Contango Ore: Producing High-Grade Gold at All-Time High Gold Prices

CEO Rick Van Nieuwenhuyse joins me to discuss how CTGO.NYSE continues to build its own virtuous cycle of growth through its "DSO" model to become a high-margin mid-tier producer in the next few years.

tl;dr:

Contango Ore (CTGO) is a smartly-run company that is currently serving as proof-of-concept to the market for a novel production model which CTGO calls its “direct shipping ore” (DSO) model. DSO is a streamlined and aggressive model that works to bring small, high-grade deposits to production fast by utilising a hub-and-spoke toll-milling strategy.

At stage one of this plan, CTGO is forecasting 60,000oz of high-grade gold worth some US$40 million to them this year.

Now, some challenges have produced some short-term pain on the ledger and in charts for CTGO. However, I fundamentally believe the long-term value proposition here still remains significant, intact, and likely.

And it is that disconnect that exists here that makes Contango especially so compelling to me currently. You’re getting a solid, cash flow positive gold producer with clear line of sight to improvement of existing margins in addition further production growth for very low valuation multiples.

Sounds like the recipe for success.

Part 1: The Interview, Part 2: The Companion Article, Part 3: The Written Summary

CTGO is a solid company with solid revenue and solid potential for substantial growth over the coming months and years. This is a good one.

If you’re feeling inclined, please support me by clicking through and subbing to their newsletter to show the following I can demonstrate.

I generally prefer to let my work do this direct promotional labour for me, but I’ll never deny the importance of data. Thank you.

Please Click Here To Support Me By Subscribing to CTGO’s Newsletter

Part 1: The Interview

Part 2: The Companion Article

2.1. Bullet Point Review

Contango Ore (CTGO) is a smartly-run company that is currently serving as proof-of-concept to the market for its “direct shipping ore” (DSO) model.

DSO is a streamlined and aggressive model that works to bring small, high-grade deposits to production fast by utilising a hub-and-spoke toll-milling strategy.

It is working.

CTGO is forecasting 60,000oz of high-grade gold produced this year (after doing 43,000 oz last year during year one)

At $2800 gold, that’s worth some US$40 million to them (~$20m after debt servicing).

Problems

There have been recent challenges recently that have impacted Contango’s ledgers and chart.

Bridge restrictions and elevated moisture content is reducing their trucking capacity and, as a result, their margins.

70% Hedged ounces (bank condition) limit their exposure to gold spot (what a world that being hedged at $2025 gold could be considered a bad thing).

Debt servicing remains priority one for the next two years delaying CTGO fully benefitting from such high gold prices.

Solutions

As unforgiving as the market has been, you’d think these were fatal flaws or permanent impairments. But they aren’t.

Consider:

The bridge issue is already being solved and has improved markedly since the initial bad news.

A federal and state agreement on funding bridge repair/reconstruction has been formally agreed to since the original news, removing this as a long-term issue.

Chances the bridge restrictions will be lightened or removed are also high.

Moisture content can be reduced by cheap and simple preventative measures (earthworks/berms to promote run-off, removing mud or snow/sleet while driving).

Remember, that even a few %s of improvement can have significant downstream economic impacts.

Other impairments are also not long term. Both hedging and all debt commitments are off the books end of H2 in 2027. That’s just over two years from now. That aint much.

Bullet Point Conclusion

So by doing nothing but waiting two years (while producing 60,000 oz of gold annually anyway, with ~$20 million going to CTGO currently after debt servicing), CTGO would see their $20 million number grow to roughly $60 million.

~$20 million of that $40 million would come from finishing their debt servicing and ~$20 million would come from removal of hedges.

And this is all just Manh Choh.

