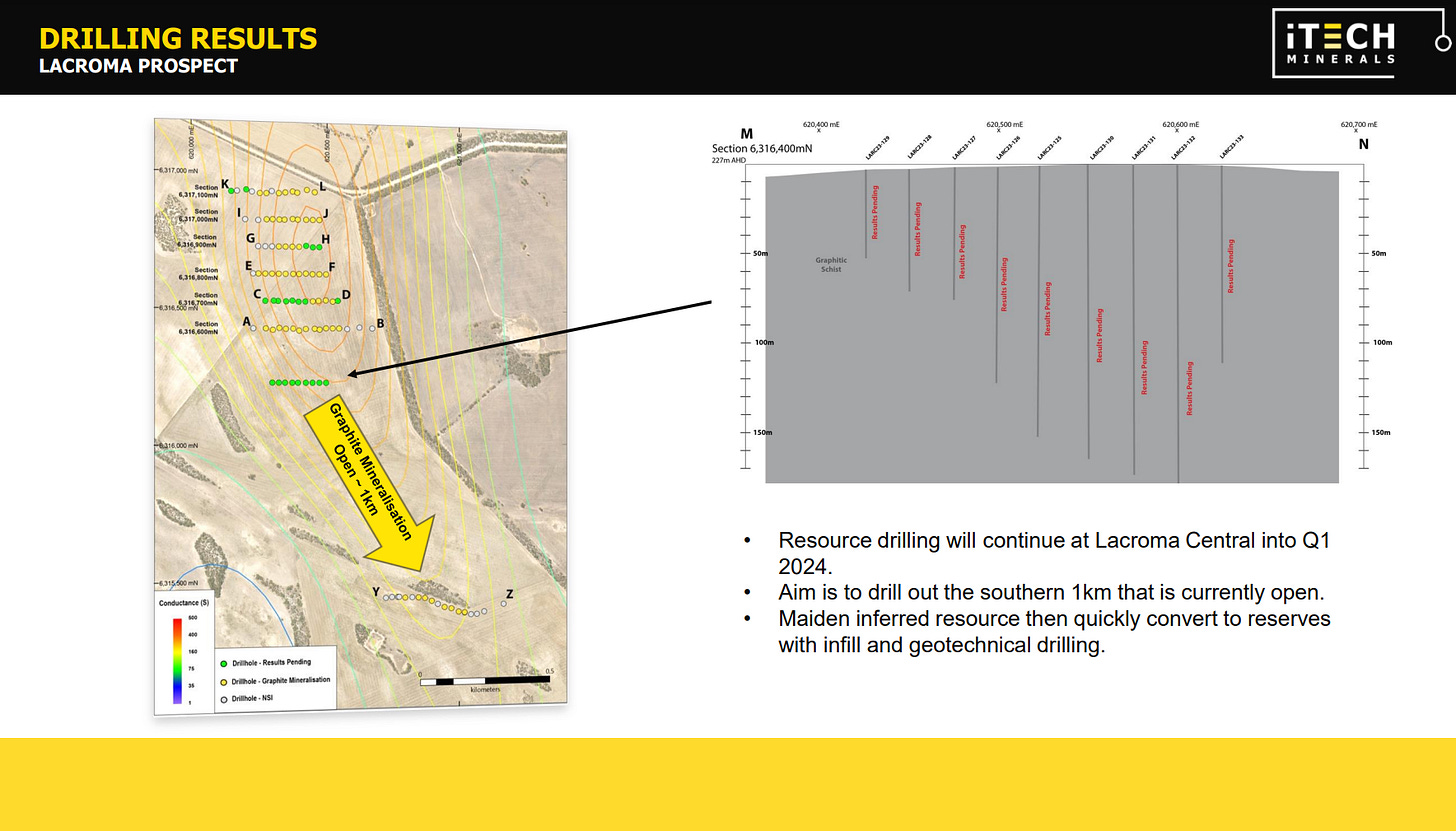

Lacroma: Currently working to establish an inferred resource of 40Mt+ @ 7%+ TGC.

