Globex Mining Update: Masters of M&A

I discuss recent news from Globex and shine the spotlight on one of its optioned properties which I think represents well how Globex conducts business.

tl;dr:

I discuss recent news and highlight a project of theirs in my first of an ongoing series highlighting various GMX properties. Overall, Globex once again displays an uncanny agility to build value.

It’s been a month or so since I last chatted meaningfully about Globex and thought it was time to head back over there. As is their norm, Globex had a lot of news flow over the past while. That’s what happens when you’ve got hundreds of irons in the fire.

I will recap some of the juicier headlines here, but I am also going to profile one of GMX’s many holdings. It was a debate for me on what to pick - A-list or back catalogue - but ultimately I went with one referenced in the news below that I believe to be emblematic of CEO Jack Stoch’s approach to value creation.

Content:

Part 1: News Flow Recap

Part 2: Project Profile Series Entry #1

Part 1: News Flow Recap

Like I said, Globex news has a tendency to come fast and furious. Sitting here writing this on September 14, I thought it a natural start to begin by recapping news starting from an August 14 press release by GMX. That specific release contained no less than 7 different individual bits of news. These separate news pieces articles how Globex received $2.25M in cash, 3 million+ shares and options, multiple NSRs, new option agreements, and more. Talk about bang for your buck.

Some notables:

1. August 14th

$2 million coming from Agnico Eagle, the 3rd of 6 payments for the Francoeur/Arntfield/Lac Fortune Gold Property.

Optioned the Gwillin Lake property off to Tomagold (LOT.V) for $135,000 cash, $100,000 worth of shares, and 625,000 shares over 4 years, maintaining a 3% NSR.

Sale of 6 Li claims in the Fiedmont Township of Quebec for $100,000 and 2,040,816 shares, while maintaining a 2% NSR to Jourdan Resources.

And relevant in its own right: $150,000 as the initial production payment in the Silidor Granite Quarry. This is critical, as it marks the entrance of a recurring revenue stream onto Globex’s books.

2. August 22nd

Brunswick Exploration released some big news on August 21, discovering spodumene in outcrops on land claims optioned to it by Globex last January. This announcement bumped BRW from 80 cents and a $150m MC all the way up to $1.12 and a $210M mc, before settling back down to 90+ cents now. Another potential future revenue stream here, as Globex maintains a 3% NSR.

3. August 25th

This one is admittedly a smaller headline. Unless you’re me. One of the first things I did when I started getting into Globex was putter around on their map of claims. I enjoyed the fact that they held a land claim just a few kilometers from me for an alkaline lake I have swam in. Dreams of becoming a dredging and mining company all on my own to feed the nearby mill danced through my head. Well, no more. Done and gone. Sold out from under me. I will shed a salty tear for what could have been.

4. August 28th and September 8

News out of Brunswick Exploration was heavy over this time period. The previous spodumene discovery on Globex’s optioned Mirage property was significant enough for Brunswick to announce it was ceasing all exploration operations elsewhere to focus on further pursuing it. This was followed up by another announcement on Sept. 8th of a minimum 5000 meter drill program for the property.

5. September 12

Some fairly interesting very initial (as in partial) drill results from Emperor Metals were released just a couple days ago. As noted in the screen grab below in one case the hole was recollared and extended. No barn burners, but solid assays that would make you want to keep looking around at what’s in the ground down there. Again, Globex gets to relax and watch its stable of picks as some develop into winners without time or money required.

That’s it for the monthly news update. It’s old hat for GMX investors but I am reminded every time I look at Globex’s news flow about how much potential future value is stirring about, slowly being built behind the scenes. Every single positive news release is a step toward future value for Globex with no further associated financial or exploration risks to go along with it. GMX’s library of projects gives it a constant source of both short term and long term opportunities for cash flow. That’s rare in this space.

Part 2: Project Profile Series Entry #1

(Note: I took efforts to source a lot of the content I provide here, but honestly Globex itself does a good job of detailing the histories of its many projects. Indeed, a good chunk of what I write about below can be found on Globex’s website itself.)

I teased this last month, but I am going to start profiling some of the many holdings under the Globex umbrella. I am a sucker for research and a bit of a completionist, so this sort of project simultaneously perks my ears and scares me. But here we are. The project today actually comes from that August 14th news release I went on about - the property underpinning Agnico Eagle’s $2 million payment: the Francoeur/Arntfield/Lac Fortune Gold Property.

Up till 2012, this was an active mine operated by Richmont Mines (which was acquired by Alamos Gold in 2017, but not before Richmont sold its Quebec properties to Monarques/Monarch Gold) when it was closed due to high operating costs and low grades with gold hovering around US$1700. At this point, this essentially became a distressed asset for Richmont as they shifted focus to their other projects. Fast forward 4 years to the spring of 2016 with gold at a 10 year low of around $1100 and in stepped Globex to take it off Richmont’s hands.

Now I feel like I am reading something wrong, because the numbers seem absurd to me, but the article seems pretty clear: Globex acquired this asset for pretty much nothing. More specifically, Richmont sold the property to Globex in exchange for a 1.5% NSR and Globex assuming responsibility over remaining environmental bonds totaling some $157,043 (which Globex didn’t even end up paying for itself, mind you, as Jack instead had a 3rd party pay for it in exchange for a 1% NSR on the property - which I believe was ultimately extinguished anyway). Fast forward to October 2017 and Globex completed the purchase by buying back the 1.5% NSR attached to the property for just $25,000.

