Great Projects Don't Stop Growing: Why Founders Metals' Impressive Run is Just Getting Started

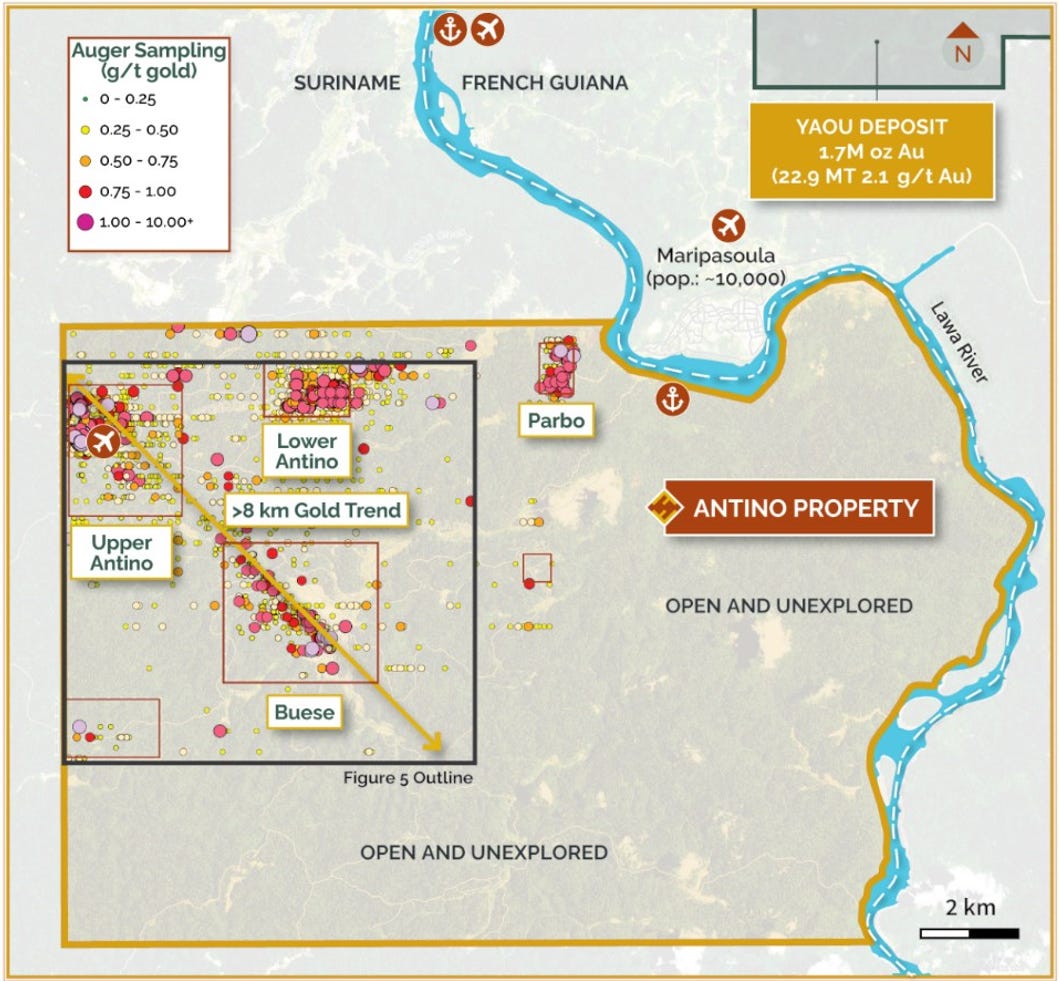

CEO Colin Padget stopped by to discuss why Founders Metals (FDR.V) - still less than a year since its IPO - has had such an amazing, well-deserved run thanks to its impressive Antino gold project.

tl;dr:

Founders Metals (FDR.V) is already a hell of a story and is just going to keep getting bigger. Honestly, that’s it.

Of course, CEO Colin Padget and I talked about a lot more than that in our longform intro interview - historical mining, modern exploration success, permitting, mining tailings, future plans, and much more - but all roads lead back to Rome here. Which is to say that my discussions with Colin (and my DD work in general so far) have led me to the belief that Founders - far from being done in terms of exploration results leading to market appreciation - is just getting started. This is because Founders’ Antino gold project has all the hallmarks of a truly great project.