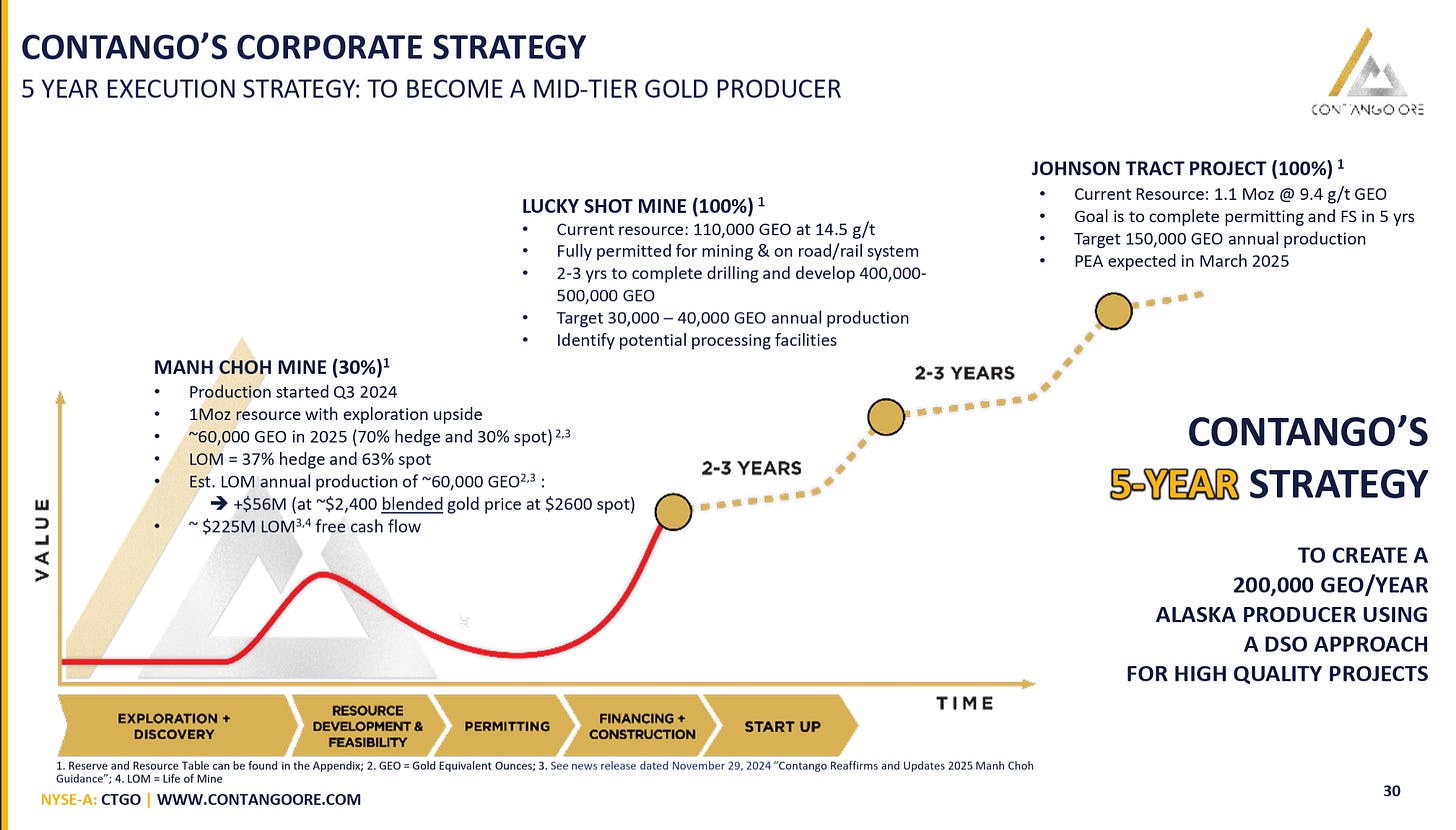

In addition to the above, Contango foresees 100,000 and even 200,000 ounces of GEO in additional production coming online over the next few years from its other projects.

Yes the other projects will come with their own challenges and funding needs, but as Contango scales up and builds its coffers, its durability and ability to execute will only increase.

2.2. The Full Article

Contango Ore (CTGO.NY) is one I have followed along with for a while and hold a long position (in my kids’ RESP no less). Their “direct shipping ore” (DSO) model is intelligent and I believe could significantly exploit a current potential market inefficiency.