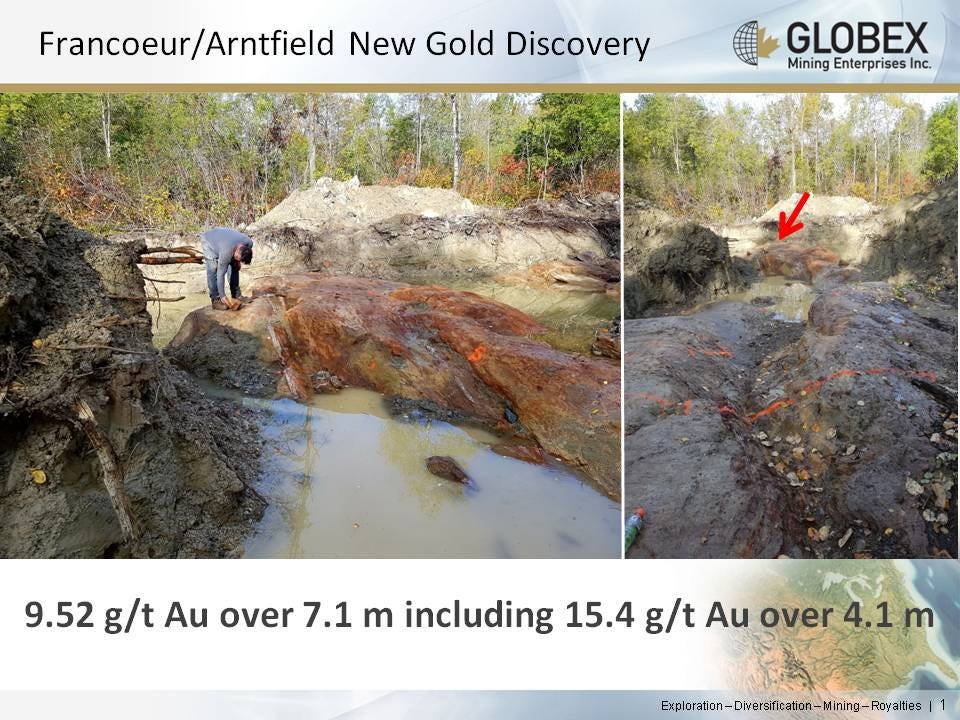

In the following years, Globex developed the project further, including adding some smaller claims to it and undertaking a series of channel sampling and modest, shallow, drill campaigns to further develop the project, all told spending a couple million dollars. Consider it money well spent, as Globex pulled out some decent intercepts from new discoveries in the process - both in trenching and drilling.

So, 100% ownership of a past-producing mine with modern infrastructure for what ultimately turned out to be just $25,000 in actual cash plus a couple million in the coming years in exploration expenses Not too shabby, right? Even if this project had just sat in Globex’s catalogue to this day gathering dust, I don’t think anyone would complain about the concept of turning $25,000 into a past-producing gold mine and upgrading it with new discoveries. So it is clear Jack knows how to shop for a good deal.

But that isn’t where the story ends if you remember where I started this update. To be clear - it isn’t just gathering dust. In fact, Globex sold this project to Yamana Gold (now PAAS) in 2021 (though now owned by Agnico Eagle) as Yamana sought to consolidate its own land package in the area. The price tag? $11 million in cash over 4 years, and $4 million in shares up front (which are now worth $5m). So Jack turned $25,000 into an old gold mine, then followed that up with a few hundred meters of trenching and shallow drilling to revitalise the property, which in turn lead to it being sold for some $15+ million in total equity . That’s a ~7.5X on invested capital - for those keeping track out there - in just 5 years of ownership.

And this is my point, and why I decided to start with this project and sequence of deals. I believe it to be representative of the type of value creation that Globex manages to achieve year after year and deal after deal. Because let’s be clear here: Assuming control of a former mine in the Abitibi right next door to a $6B mc producer at the bottom of market sentiment for pennies and selling it into the upswing of a bull run for a 7.5X return a few years later isn’t luck - that’s shrewd, smart, nimble management. Especially when you manage to pull it off repeatedly, which Jack and Globex have over the years. And with $6M in payments left over the next 2 years, Globex will be benefitting from this deal for a good while yet.

That ability to spin yarn into gold is a fundamental aspect to the Globex story and part of what sets it apart from its peers. Jack Stoch approaches the game of resource exploration as an actual, traditional, business and works to maintain positive cash flow to support his growth efforts without dilution. This makes him a unicorn in a sector famous for its ability to burn through cash.

And yet the market doesn’t seem to care - that $15 million dollar deal is going into the coffers of a company with just a $43 million dollar market cap today. Globex remains somehow less than the sum of its parts. And yet, inertia continues to grow behind Globex’s growth. Options and royalties are constantly being collected and - as we saw with the Silidor granite project - revenue streams are slowly starting to come online. In a sense, Globex is a legitimate investment in a way that its junior explorer peers simply aren’t and can’t be.

Despite all the skill and knowledge and experience (and maddening failures) it can take to become a strong investor, the ultimate goal of investing is itself remarkably simple: Buy a company for less than what you think it should be worth. And from this perspective, it is difficult not to find Globex an incredibly compelling opportunity. True value always, eventually, wins.

Thanks again.

-JRI