Part 1. The Interview

Part 2. The Companion Article

Alright, I am going to try to be brief with this one. Not by choice, mind you - Founders is one I could talk for a long time about. Rather, it is 4:24 AM and a have I date with an air strip 7 hours north of here to pick up a geotechnician at 12:30 PM to drive into Missinipe together for us to take a Twin Otter deeper into Saskatchewan’s Canadian Shield to get to Fathom’s Albert Lake Project for my very first site visit. And, anticipating that the internet up there will be… challenging, I thought it best to get this one prior to departure.

Founders Metals’ CEO Colin Padget is clearly an intelligent guy and I give him credit for a very forthcoming interview. I understand the drive to answer in “CEO-speak” to more challenging questions (vague generalities, non-committal affirming pleasantries) for these guys must be high. Even for those working in good faith (which is not everyone in this business unfortunately) it is a challenging and merciless sector, so the instinct to “turtle” in the face of potential danger does make sense.

However, this was not Colin’s style at all. Rather, he worked to provide direct, informative, and articulate answers where he was materially able to do so.

Speaking practically, I imagine that part of Colin’s honesty stems from the remarkable success Founders is discovering down in the Amazon jungle. It must be easier to inhabit those characteristics when you look to have an emerging, world-class gold project on your hands. Because, make no mistake, that is exactly what Founders appears to have with its Antino gold project in Suriname.

There are a heck of a lot of reasons to like Founders and Antino a whole bunch. The team, the jurisdiction, the grades, the high-degree of confidence in the geological model, the simultaneous nature of decades of artisanal mining serving as a sort of ultimate human pathfinder element, while the land still be inherently underexplored and there still being absolutely immense exploration potential, topped off with an intriguing potential path forward for Founders to significantly reduce the threats of dilution and becoming a positive cash-flowing company even as it remains deep in the exploration phase.

Suriname, I admit, is not high on my list of “known jurisdictions”. I don’t think I had ever spent any serious time researching it or companies operating within it prior to Founders. I naturally have a tendency to prefer traditional tier one jurisdictions, but it is foolish to blindly ignore the rest of the world, as you risk missing out on opportunities such as Founders in doing so.

But for those who share similar jurisdictional concerns let me be clear that Suriname does not get my flashing amber warning light going like many other South and Central American countries do. Rather, support of extractive industries appears to be much more widespread and Suriname appears to be genuinely welcoming to miners (perhaps due precisely to the fact it does not have a deep, generational memory of the worst excesses mining brought in the past). By all accounts, though, Suriname is a very pro-mining, emerging jurisdiction.

And you can understand why, given the economic potential these industries appear to have in-country. Lightly populated - just some 600,000 people - and traditionally very poor Suriname came to the realization some years ago that resource extraction was a critical ingredient in improving the quality of life of its people. This came no doubt at least in part from watching its western neighbour Guyana revolutionize its economy and quality of life over recent decades using that very same strategy.

So yes, industrial mining mining very much remains in a relatively nascent stage in the country, but make no mistake about Suriname’s support - both political and social - of the industry. Colin speaks clearly in our interview about the clear support of local communities and the ready access of industry knowledge and skillsets available to be tapped into.

So, Suriname itself represents an opportunity if you ask me. Likely the market has a weak understanding of the risks and opportunities it presents, given its relatively new reputation, and any risk discount factor being applied is one that is likely more conservative and pessimistic than reality itself supports. Which, if you’re following along here, creates one of those asymmetrical risk:reward investing opportunities you are constantly on the hunt for in this sector.

Because Antino itself well and truly has tier-1 potential written all over it. First off, just go take a look at their news page at the headline numbers they’ve been releasing to market since the summer. And then note that all those impressive assays are from within 150 meters of surface. Woah.

I am down to the nitty gritty in terms of time here, so I will have to treat this as Part 1 of a larger article, unfortunately, but let me summarize some core thoughts quickly on why I find Founders so particularly compelling:

Artisanal miners have effectively already created bullseye targets for Founders to hone in on. As the saying goes, “the past pathfinder element for gold is gold”.

This has a variety of advantages:

Having dug down into small pits, it allows for much greater access for Founders own preliminary exploratory work, rather than having to rely purely with what is on surface.

