Bigger and Better: Abra Silver's Newly-Updated MRE.

It is always satisfying watching strong projects get better, and Abra's recent resource update did just that.

tl;dr:

CEO John Miniotis of Argentinian Ag+Au developer Abra Silver (ABRA.V) sat down to go over his company’s recently-updated Mineral Resource Estimate. The MRE showed improvements essentially across the board for Abra, from grade, ounces, further potential, and recovery rates, and sets them up nicely to hopefully deliver what looks like to be an economically compelling PFS in time for PDAC.

Index

Interview

Companion Article

Timestamped Summary + Transcript

1. Interview

2. Companion Article

Sometimes it is just obvious that a project will eventually become a mine. Abra Silver's Diablillos project is one of these. Large, high grade, shallow, ongoing expansion, and new discoveries still lurking - it has all the trademark characteristics of a deposit just waiting for first pour.

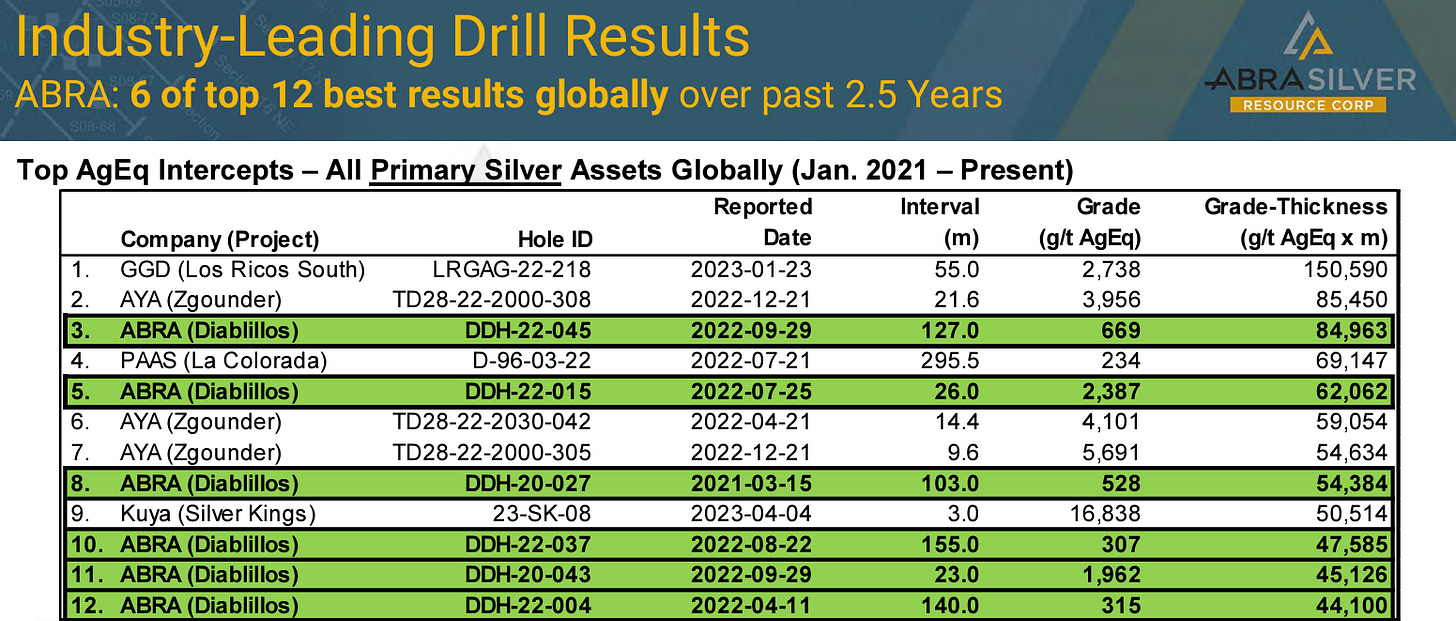

Abra certainly had the kind of year of drilling you would expect from a company of such a description. Which is to say oodles of strong assays and impressive hits from its Phase III drill program dedicated primarily to fleshing out the new JAC discovery. Take a note below on the top primary Ag drill holes from the last couple years and just now many times Abra made that list.