2.2.1. What is DSO?

DSO might be described as taking hub-and-spoke toll mining to its logical extreme. This is because Contango wants to spend as little time as possible in the development phase with its projects as it can. To achieve this, Contango has built a checklist to identify projects that can get to production fast.

Characteristics essential to this include things like streamlined permitting processes, proximity to transport, close to mining infrastructure, possessing high-grade historic resources. But their fatal flaw? All considered too small to have a mine plan designed and built around them as understood.

2.2.2. Contango’s Vision

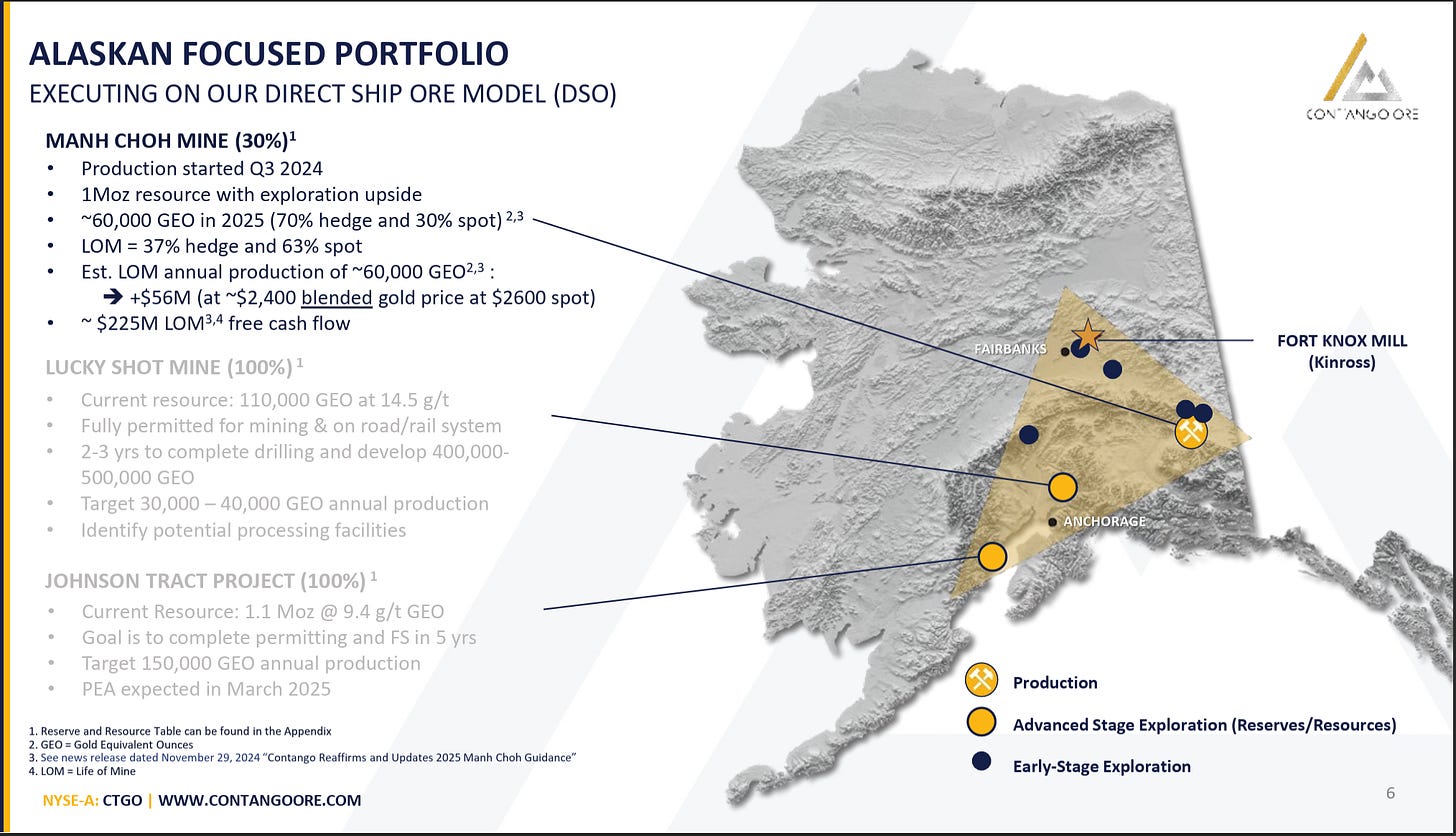

Enter Contango Ore, and their plan effectively to stitch a collection of these individual parts together into a greater sum. They currently have three key projects - currently-producing Manh Choh, Lucky Shot, and Johnson Tract.