Colin and his team can rebuild correlations between geophysical signatures and known, already-exploited deposits, which is a significant advantage for what is technically a pre-discovery/pre-mining explorer. They already know what success looks like.

Significant infrastructure spend is already complete. Areas are cleared. Machinery and supportive infrastructure is in place. These (legally operating) artisanal miners have been working for some decades already, so Founders has the advantage of preexisting momentum already behind it.

The tailings (which are their own conversation) are a legitimate potential deposit and source of revenue all on their own, with likely well over a million ounces gold that will likely be amenable to modern industrial extraction techniques (local miners have been using a simple gravity circuit only).

By all accounts, Founders remarkable discovery success (which really can’t get understated) is just getting started. Consider:

All success to date was accomplished in only 10,000 meters of drilling. Founders is planning for 30,000 meters and up to 3 rigs in 2024.

Geographically, drilling has so far been limited almost entirely to Antino North, and even then just a small subsection of that subsection. There are many other locations within the larger property that share the exact same characteristics: Geophysical and geochemical anomalises correlating heavily with preexisting artisanal mining.

Put another way, Founders geological model already appears to be robust, and is producing a plethora of high confidence targets.

Antino North itself is still amazingly just getting started. As Colin references, they are still discovering parallel trends of mineralisation with stepout drilling. What initially looked to be a nice, healthy, high-grade underground mine (all within 150 meters of surface, mind you) suddenly looks like it could transform into an ultra-high-grade open pittable scenario if assays (still outstanding) continue to come good with impressive results. Think back to those impressive drill results. Now imagine them as an open pit mine. Woah.

Alright, despite the fact there is a heck of a lot more I want to talk about, I better call it quits. It is now just after 6:00 AM and I will be feeling foolish if that poor geotech is stuck at the La Ronge airport waiting on me. There is a whole host of other topics that I can and will discuss on Founders. Not least of which is the intriguing potential of the tailings, which could provide real capital inflow and help to significantly limit exploration dilution for Founders. When I asked Colin if a decision on the tailings would be made in 2024, he confirmed it.

So, in an embarrassment of riches scenario, you have a junior explorer that just capped off an incredible run of success in 2024 on just 10,000 meters. Next, they will triple that number and start targeting more than one small area in their very large, and very prospective land package. And, to top it all off, they have a legitimate route to revenue to fund their exploration, which would obviously place a very strong premium on preexisting Founders shares. Abbreviated though my introduction is here, I hope it is clear why I like this company so much and why it is a clear-cut emerging favourite of mine.

Thanks for reading, and make sure to stick around for Part 2 of this intro in a few weeks. And make sure to read part 3, as I still have the written summary available for you. For now, though, I have to say goodbye, as it’s off to the north for Fathom Nickel’s drill campaign for me. Wish me luck!

Part 3. The Written Summary and Transcripts

Timestamps are links to the interview time in questions.

Click through here for the written transcript.

02:20 Founder's Metals Overview and Colin Padget Intro

Colin Padget, CEO of Founder's Metals, outlines the company's flagship project, the Antino Gold Project, situated in the mineral-rich Guyana Shield in southeastern Suriname. He discusses the project's exploration success, and the strategic importance of the location, emphasizing the underexplored nature of the area and the promising drill results received on a consistent basis.

07:04 Acquisition Strategy and Exploration Focus

The conversation shifts to the strategic acquisition of the Antino project from Oria, emphasizing the decision-making process, due diligence, and the project's standout features that made it an attractive investment. The discussion underscores the importance of Suriname's geological potential and the company's focus on leveraging the Antino project's location within this promising jurisdiction.

09:30 Ownership, Partnerships, and Future Directions

Colin elaborates on the company's partnership strategy in Suriname, discussing the pathway towards increasing ownership and the role of local partners in facilitating the project's success. The dialogue includes considerations around expanding Founder's Metals' stake in the project, the significance of solid in-country relationships, and the ongoing discussions for a potential path to 100% ownership.