And yet, even from such a strong foundation, Abra Silver still managed to improve in a number of important ways from their recent MRE. The resource got bigger. Grade improved - both average and cut-off. New zones were added to the resource with more new targets identified. To see what I mean about the improved resource, take a look at the graph below for the comparison of the previous two MREs released by Abra.

Perhaps the most impressive aspect to me, though, wasn’t what Abra accomplished below ground, but above ground: Namely, I found the metallurgical improvements to be the surprising addition to this update. We know the PFS will yield typical enhancements such as pit pushbacks, but it was a pleasant surprise getting a bit of a sneak preview of the work their team has been doing on it behind the scenes.

From the PEA to today, Abra has managed to increase their silver recovery nearly 10%, from ~73%-~83% by adding a gravity separation step to the start of their flowsheet. This also has the cascading benefit of simplifying the flow sheet in other ways. This improvement alone adds 12m oz to the current pit and will have long-lasting ramifications for this project.

There were other improvements John discussed with me. Thanks to their strong geological understanding, Abra has implemented a net value block model to better build their mine on a more granular level in response to grade and depth variance. This of course has its own economic benefits, as it allowed Abra to target higher quality ore more effectively and thus raise their cutoff grade from 35 gpt Ag to 45 gpt Ag.

Common wisdom in the industry (well proven to be grimly accurate) is that projects will never look better than in the PEA. Problems are glossed over, all decisions are optimal, and blue sky remains intact. Abra looks to be one of the rare ones to buck this trend and have a PFS meaningfully and demonstrably improve a project’s economics.

With a PFS due by PDAC, I am sure that it is doubtless going to have some very impressive numbers in it. This is one of those plays where, sure, you've missed out on the share price multiples that happens along the way to become such a powerful deposit, but it is very high confidence to still net you market-beating returns whenever the inevitable M&A transaction occurs. Projects like Abra will lead the way if and when the metal bulls return.

3. Timestamped Summary + Link to Transcripts

Link to transcript

Click on the timestamps for links to the interview.

01:00 Brief walkthrough of the MRE Improvements

Improvements across the board.

Resource size up

Grade up.

New zones.

Recovery rates up.

1.36m oz Au and 148m oz Ag at 258 gpt AgEq.

04:40 JAC starter pit grade and grade in general

202gpt at JAC, 5.3mt, 34m oz Ag

All M+I

07:35: Drill hole spacing for the different categories.

Measured: 25m

Indicated: 50-75m

Inf: 80m+

08:35: What is John’s Target

Thinks they’ve already achieved it. High grade. Highly economic. Proof of further expansion potential throughout.

Just have to keep building. PFS soon.

11:20: Further potential of other targets

Lots more targets that could get added to a bankable feasibility study.

Will announce in 2024 further targets if they decide to add more.

12:05: Phase 4 Drilling (what’s next)

Likely before FS but not confirmed.

If there is more drilling, it will be to target high grade ounces to add to the start of the mine plan.

13:35: What is their plan with the copper/sulphides

Goes through La Coipita – hole they drilled. Talking with potential partners.

Diablillos – Just isn’t worth the additional time and money to go after it properly. But they have absolutely confirmed there is something bigger down therein the oxides.

Already have a highly economic mine plan. But with a 20 year mine plan already it isn’t worth chasing.

20:15: What made you change your cut-off grade/block model discussion

As their geological understanding increased they could get more granular and specify with greater confidence what was ore and what was waste rock.

There is a range of grades across the pit, but overall average of 45 gpt Ag.

24:00: Increased recoveries: Discussion

Significant increase in silver ratio

12 million ounces of additional silver in the mine plan

Added a gravity separation circuit up front in the flow sheet.

Helps them simplify/skip steps later

29:00: Strip Ratio and Depth of the Pit

200-300m deep

Stripping not finalised stil for PFS but will have come down.

JAC is free dig, making it cheap and easy

Pit not yet optimised with pushbacks

32:00: Discussion on $ per oz Ag discovery ($0.17)

Cheap but they don’t know peer averages – not commonly reported

Not reported, cyclical challenge of exploration makes it difficult to ascertain

36:20: Final Thoughts

Lots of upcoming catalysts

PFS

More drilling

This is another good company consistently making positive progress. A bloated float will get cleaned up prior to M&A no doubt. If you want exposure to a high-grade silver developer that seems destined for a buyout, then this is right up your alley.

-Matthew from JRI