By skipping the actual processing step and directly shipping ore (hey, that’s the name of the process) to nearby mills, Contango’s plan allows these projects to get into production quickly and cheaply.

And production means money.

And money means being able to fund (dilution free) exploring for more ounces, means acquiring more projects, means more avenues for more production - and the beginnings of a nice little virtuous cycle of growth.

Now, it all comes down to execution. Which is true for every company, yes, but this model - with greater complexity and more moving parts- it is especially true.

And Contango is executing. They’re making more money, and stand to make even more money very soon from their producing project.

Now I know the long-term chart doesn’t seem to track with this take, as its has been dinged hard a couple times the last 2 years. And yes, there have been bumps along the way that has taken a bit of glint off the edge in the eyes of the market, but I pretty firmly believe the bones here are sound, and the grander vision remains intact.

I covered the basics of the problems and their solutions in 2.1. above so won’t go over them here again. Bridge restrictions, hedging, debt servicing etc. Yes, all impact the bottom line. But more importantly, all can be very cleanly resolved. And yet, the market is acting like they are permanent and fatal when they are clearly neither.

Yes, Manh Choh has been dinged up a bit in terms of what it could have been, but its LOM is already growing and it looks like it will be a strong producer for another half decade at least.

But Manh Choh is just step one of this little empire Contango looks to be building. It is certainly not the end game for Contango, though the market looks to be perceiving it as such. They have two other high quality projects that can reasonably be producing within 3-5 years.

Contango is revenue positive, has a strong vision it is already executing on, effective leadership (Rick strikes me as a very capable executive), short term paths to improved margins, and long term blue sky still intact. Sounds pretty good, no?

2.3. Conclusion

So Contango is two years from tripling their cash flow without doing a thing but keep selling gold.

What is $20 million right now this year in after debt cash worth to you? What’s a gap up in that number from $20 to $60 million in two years worth?

Now add in a realistic path to adding another 100,000 ounces of high-grade, high-margin production annually over the next 3-5 years through Johnson Tract and Lucky Shot.

And lest we forget the absurdly tight float of just 12+ million shares here.

So what’s a fair valuation? What multiple do you put on these numbers? Do your own valuation calcs and use your own metrics, but mine suggests that the current market cap of $110 million is a pretty compelling discount for what is on offer here.

And it is that disconnect that exists here that makes Contango especially so compelling to me currently.

All this means I believe Contango is a classic example of an asymmetrical relationship between risk and reward that forward-looking investors can take advantage of.

You’re getting a solid, cash flow positive gold producer in a tier 1 jurisdiction with clear line of sight to both improving existing margins and further production growth for very low valuation multiples.

Sounds like the recipe for success to me.

Part 3: The Written Summary

00:45 Intro to Contango and the DSO Model

Contango doesn’t fit the traditional mold of an explorer or producer.

They employ the Direct Ship Ore (DSO) model, which Rick will elaborate on.

Contango operates in Alaska and is part explorer, part royalty company, and part toll miner.

They are generating revenue (~$56M forecast from their JV with Kinross).

Strong dilution management

Fully diluted share count ~13.1M.

Share count has less than doubled in the last 4-5 years

Industry recognition and analyst coverage.

In multiple ETFs

DSO = Direct Ship Ore, meaning mined ore is directly transported to an existing mill for processing.

Permitting challenges in the U.S., particularly in Alaska, led to Contango adopting the DSO approach.

Rick has extensive experience in exploration, working with Placer Dome, and founding Novagold (~25 years ago).