Sugarloaf: Met work remains the key. Currently working with the CRC-P grant to research a new, unconventional metallurgical technique to achieve 94% con, 80%+ recovery, conducive to spheronisation and purification.

If and when that is achieved, they will drill out an inferred resource targeting 60Mt+ of 10%+TGC

Slide 12: The Path to Resource Growth

Assuming individual successes, both resources would then get fed into a feasibility study

Sugarloaf is not the main game currently.

Getting Lacroma Central proved up is the main game because it is high-quality met-wise

8,000m of infill completed, 4,000-5,000m remaining at Lacroma

12:15

Slides 13-17: Drill Results, Lacroma Prospect

Over the next several slides, Mike goes over the various E-W traverses drilled across Lacroma, starting from the North and moving South.

Each traverse is 100m apart. By the time you get 300m South the graphite horizon starts to thicken up nicely

Continues to thicken into the south (90m at 7% TGC)

They are currently drilling another traverse further to the south.

They are seeing the continued improvement of thickness of mineralisation.

There is a km gap between traverses to the south here.

If that thickness holds up it will produce a significant resource at Lacroma (see image below)

Slides 18-21: Drill Results, Sugarloaf Prospect

Knew already there was extensive graphite mineralisation.

Archer Materials (previous operator) couldn’t crack the met code.

ITM wanted to collect a representative bulk sample to submit for met work.

17 holes drilled in the southern half of the prospect.

Increased strike 2km to 4.3km

Sugarloaf has very high-grade zones (Up to 26%+)

Excellent target if it can get its met work code cracked

Slide 22: New Drill Targets

Lacroma North (newly-named, not previous Lacroma North)

Appears to have exact same geology as Lacroma Central

Outcropping of graphite present

Graphite in historic drill holes

After Lacroma North will move East to Balumbah and Balumbah North

Anomaly is twice the size of Lacroma Central

Anomaly is 3X the intensity of Lacroma Central, adds potentially 10km of strike length.

Might have some sediments with salt water than can impact mag anomaly reading and create false positives, but generally intensity is tied to grade of graphite.

Still have a 40Mt target in the next 12 months.

19:06

Slides 23-28: Caralue Bluff REE-Kaolin Project

Large exploration target 110-220Mt @ 635-832 ppm TREO and 19-22% Al2o3 (Kaolin content)

Looking for a cost-effective met technique to extract REE. 12 months of work ongoing.

Key magnet REEs (MREOs) is about 25% of REE content in clays

Want to produce 2 products:

REE product/carbonate

Also a bright white Kaolin product

Recovery rates 86-88%

Two main breakthroughs:

75% of REEs can be recovered in 51% of sample volume (half the total product having to get processed - cuts costs significantly).

Also a breakthrough that 95% of HCl (hydrochloric acid) can be recovered from the leach solution, drastically reducing acid consumptio, thus lowering costs.

The next step is to see if they can extract enough impurities at an economic cost.

24:48

Project Milestones

Forward looking project milestones:

Maiden Resources and Resource Upgrades for Lacroma in 2024

Inferred will get upgraded t M+I in H2.

Continuing of met work on Sugarloaf and Caralue

Preliminary Sugarloaf flowsheet in H1

Flowsheet optimisation in H2.

Slide 30: Investment Highlights

Overview of previous slides

Great jurisdiction.

Great infrastructure including new powerline.

Lots of mining knowledge and infrastructure.

Renewable energy dominates Eyre Peninsula.

Advancing 3 separate projects.

For a final thought, exploration and development are rarely a straight line, and even major successes often become a story of two steps forward and one step back. And iTech is no different. What iTech is setting out to accomplish is a deeply iterative progress, and failure is just another step on the path to succsss. Importantly, iTech continues to progress in meaningful and important fashions towards multiple ends. With a few different irons in the fire and smart management leading the way, the odds are good for iTech in 2024. creating the potential for positive outcomes, iTech remains a strong pick to come good for its investors.

Thanks for reading.

-Matthew from JRI