11:57 Exploration Achievements and Jurisdictional Advantages

The ability to conduct year-round drilling in Suriname is highlighted, with particular attention to the strategic adjustments made during the rainy season to optimize drilling operations. Colin points out the logistical advantages provided by the property's location, including access to established road networks, river barging capabilities, and the proximity to commercial flight access, underscoring the operational efficiencies these factors provide. The discussion also covers the mining-friendly environment of Suriname, focusing on the availability of skilled and unskilled labor, the history of gold mining in the region, and the government's supportive stance towards mining operations.

16:43 Community Engagement

Colin discusses Founder's Metals' approach to community engagement, emphasizing the absence of opposition to the project and the company's efforts to foster positive relationships with local communities. He highlights the importance of recognizing and supporting the interests of local residents, demonstrating the company's commitment to responsible and inclusive development practices.

19:06 Taxation, Royalties, and Permitting Insights

The session delves into Suriname's taxation and royalty framework, with Colin explaining the negotiation process for government stakes and the role of infrastructure contributions in these discussions. He also clarifies the scope of the existing exploitation permit, outlining its coverage and the operational freedoms it grants, including the potential for small-scale mining under the current regulatory conditions.

23:52 Artisanal Mining History at Antino

Colin reflects on the long history of artisanal mining on the property, estimating that over half of the historically mined 530,000 ounces of gold were extracted in the last 15-20 years. He discusses the implications of this for understanding the scale of the gold system in place and the potential for future exploration and production.

26:14 2023 Recap and 2024 Exploration Plans

The CEO summarizes the 2023 drilling achievements, noting the completion of 54 holes and the strategic focus on the Froyo and Donut areas within the Antino project. Looking ahead to 2024, Colin outlines ambitious plans for extensive drilling, with a focus on expanding known mineralization zones and exploring new targets, highlighting the potential for further significant discoveries on the property

30:51 Geological Insights and Exploration Strategy

Colin provides detailed insights into the geological model guiding exploration at the Antino project, emphasizing the role of modern geophysical data in shaping the company's understanding of the deposit's structure. He discusses the benefits of ground magnetics and IP surveys in identifying key features and driving targeted exploration efforts, showcasing the methodical approach to uncovering the project's full potential.

33:20 Vision for the Future and Potential Partnerships

The conversation concludes with Colin sharing his vision for the future of Founder's Metals and the Antino project, touching on the potential for joint ventures or sales as part of the company's growth strategy.

42:55 Tailings Processing and Non-Dilutive Funding Options

The conversation shifts towards the potential for processing tailings as a non-dilutive funding strategy for the project. Colin discusses the preliminary metallurgical work and sampling being conducted to assess the viability of tailings processing, weighing the options between internal development and partnering with third-party operators. This strategy highlights the innovative approaches being considered to fund exploration and development without diluting shareholder value.

47:43 2023 Drilling Highlights and 2024 Objectives

Reflecting on the success of the 2023 drilling campaign, which included 54 holes and notable high-grade discoveries, Colin sets the stage for the 2024 exploration objectives. He outlines a comprehensive drilling program focused on expanding the project's mineralized footprint, with particular attention to areas like Froyo and Donut, and the exploration of new targets that could further enhance the project's value.

52:35 Engagement with Potential Partners and NDAs

Colin mentions that there has been interest in the project from various parties, with some non-disclosure agreements (NDAs) signed, indicating preliminary discussions with potential partners or acquirers. This segment underscores the growing recognition of the Antino project's potential within the broader mining industry and the strategic options available to Founder's Metals as it continues to advance the project.

54:58 Elmtree Project in New Brunswick

Briefly stepping away from the Antino project, the conversation touches on Founder's Metals' Elmtree project in New Brunswick. Colin indicates that while the focus remains squarely on Suriname, the Elmtree project represents a valuable asset that could potentially be advanced through partnerships or sale, allowing the company to concentrate resources on its flagship project.

57:23 Closing Thoughts and Future Outlook

In closing, Colin reflects on the exciting prospects for Founder's Metals and the Antino project, highlighting the combination of strategic exploration, potential for non-dilutive funding through tailings processing, and the open-ended potential for further discoveries within the project area. The discussion concludes with optimism for the project's future and the broader implications for Suriname's mining sector.

That’s all I can get done before I am off to the Canadian shield to witness some nickel exploration. I will end on the note that I m very excited to be covering Founders as they remain one heck of a story. There’s lots of angles for future deepdives with them, so I hope to see you there.

-Matthew from JRI