The key benefits

High-grade deposits are powerful economic engines and can be small but still impactful.

High-grade ore is prioritized in toll milliing agreements (~8 g/t displacing 0.6 g/t material at Fort Knox).

Utilization of existing infrastructure (roads, rail, water access).

Faster permitting and lower environmental impact (e.g., Manh Choh project had wetlands impact of only 5.6 acres).

Reduced capital intensity (not building new mills/tailings facilities).

The key risks

Execution as a key challenge—requires managing multiple projects seamlessly.

Contango follows a hub-and-spoke model, where a central mill can process ore from multiple sites.

Australian miners use DSO more extensively due to easier transportation.

The goal is to avoid the traditional junior mining cycle (raising funds and diluting constantly while waiting for buyouts).

14:00 Intro to Manh Choh: Economics & LOM

Manh Choh exists in a producing 70-30 JV with Kinross, using the Fort Knox mill to process Contango’s high-grade ore.

4.5 year mine life originally,

Producing 200,000 oz/year

Started production July 2024, producing 42,000 oz gold for 2024 in for their 30% share, proving the DSO model is viable.

18:10 Operational Performance & Financials

3 ore batches in 2023, aiming for 4 in 2024, with disbursements expected quarterly(~60,000 oz gold production).

Cash flow positive, permitting achieved in just one year.

Debt & Hedging:

$60M debt, paid down to $38M in 2024.

Plan to pay another $20M in 2025.

Hedging is limiting upside a bit (hedged at ~$2025/oz, while spot gold is ~$2850-2900/oz).

70% of production hedged in 2024-2025, with limited hedging beyond that.

They have rengeotiated some of their debt to extend it 2 quarters beyond original end of 2026 expiry.

Manh Choh AISC (All-In Sustaining Cost) forecast: ~$1,625/oz in 2024; Life of Mine estimate ~$1,400/oz.

Projected life of mine free cash flow: >$150M post-debt repayment (at $2,500/oz gold price).

G&A costs: ~$5M annually.

Kinross receives 200,000 oz from Manh Choh, a significant contribution (~8-10%) to their production. 30% nets to Contango.

25:00 Johnson Tract Exploration & Development

Manh Choh

Kinross’ primary focus is on extending mine life.

(Unfinalised) exploration budget for 2025 of roughly ~$4-5M (Contango's share ~$1.3M).

Targeting additional near-surface resources.

Kinross is aligned with extending mine life (~unofficial current LOM to 2030+).

Johnson Tract

Acquired from HighGold Mining.

1.1M oz gold equivalent; high-grade (~55-75% gold by value).

Located within Lake Clark National Park and Preserve but on private land owned by Ciri Corporation (Alaska Native land, with favorable permitting rights).

Permitted access road and planned underground development.

Feasibility study pending, with discussions on off-site processing options (potential toll milling or own facility).

PEA expected in March 2025.

Lucky Shot

Smaller, but fully permitted.

High-grade (~30-40K oz annual production potential).

20 miles from rail line, allowing for flexible processing options.

33:10 Current Issues and Risks

Bridge weight restrictions & moisture content issues:

Reduced truck payloads, but state & federal DOT now aligned on funding bridge repairs.

Mitigation strategies: Improved drainage, stockpile management, potential wash plant.

Expected incremental operational improvements in 2024.

Market reaction to challenges:

Share price dropped significantly (~$9, a five-year low) despite strong fundamentals.

Rick & chairman purchased shares (currently in blackout period).

Market appears to be pricing in worst-case scenario, which Rick argues is unwarranted.

38:00 Looking Ahead

Pay down debt & deliver into hedges.

Advance permitting at Johnson Tract & finalize processing strategy.

Manh Choh exploration focused on extending mine life.

Lucky Shot & Johnson Tract PEA and permitting progressing.

Potential toll milling partnerships in Alaska or elsewhere.

Final Thoughts

I like this one. Smart. Already executing. Big blue sky potential. Depressed valuations. Perfect combination for investors.

Thanks for reading.

Matthew from JRI